- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

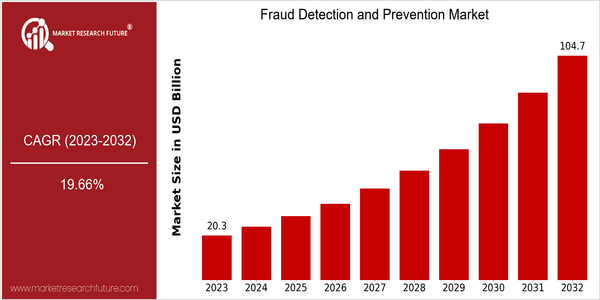

Fraud Detection Prevention Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 20.3 Billion |

| 2032 | USD 104.7 Billion |

| CAGR (2024-2032) | 19.66 % |

Note – Market size depicts the revenue generated over the financial year

Fraud Detection and Prevention Market is a high growth market, with an estimated value of $20.3 billion in 2023 and is projected to reach $104 billion by 2032. The CAGR for this market is 19.66% from 2024 to 2032. The high growth rate is due to the demand for advanced fraud prevention solutions from various industries. Increasingly sophisticated cyber threats and frauds are driving organizations to adopt new and advanced solutions to enhance their security framework. The adoption of artificial intelligence and machine learning technology enables real-time fraud detection and advanced fraud detection capabilities. In addition, the increasing digital transaction volume and the increasing focus on regulatory compliance are driving companies to implement fraud management systems. The key players in this market are IBM, FICO, and SAS. These companies are pursuing strategic initiatives such as strategic alliances and product innovations to strengthen their market positions. In recent years, IBM has been a pioneer in investing in the development of artificial intelligence-based fraud detection tools.

Regional Deep Dive

Fraud Detection and Prevention Market is experiencing a steady growth across various regions, owing to the rise in digital transactions, the evolution of cyber threats and the strict regulatory framework. North America is characterized by advanced technological adoption and the presence of large market players, whereas Europe is characterized by a surge in regulatory compliances. The Asia-Pacific region is experiencing a rapid growth due to the rise in e-commerce and mobile payments, while the Middle East and Africa are focusing on improving their security framework. Latin America is also emerging as a major market, with an increasing awareness of the risks of fraud and the need for robust fraud detection and prevention solutions.

North America

- The new General Data Protection Regulation and the Californian Consumer Protection Act have pushed the importance of data protection and data security even further, which has led to a greater investment in fraud detection tools.

- The leading companies are working on fraud prevention with artificial intelligence.

- The growth of digital banking and fintech companies has led to closer collaboration between the financial industry and IT companies, and to greater innovation in fraud prevention.

Europe

- The European Union’s Payment Services Directive 2 (PSD2) is transforming the payment landscape. The new rules require enhanced customer authentication, which has created a need for more sophisticated fraud detection systems.

- Fraud detection agencies like FICO and Experian are actively developing machine learning algorithms to counter the growing sophistication of fraud.

- Culture, a strong emphasis on consumer protection and privacy, influences the implementation of prevention technology in various European industries.

Asia-Pacific

- The rapid growth of e-commerce in China and India has heightened the importance of fraud prevention systems. As fraud grows, businesses are looking for ways to protect themselves from it.

- Government initiatives like the ‘Digital India’ programme are driving digital transactions and increasing the demand for security systems.

- Zeta and Razorpay are the two companies that have been innovating in the fraud detection space in Malaysia.

MEA

- In the United Arab Emirates, the drive to become a global financial technology hub is generating investments in fraud detection, with initiatives like the Dubai Fintech Strategy promoting innovation in this area.

- The African Cybersecurity Alliance is developing the region's cyber-security, including fraud detection and prevention.

- Culture, including the growing awareness of digital fraud risks among consumers and businesses, is also driving the increased use of fraud prevention solutions in the region.

Latin America

- In Brazil and Mexico, the growth of digital banking has led to the installation of new fraud-detection systems, to counter the growing threat of cyber-attacks.

- In Brazil, the new General Data Protection Law requires companies to adopt more stringent fraud prevention measures to ensure compliance with the new data protection standards.

- Kueski and Creditea are two of the local start-ups that are developing their own solutions to combat fraud, a problem that is particularly relevant to the region.

Did You Know?

“In the event of a fraud, approximately sixty per cent of small companies go out of business within six months. Hence the need for fraud detection and prevention solutions.” — Cybersecurity & Infrastructure Security Agency (CISA)

Segmental Market Size

Fraud Detection and Prevention Market is growing at a robust pace, driven by increasing digital transactions and the sophistication of cyber-attacks. Fraud detection and prevention solutions protect financial institutions, e-commerce platforms, and enterprises from fraudulent activities. This solution is vital for maintaining the trust of consumers and for regulatory compliance.

The demand for these products is being driven by the increased need for security in online transactions, as well as the onset of stricter regulations, such as the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS), which are demanding enhanced data protection measures. Among the major players are FICO and SAS, which have been the first to deploy advanced analytic and machine learning solutions. In the financial sector, the most important applications are real-time monitoring of transactions, the verification of customers’ identity, and the detection of fraud in insurance claims. The COVID19 pandemic has accelerated digital transformation, and this has led to an increased investment in fraud prevention. The integration of artificial intelligence and machine learning is shaping the evolution of the market, enabling more precise detection and response to fraudulent behaviour.

Future Outlook

Fraud detection and prevention systems will be a very significant market from 2023 to 2032, when the market is expected to increase from $ 20 billion to $ 104 billion, a strong compound annual growth rate of 19.66 percent. Fraud is becoming more and more common and sophisticated in all sectors, from finance to e-commerce to health. And as more and more organizations realize the importance of fraud prevention systems, the market will experience a high penetration rate of more than 60 percent in key industries by 2032.

Artificial intelligence and machine learning will change the way we detect fraud. These new techniques enable real-time data analysis and the creation of predictive models, enabling companies to better identify and manage risks. Also, the regulatory framework is becoming more demanding, forcing companies to invest in fraud prevention. Biometrics and the development of blockchain are also expected to enhance the security and the reliability of fraud detection systems, further driving growth. With the digital economy becoming the norm, the demand for fraud prevention solutions will continue to grow, and the market will continue to grow.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 16.6 Billion |

| Market Size Value In 2023 | USD 20.3 Billion |

| Growth Rate | 22.71% (2023-2032) |

Fraud Detection Prevention Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.