Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare within the GCC region, which is positively impacting the medical imaging-software market. As healthcare systems shift towards preventive measures, the demand for imaging solutions that aid in early disease detection is increasing. This trend is supported by initiatives aimed at promoting health awareness and regular screenings. Consequently, the market for medical imaging software is expected to expand, as healthcare providers seek to implement solutions that facilitate early diagnosis and intervention, potentially reducing long-term healthcare costs.

Increased Healthcare Expenditure

The medical imaging-software market benefits from rising healthcare expenditure across the GCC countries. Governments are investing heavily in healthcare infrastructure, aiming to improve service delivery and patient care. For instance, healthcare spending in the GCC is expected to reach approximately $100 billion by 2025. This increase in funding is likely to facilitate the procurement of advanced medical imaging technologies and software solutions. As healthcare facilities expand their capabilities, the demand for innovative imaging software is anticipated to grow, thereby driving market expansion.

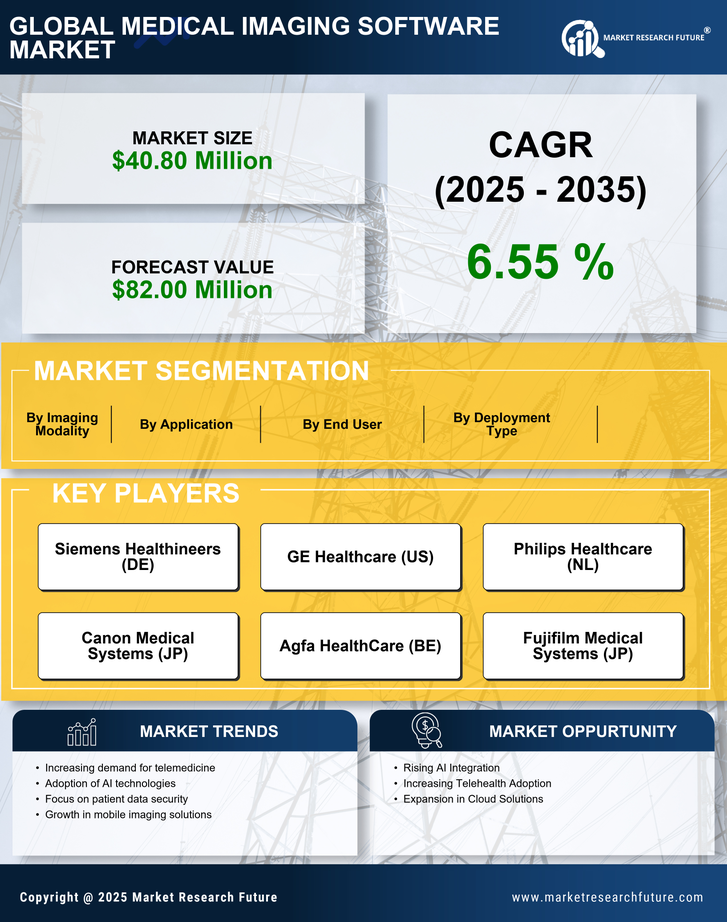

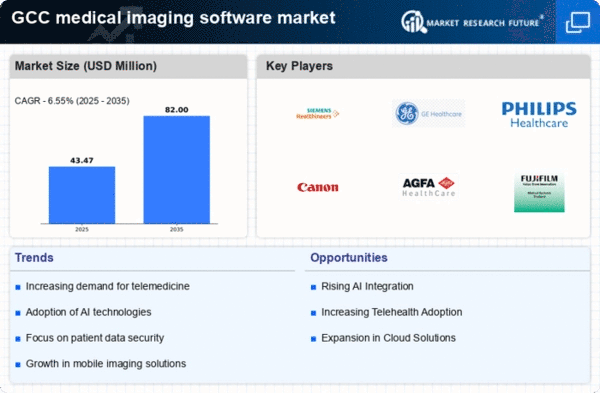

Rising Demand for Diagnostic Imaging

The medical imaging-software market is experiencing a surge in demand for diagnostic imaging solutions. This trend is driven by an increasing prevalence of chronic diseases and a growing aging population in the GCC region. As healthcare providers seek to enhance diagnostic accuracy and patient outcomes, the adoption of advanced imaging technologies becomes imperative. Reports indicate that the market for diagnostic imaging is projected to grow at a CAGR of approximately 8% from 2025 to 2030. This growth is likely to stimulate investments in medical imaging-software, as healthcare facilities aim to integrate sophisticated imaging solutions into their practices.

Technological Advancements in Imaging Techniques

Technological innovations are significantly influencing the medical imaging-software market. The introduction of high-resolution imaging modalities, such as MRI and CT scans, has transformed diagnostic capabilities. Furthermore, advancements in software algorithms enhance image processing and analysis, leading to improved diagnostic accuracy. The GCC region is witnessing a shift towards more sophisticated imaging solutions, with a projected market growth of around 7% annually. This trend suggests that healthcare providers are increasingly prioritizing the acquisition of cutting-edge imaging software to remain competitive and provide superior patient care.

Collaboration Between Healthcare Providers and Tech Firms

The medical imaging-software market is witnessing a trend of collaboration between healthcare providers and technology firms. Such partnerships are fostering innovation and the development of tailored imaging solutions that meet specific healthcare needs. By leveraging technological expertise, healthcare organizations can enhance their imaging capabilities and improve patient outcomes. This collaborative approach is likely to drive market growth, as evidenced by the increasing number of joint ventures and partnerships in the GCC region. The synergy between healthcare and technology sectors may lead to the introduction of novel imaging software solutions that address emerging healthcare challenges.