- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

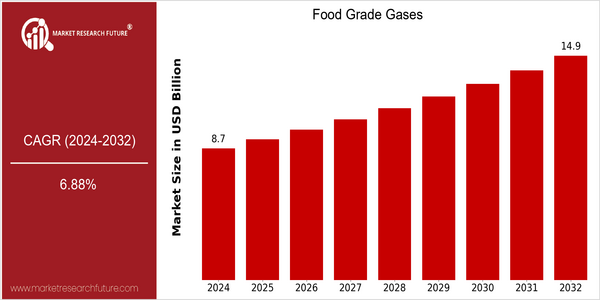

| Year | Value |

|---|---|

| 2024 | USD 8.73 Billion |

| 2032 | USD 14.86 Billion |

| CAGR (2024-2032) | 6.88 % |

Note – Market size depicts the revenue generated over the financial year

The world food gases market is expected to grow significantly, from a current value of $8.73 billion in 2024 to a projected value of $14.86 billion by 2032. This is a strong compound annual growth rate (CAGR) of 6.88% over the forecast period. The increasing demand for food preservation, extended shelf life and improved food quality are the main driving forces for this market. Also, the growing trend towards convenient foods and the increasing awareness of food safety are expected to boost the demand for food-grade gases in food processing and packaging. The development of gas production and distribution, and the development of packaging technology, will also promote the development of the market. Leading companies such as Air Products and Chemicals, Inc., The Linde Group and Praxair, Inc. are expected to actively participate in strategic cooperation and new product development, so as to meet the needs of consumers. This will not only enhance their own competitiveness, but also promote the development of the food-grade gases industry.

Regional Market Size

Regional Deep Dive

The food-grade gases market is expected to witness significant growth, owing to the growing demand for food preservation, enhanced safety standards, and technological innovations in food processing. In North America, the market is characterized by a strong regulatory framework and a high level of consumer awareness about food safety, which are expected to drive the demand for food-grade gases. Europe is a diverse market, with stringent regulations and a focus on sustainability. The Asia-Pacific region is characterized by rapid industrialization and urbanization, which are driving the demand for food-grade gases in food and beverage applications. The Middle East and Africa are slowly adopting the technology, which is mainly driven by changing consumer preferences and economic diversification. The Latin America market is expected to grow, owing to the expansion of the food industry and increasing export opportunities.

Europe

- The European Union has introduced the European Green Deal, which encourages the use of sustainable practices in food production, thereby increasing the demand for eco-friendly food-grade gases.

- Companies like Linde plc are focusing on developing innovative gas mixtures that cater to the specific needs of the food industry, such as modified atmosphere packaging (MAP) solutions.

Asia Pacific

- Rapid urbanization and changing dietary preferences in countries like China and India are driving the demand for food-grade gases, particularly in the fast-food and convenience food sectors.

- Local companies such as BOC India Limited are expanding their production capabilities to meet the growing needs of the food processing industry, which is increasingly adopting advanced preservation techniques.

Latin America

- The expansion of the food processing industry in Brazil and Argentina is driving the demand for food-grade gases, as manufacturers seek to improve product shelf life and quality.

- Regulatory bodies in the region are increasingly focusing on food safety standards, which is leading to a higher adoption of food-grade gases in packaging and preservation.

North America

- The U.S. Food and Drug Administration (FDA) has implemented stricter regulations on food safety, which has led to increased usage of food-grade gases like nitrogen and carbon dioxide for preservation and packaging.

- Key players such as Praxair, Inc. and Air Products and Chemicals, Inc. are investing in advanced technologies to enhance the efficiency of food-grade gas applications, particularly in the meat and dairy sectors.

Middle East And Africa

- The region is witnessing a shift towards modern food processing techniques, with governments promoting initiatives to enhance food security, which is boosting the demand for food-grade gases.

- Companies like Gulf Cryo are investing in infrastructure to supply food-grade gases to the growing food and beverage sector, particularly in the UAE and Saudi Arabia.

Did You Know?

“Approximately 70% of the food-grade gases used in the market are employed in modified atmosphere packaging (MAP), which significantly extends the shelf life of perishable products.” — International Journal of Food Science & Technology

Segmental Market Size

Food gases are a vital part of the food industry. The market for food gases is presently undergoing steady growth, primarily due to the increasing demand for fresh and preserved food. Food safety is also becoming increasingly important. Along with the advances in gas production and storage technology, this has led to increased efficiency in the food industry. The use of food gases has now reached a mature stage. The major suppliers of these gases, such as Air Liquide, Air Products, The Linde Group and The Praxair Group, are at the forefront of this development. Their main applications are in modified atmosphere packaging (MAP) for extending shelf life and carbon dioxide for carbonation of beverages. Also, the trend towards more sustainable production and the drive towards a cleaner production process are contributing to this growth. Cryogenic freezing and gas blending are shaping the development of the food industry, and quality and safety are at the forefront.

Future Outlook

The Food Grade Gases Market is estimated to grow at a CAGR of 6.88% between 2024 and 2032. The demand for food packaging and preservation solutions is increasing, mainly due to the increasing population and changing consumers’ preferences towards convenience food. Food safety and quality will continue to be of prime importance, which is expected to drive the demand for food grade gases in modified atmosphere packaging (MAP). The penetration of food grade gases in the food and beverage industry is expected to be over 30% by 2032, which shows a strong shift towards gas-based preservation methods. Also, innovations in gas production and delivery systems are likely to further drive the market growth. Moreover, the integration of smart food technology, such as Internet of Things (IoT)-enabled monitoring systems, will increase the efficiency of gas usage and ensure the optimum conditions for food preservation. In addition, government initiatives to reduce food wastage and promote sustainable practices will create a favorable regulatory environment for the food grade gases market. The growing demand for organic and plant-based foods, which often require specialized packaging to maintain freshness and quality, will also drive the market growth. The food grade gases market will continue to be driven by the growing demand for food, technological advancements, and regulatory support.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 7.5 Billion |

| Market Size Value In 2023 | USD 8.09 Billion |

| Growth Rate | 7.90% (2023-2032) |

Food Grade Gases Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.