- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

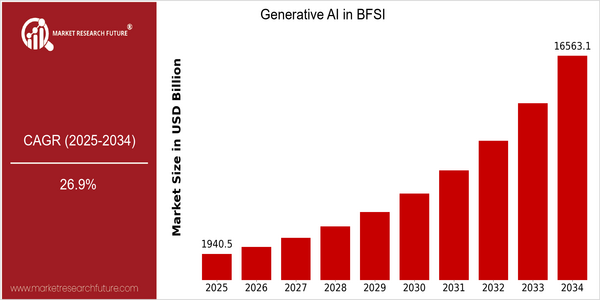

| Year | Value |

|---|---|

| 2025 | USD 1940.55 Billion |

| 2034 | USD 16563.08 Billion |

| CAGR (2025-2034) | 26.9 % |

Note – Market size depicts the revenue generated over the financial year

The BFSI industry is a great place to start. It is the world's largest economy. The industry is growing at a CAGR of 26% during the forecast period. This phenomenal growth is attributed to the increasing adoption of advanced AI tools in this industry. This is driven by the need for improved customer experiences, improved operations, and data-driven decisions. It is also driven by the need for a more individualized financial experience, the integration of AI into risk management, and the automation of routine tasks. The technological advancements in natural language processing and machine learning have made it possible for financial institutions to use generative AI to build solutions like chatbots, fraud detection systems, and algorithmic trading. And the major players in the industry are not to be left behind. They are investing heavily in their AI capabilities, forming strategic alliances, and launching new products to capture this lucrative market. These initiatives not only enhance their competitive edge but also contribute to the growth of the generative AI market in the BFSI industry.

Regional Market Size

Regional Deep Dive

The generative AI in BFSI market is experiencing significant growth in various regions, driven by advancements in technology, the growing demand for personal financial services, and the need to optimize operations. In North America, the market is characterized by the presence of technologically advanced financial institutions and a regulatory environment that encourages innovation. In Europe, there is a surge in regulatory initiatives to ensure data security and privacy. In the Asia-Pacific region, there is a growing trend of digitalization, and a large number of fintechs are using generative AI to enhance customer experience. The Middle East and Africa are also beginning to explore the potential of generative AI, although at a slower pace. The market is characterized by varying levels of investment in technology. Latin America is gradually catching up. There is an increased interest among both traditional and new-age financial institutions in utilizing generative AI for better service delivery and risk management.

Europe

- In Europe, the general data protection regulation has brought a cautious approach to the application of artificial intelligence, which has forced financial institutions to put compliance first when deploying generative solutions. The market is changing.

- Companies like HSBC and Deutsche Bank are collaborating with AI startups to develop generative AI tools that enhance fraud detection and risk assessment, showcasing a trend of partnerships between traditional banks and tech innovators.

Asia Pacific

- In countries like India and China, fintech companies are rapidly adopting generative AI to offer personalized financial products, driven by a young, tech-savvy population and increasing smartphone penetration.

- Government initiatives, such as the Digital India program, are promoting the use of AI in financial services, encouraging banks to innovate and improve customer engagement through generative AI technologies.

Latin America

- Brazil's fintech landscape is booming, with companies like Nubank leveraging generative AI to enhance customer service and streamline operations, indicating a shift towards digital-first banking solutions.

- Regulatory bodies in countries like Mexico are beginning to establish frameworks for AI use in financial services, which is expected to encourage more banks to adopt generative AI technologies.

North America

- Major banks like JPMorgan Chase and Bank of America are investing heavily in generative AI technologies to enhance customer service and streamline operations, reflecting a trend towards automation and personalization in financial services.

- The United States government has launched initiatives to encourage the development of AI. The National Artificial Intelligence Initiative Act is intended to promote research and development in this field. This creates a favorable environment for generative applications of AI in the BFSI sector.

Middle East And Africa

- The UAE is leading the charge in the Middle East with its AI Strategy 2031, which aims to position the country as a global hub for AI, influencing the BFSI sector to adopt generative AI for enhanced customer experiences.

- In Africa, banks like Standard Bank are exploring generative AI to improve credit scoring and risk management, reflecting a growing recognition of AI's potential to address unique regional challenges.

Did You Know?

“A recent study found that 75% of financial institutions in North America are planning to invest in generative AI technologies within the next two years, highlighting the rapid adoption of AI in the BFSI sector.” — Source: Deloitte Insights

Segmental Market Size

Generative AI is a segment of the BFSI market that is currently undergoing robust growth, owing to the growing demand for a more personalised customer experience and greater operational efficiency. This is being driven by the need for advanced data analytics to improve decision-making, as well as by regulatory requirements for better risk management and compliance. In particular, financial institutions are keen to exploit AI to reduce costs and streamline operations. Among the notable players already deploying generative AI in BFSI are JP Morgan Chase, which uses it for fraud detection and risk management, and Goldman Sachs, which uses it for investment analysis. These applications are the most common. Other important applications include customer service chatbots, automated report generation and personalised financial advice. Natural language processing and machine learning are driving the evolution of this market, enabling more sophisticated and efficient solutions.

Future Outlook

Generative artificial intelligence in the financial industry is slated to grow at an astonishing rate between 2025 and 2034, with a projected market value of $1.94 billion soaring to an impressive $16.56 billion. This would be at a CAGR of 26.9%, driven by the increased use of AI to enhance customer experience, optimize operations and reduce risk. It is anticipated that by 2034, more than 60% of financial services firms will have integrated generative solutions into their core processes, transforming service delivery and operational efficiency. The most important developments in the generative AI space will be in the areas of natural language processing and machine learning. Also, regulatory frameworks will evolve to ensure the responsible use of AI and the protection of data privacy and security. Future trends, such as individualized financial services and automated compliance monitoring, will further drive growth. It is predicted that, as companies come to realize the strategic value of generative AI, it will be an essential part of their digital transformation strategies, enabling them to compete in an increasingly crowded market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 26.90% (2023-2032) |

Generative AI in BFSI Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.