The biometric ATM market in France is characterized by a dynamic competitive landscape, driven by technological advancements and increasing consumer demand for secure banking solutions. Key players such as NCR Corporation (US), Diebold Nixdorf (US), and Fujitsu (JP) are at the forefront, each adopting distinct strategies to enhance their market presence. NCR Corporation (US) focuses on innovation, particularly in integrating biometric technologies with existing ATM systems, thereby improving user experience and security. Diebold Nixdorf (US) emphasizes partnerships with local banks to tailor solutions that meet specific regional needs, while Fujitsu (JP) is investing heavily in R&D to develop next-generation biometric systems that leverage AI for enhanced fraud detection. Collectively, these strategies contribute to a competitive environment that is increasingly centered around technological differentiation and customer-centric solutions.

In terms of business tactics, companies are localizing manufacturing to reduce costs and improve supply chain efficiency. This approach is particularly relevant in a moderately fragmented market where several players vie for market share. The competitive structure is influenced by the collective actions of these key players, who are not only competing on technology but also on service delivery and customer engagement. The emphasis on supply chain optimization is becoming a critical factor in maintaining competitive advantage, especially as demand for biometric ATMs continues to rise.

In October 2025, NCR Corporation (US) announced a strategic partnership with a leading French bank to deploy a new line of biometric ATMs that utilize facial recognition technology. This move is significant as it not only enhances the bank's service offerings but also positions NCR as a leader in biometric innovation within the region. The partnership is expected to increase customer trust and satisfaction, thereby driving higher transaction volumes.

In September 2025, Diebold Nixdorf (US) launched a new software platform designed to integrate seamlessly with existing ATM networks, allowing for the rapid deployment of biometric authentication features. This initiative is crucial as it enables banks to upgrade their systems without significant capital expenditure, thus appealing to a broader range of financial institutions. The flexibility of this platform may lead to increased adoption rates of biometric solutions across the market.

In August 2025, Fujitsu (JP) unveiled a pilot program for its latest biometric ATM model, which incorporates advanced AI algorithms for real-time fraud detection. This development is particularly noteworthy as it addresses growing concerns over security in financial transactions. By leveraging AI, Fujitsu aims to set a new standard for security in the biometric ATM sector, potentially reshaping customer expectations and competitive benchmarks.

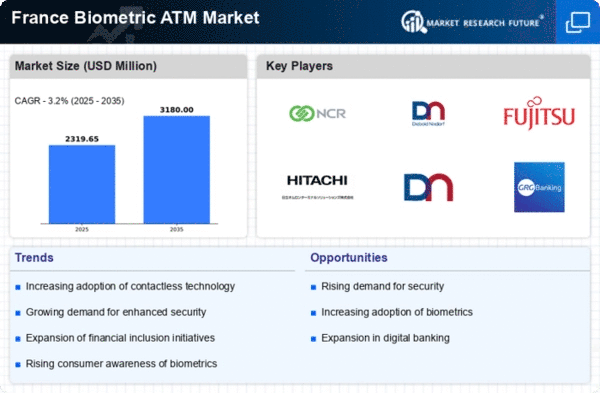

As of November 2025, current trends in the biometric ATM market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly important, as companies recognize the need to collaborate to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability. This shift underscores the necessity for companies to not only invest in cutting-edge technology but also to ensure that their operational frameworks can support these advancements.