- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

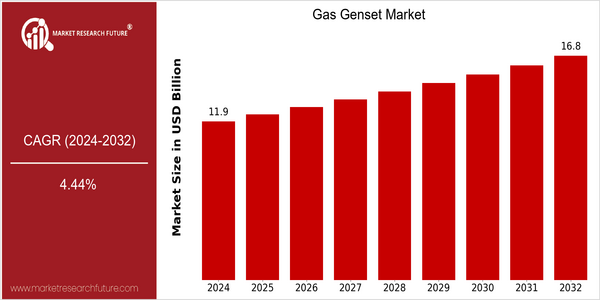

| Year | Value |

|---|---|

| 2024 | USD 11.87 Billion |

| 2032 | USD 16.8 Billion |

| CAGR (2024-2032) | 4.44 % |

Note – Market size depicts the revenue generated over the financial year

Gas-fired power generation has a steady growth. The market is expected to reach USD 11.8 billion in 2024 and USD 16.8 billion in 2032. This represents a CAGR of 4.44%. The increasing demand for reliable and efficient power generation, especially in regions where the electricity supply is not guaranteed, is driving the market. The transition to clean energy and the use of natural gas as a more sustainable alternative to diesel are also driving the market. The development of high-efficiency gas engines and hybrid power generation systems will also drive the market. The key players in the gas-fired power generation industry, such as Caterpillar Inc., Cummins Inc. and Generac Holdings Inc., are actively investing in research and development to improve product performance and reduce emissions. Strategic initiatives such as acquisitions and mergers, as well as the establishment of joint ventures and other forms of cooperation, are expected to play an important role in the future development of the market.

Regional Market Size

Regional Deep Dive

The gas-driven generators market is growing significantly across many regions, driven by the increasing demand for reliable power solutions, particularly in areas with unreliable electricity supply. The market is also influenced by technological developments, regulatory frameworks promoting cleaner energy and the growing trend towards hybrid power systems. The regions have their own particular characteristics: North America focuses on energy efficiency and sustainability, Europe on strict emissions regulations, Asia-Pacific on industrialization, the Middle East and Africa on the development of the country's economy and Latin America on the integration of renewable energies.

Europe

- Europe is leading the charge in regulatory changes, with the European Union's Green Deal pushing for a significant reduction in greenhouse gas emissions, thereby increasing the demand for gas gensets as a transitional technology.

- Companies like Rolls-Royce and Wärtsilä are at the forefront of developing high-efficiency gas gensets, which are increasingly being utilized in combined heat and power (CHP) applications across the region.

Asia Pacific

- The Asia-Pacific region is experiencing rapid industrial growth, particularly in countries like India and China, where gas gensets are being deployed to support infrastructure development and urbanization.

- Government initiatives, such as India's National Gas Grid project, are facilitating the expansion of natural gas infrastructure, which is expected to boost the gas genset market significantly.

Latin America

- Latin America is increasingly focusing on renewable energy integration, with countries like Brazil and Chile exploring gas gensets as a backup power solution to complement their renewable energy sources.

- Regulatory frameworks in the region are evolving, with governments promoting cleaner energy technologies, which is expected to drive the adoption of gas gensets in both residential and commercial sectors.

North America

- The North American market is witnessing a surge in demand for gas gensets due to the increasing adoption of natural gas as a cleaner alternative to diesel, supported by government incentives for cleaner energy solutions.

- Key players like Caterpillar Inc. and Generac Holdings Inc. are innovating with advanced technologies, such as remote monitoring and IoT integration, enhancing the efficiency and reliability of gas gensets.

Middle East And Africa

- The main factor driving the gas engine market in the Middle East and Africa is the investment in energy-related projects, particularly in the United Arab Emirates and South Africa, where gas is seen as a key element of the energy diversification strategy.

- The region is also witnessing partnerships between local governments and international companies, such as Siemens and GE, to develop gas-fired power plants, which will enhance the demand for gas gensets.

Did You Know?

“Did you know that gas gensets can achieve up to 90% efficiency when used in combined heat and power (CHP) applications, making them one of the most efficient power generation solutions available?” — International Energy Agency (IEA)

Segmental Market Size

Gas-powered generators are currently enjoying a steady growth spurt, driven by the increasing need for reliable power solutions in a wide range of industries. The need for reliable back-up power in commercial and industrial applications, coupled with stringent regulations aimed at reducing emissions, has led to a surge in demand for gas-powered generators. In addition, technological advances in engine performance and efficiency have further increased the popularity of gas-powered generators over diesel-powered units. Gas-powered generators are now in a stage of mass production, and leading players such as Caterpillar and Cummins are already reaping the benefits of their innovations. North America and Europe are the frontrunners in the market, especially in industries such as hospitals and data centers, where the need for reliable power is paramount. Gas-powered generators are primarily used for back-up power, peak shaving, and cogeneration applications. These trends will continue to drive the market as governments mandate cleaner energy sources and digital monitoring and control systems evolve.

Future Outlook

From 2024 to 2032, the gas generating market is expected to grow from $11.87 billion to $16.8 billion, with a compound annual growth rate (CAGR) of 4.44%. This growth is due to the increasing demand for reliable and efficient power generation solutions in the industrial, commercial, and residential sectors. Gas generators, with their lower emissions compared to diesel generators, are increasingly being used to meet stricter regulations and sustainable goals. Gas generators will account for approximately one-quarter of the total generating market in 2032, driven by their efficiency and flexibility in hybrid and micro-grid applications. Moreover, the integration of digital monitoring systems and the improvement of engine efficiency will further enhance the performance and reliability of gas gensets. Moreover, the development of natural gas and government support for this energy source will continue to drive the market. Also, the integration of renewable energy sources and the growing adoption of combined heat and power systems will have a major influence on the market. As the main focus of the energy industry is on energy security and sustainable development, the gas genset market is well positioned to meet the evolving needs of the global energy market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 10.8 Billion |

| Market Size Value In 2023 | USD 11.3 Billion |

| Growth Rate | 5.00% (2023-2032) |

Gas Genset Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.