Increasing Health Awareness

The GCC Health And Wellness Product Market is experiencing a notable surge in health awareness among consumers. This trend is largely driven by a growing understanding of the importance of preventive healthcare and healthy living. As individuals become more informed about the benefits of nutrition, exercise, and mental well-being, they are increasingly seeking products that align with these values. According to recent surveys, approximately 70% of consumers in the GCC region express a desire to improve their health through dietary changes and physical activity. This heightened awareness is prompting manufacturers to innovate and diversify their product offerings, catering to the evolving preferences of health-conscious consumers.

Rising Demand for Functional Foods

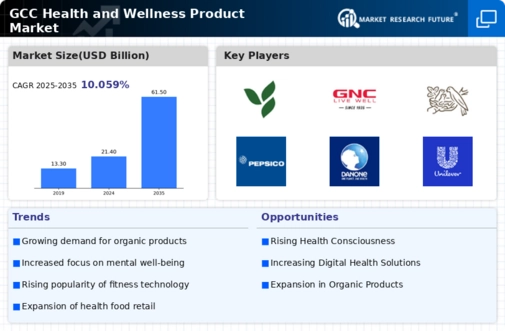

The GCC Health And Wellness Product Market is witnessing a significant increase in demand for functional foods. These products, which offer health benefits beyond basic nutrition, are becoming increasingly popular among consumers seeking to enhance their overall well-being. The market for functional foods in the GCC is projected to grow at a compound annual growth rate (CAGR) of over 8% in the coming years. This growth is attributed to a rising awareness of the role of nutrition in disease prevention and health maintenance. As consumers become more discerning, they are likely to gravitate towards products that provide specific health benefits, such as improved digestion, enhanced immunity, and better heart health.

Government Initiatives and Policies

Government initiatives in the GCC region are playing a pivotal role in shaping the Health And Wellness Product Market. Various countries are implementing policies aimed at promoting healthier lifestyles and reducing the prevalence of lifestyle-related diseases. For instance, the UAE's National Agenda emphasizes the importance of health and wellness, encouraging investments in health-related sectors. Additionally, Saudi Arabia's Vision 2030 includes objectives to enhance the quality of life, which encompasses health and wellness initiatives. These government-led efforts are likely to stimulate market growth by fostering an environment conducive to the development and distribution of health and wellness products.

Shift Towards Preventive Healthcare

A notable shift towards preventive healthcare is influencing the GCC Health And Wellness Product Market. Consumers are increasingly prioritizing preventive measures over reactive treatments, leading to a growing interest in products that promote long-term health. This trend is reflected in the rising sales of supplements, vitamins, and health-enhancing products. Market data indicates that the sales of dietary supplements in the GCC region have seen a steady increase, with a projected growth rate of 7% annually. This shift is likely to encourage manufacturers to focus on developing innovative products that cater to the preventive health needs of consumers, thereby driving market expansion.

Emphasis on Sustainable and Eco-friendly Products

The GCC Health And Wellness Product Market is also experiencing a growing emphasis on sustainable and eco-friendly products. As consumers become more environmentally conscious, there is a rising demand for health and wellness products that are produced sustainably and have minimal environmental impact. This trend is evident in the increasing popularity of organic and natural products, which are perceived as healthier and more environmentally friendly. Market Research Future suggests that the demand for eco-friendly health products in the GCC is expected to rise by 10% over the next few years. This shift towards sustainability is likely to influence product development and marketing strategies within the industry.