- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

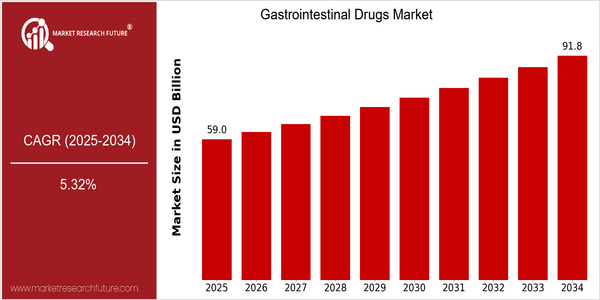

| Year | Value |

|---|---|

| 2025 | USD 59.02 Billion |

| 2034 | USD 91.81 Billion |

| CAGR (2025-2034) | 5.32 % |

Note – Market size depicts the revenue generated over the financial year

The gastrointestinal drugs market is poised for significant growth, with a current market size of USD 59.02 billion in 2025, projected to reach USD 91.81 billion by 2034. This growth trajectory reflects a compound annual growth rate (CAGR) of 5.32% over the forecast period. The increasing prevalence of gastrointestinal disorders, coupled with an aging population and rising healthcare expenditures, are key factors driving this market expansion. Additionally, advancements in drug formulations and delivery systems, including biologics and personalized medicine, are enhancing treatment efficacy and patient compliance, further propelling market growth. Key players in the gastrointestinal drugs sector, such as Johnson & Johnson, Pfizer, and AbbVie, are actively investing in research and development to innovate and expand their product portfolios. Strategic initiatives, including partnerships and collaborations aimed at developing novel therapies, are also shaping the competitive landscape. For instance, recent product launches targeting specific gastrointestinal conditions, such as irritable bowel syndrome and inflammatory bowel disease, underscore the commitment of these companies to address unmet medical needs and capture a larger market share. As the market evolves, the integration of digital health technologies and telemedicine is expected to play a pivotal role in enhancing patient access to gastrointestinal treatments.

Regional Market Size

Regional Deep Dive

The Gastrointestinal Drugs Market is characterized by a diverse range of products aimed at treating various gastrointestinal disorders, including acid reflux, irritable bowel syndrome, and inflammatory bowel disease. In North America, the market is driven by a high prevalence of gastrointestinal diseases, advanced healthcare infrastructure, and significant investments in research and development. Europe showcases a strong regulatory framework and a growing emphasis on personalized medicine, while the Asia-Pacific region is witnessing rapid growth due to increasing healthcare access and rising awareness of gastrointestinal health. The Middle East and Africa present unique challenges, including varying healthcare standards and economic disparities, but also opportunities for growth as healthcare systems evolve. Latin America is experiencing a gradual increase in demand for gastrointestinal drugs, influenced by changing dietary habits and urbanization.

Europe

- The European Medicines Agency (EMA) has introduced new guidelines for the approval of biosimilars, which is expected to increase competition and reduce costs for gastrointestinal drugs.

- There is a growing trend towards the use of probiotics and prebiotics in gastrointestinal treatments, with several companies, such as Danone and Yakult, investing in research to develop innovative products.

Asia Pacific

- Countries like India and China are witnessing a surge in gastrointestinal disorders due to lifestyle changes and dietary habits, prompting local pharmaceutical companies to invest in the development of targeted therapies.

- The Asia-Pacific region is seeing increased collaboration between pharmaceutical companies and research institutions to develop novel drug delivery systems, enhancing the efficacy of gastrointestinal treatments.

Latin America

- The rise in urbanization and changing dietary patterns in Latin America are leading to an increase in gastrointestinal disorders, prompting pharmaceutical companies to expand their product offerings in the region.

- Regulatory bodies in countries like Brazil and Mexico are streamlining approval processes for new gastrointestinal drugs, encouraging innovation and faster market entry.

North America

- The FDA has recently approved several new biologics for the treatment of inflammatory bowel diseases, which is expected to enhance treatment options and improve patient outcomes.

- Telehealth services have gained traction in North America, allowing for better management of gastrointestinal disorders, particularly during the COVID-19 pandemic, leading to increased patient engagement and adherence to treatment.

Middle East And Africa

- The World Health Organization (WHO) has launched initiatives to improve gastrointestinal health awareness in the region, which is expected to drive demand for gastrointestinal drugs.

- Local manufacturers are increasingly focusing on producing generic versions of popular gastrointestinal medications, making treatments more accessible to the population.

Did You Know?

“Approximately 60-70 million people in the United States are affected by gastrointestinal diseases, making it a significant public health concern.” — National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK)

Segmental Market Size

The Gastrointestinal Drugs Market is a dynamic segment within the pharmaceutical industry, currently experiencing stable growth driven by increasing prevalence of gastrointestinal disorders such as irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD). Key factors propelling demand include rising consumer awareness regarding digestive health and advancements in drug formulations that enhance efficacy and reduce side effects. Regulatory policies, particularly in regions like the EU and the US, are also facilitating faster approvals for innovative therapies, further stimulating market activity. Currently, the adoption stage of gastrointestinal drugs is in a mature phase, with companies like AbbVie and Takeda leading in the development of biologics and biosimilars for chronic conditions. Primary applications include prescription medications for IBS, ulcerative colitis, and Crohn's disease, with notable products such as Humira and Entyvio. Trends such as the increasing focus on personalized medicine and the integration of digital health technologies, including telemedicine and mobile health apps, are catalyzing growth. Additionally, the ongoing emphasis on preventive healthcare and patient-centric approaches is shaping the evolution of this segment, ensuring that gastrointestinal drugs remain at the forefront of therapeutic innovation.

Future Outlook

The Gastrointestinal Drugs Market is poised for significant growth from 2025 to 2034, with the market value projected to increase from $59.02 billion to $91.81 billion, reflecting a robust compound annual growth rate (CAGR) of 5.32%. This growth trajectory is driven by an aging population, rising prevalence of gastrointestinal disorders, and increasing awareness of digestive health. By 2034, it is anticipated that the penetration of gastrointestinal drugs will reach approximately 25% of the global population, highlighting a growing reliance on pharmacological interventions for managing digestive health issues. Key technological advancements, such as the development of biologics and personalized medicine, are expected to revolutionize treatment options, offering more effective and targeted therapies for conditions like irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD). Additionally, policy drivers, including increased healthcare spending and supportive regulatory frameworks for drug approvals, will further facilitate market expansion. Emerging trends, such as the integration of digital health solutions and telemedicine in gastrointestinal care, will also play a crucial role in enhancing patient access to treatments and improving adherence to medication regimens, ultimately shaping the future landscape of the gastrointestinal drugs market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 50.9 Billion |

| Market Size Value In 2023 | USD 53.5 Billion |

| Growth Rate | 5.03% (2023-2032) |

Gastrointestinal Drugs Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.