Regulatory Support for Cleaner Energy

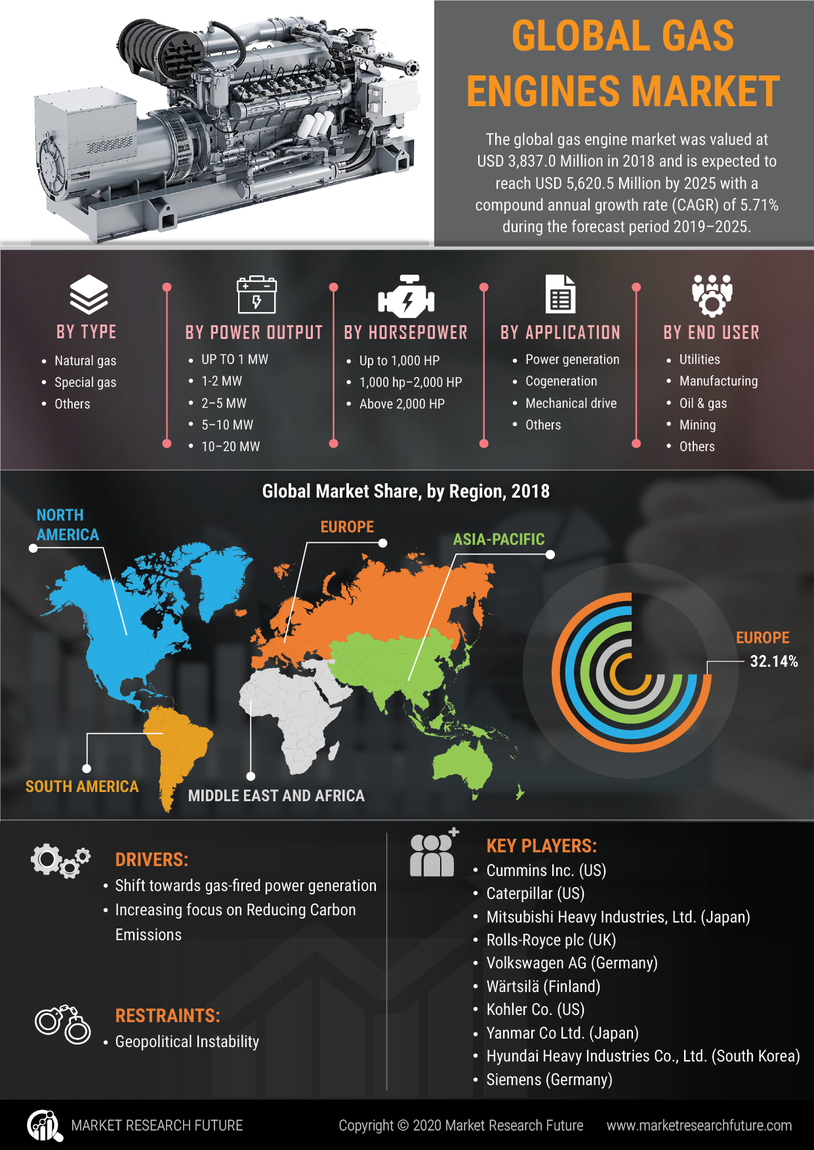

The Gas Engines Market benefits significantly from regulatory support aimed at promoting cleaner energy solutions. Governments worldwide are implementing stringent emissions regulations, which encourage the adoption of gas engines as a cleaner alternative to traditional diesel engines. For example, the implementation of the Euro 6 standards has led to a marked increase in the demand for gas engines in transportation and industrial applications. This regulatory framework not only incentivizes manufacturers to innovate but also fosters a competitive environment that drives down costs. As a result, the market is projected to grow at a compound annual growth rate of around 5% over the next five years, reflecting the positive impact of these regulations on the gas engines sector.

Emerging Market Demand for Gas Engines

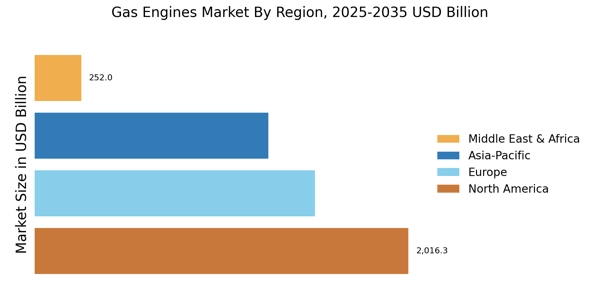

The Gas Engines Market is witnessing a surge in demand from emerging markets, where economic growth is driving the need for reliable and efficient energy solutions. Countries in Asia and Africa are increasingly investing in infrastructure development, which necessitates the use of gas engines for power generation and transportation. Recent statistics indicate that the demand for gas engines in these regions is expected to grow by over 30% by 2030. This trend is fueled by the need for energy security and the desire to reduce reliance on coal and oil. As these markets continue to expand, the gas engines sector is likely to capitalize on the growing appetite for cleaner and more efficient energy sources.

Technological Advancements in Gas Engines

The Gas Engines Market is experiencing a notable transformation due to rapid technological advancements. Innovations in engine design, fuel efficiency, and emissions control are driving the market forward. For instance, the introduction of turbocharging and advanced fuel injection systems has enhanced performance while reducing environmental impact. According to recent data, the efficiency of gas engines has improved by approximately 20% over the last decade, making them more appealing for various applications. Furthermore, the integration of digital technologies, such as IoT and AI, is optimizing engine performance and maintenance. These advancements not only cater to the growing demand for cleaner energy solutions but also position gas engines as a viable alternative in the energy sector.

Increased Investment in Natural Gas Infrastructure

The Gas Engines Market is poised for growth due to increased investment in natural gas infrastructure. As countries seek to diversify their energy sources, investments in pipelines, storage facilities, and distribution networks are becoming more prevalent. This infrastructure development not only facilitates the supply of natural gas but also enhances the viability of gas engines in various applications. Recent reports suggest that investments in natural gas infrastructure could exceed 200 billion dollars over the next decade. This influx of capital is expected to bolster the gas engines market, as it enables more widespread adoption and integration of gas engines into existing energy systems, thereby enhancing overall energy efficiency.

Growing Focus on Energy Efficiency and Sustainability

The Gas Engines Market is increasingly influenced by a growing focus on energy efficiency and sustainability. As industries and consumers become more environmentally conscious, there is a rising demand for energy solutions that minimize carbon footprints. Gas engines, known for their lower emissions compared to traditional fossil fuel engines, are well-positioned to meet this demand. Recent analyses indicate that gas engines can reduce greenhouse gas emissions by up to 30% compared to coal-fired power generation. This shift towards sustainable energy practices is prompting manufacturers to innovate and improve the efficiency of gas engines, further driving market growth. The emphasis on sustainability is likely to shape the future of the gas engines market, aligning it with global energy transition goals.