Germany E-Waste Management Market Overview

As per MRFR analysis, the Germany E-Waste Management Market Size was estimated at 4.55 (USD Billion) in 2023.The Germany E-Waste Management Market is expected to grow from 4.85(USD Billion) in 2024 to 11.92 (USD Billion) by 2035. The Germany E-Waste Management Market CAGR (growth rate) is expected to be around 8.518% during the forecast period (2025 - 2035).

Key Germany E-Waste Management Market Trends Highlighted

A number of important market factors impact the e-waste management industry in Germany. The government's strict regulatory structure, which places a strong emphasis on the appropriate disposal and recycling of electronic trash, is one important motivator.

The ElektroG (Electrical and Electronic Equipment Act) forces manufacturers to adopt sustainable practices by requiring them to be accountable for the end-of-life management of their goods. The EU's Waste Electrical and Electronic Equipment (WEEE) directive, which encourages the development of a systematic e-waste recycling system, has also been ratified by Germany.

There are new opportunities in the German e-waste industry, especially in the field of cutting-edge recycling methods and technologies that increase the recovery rates of valuable materials from discarded electronics.

The growing consumer demand for sustainability and environmental consciousness will be advantageous to businesses that can provide solutions for the safe processing of hazardous elements in e-waste and figure out how to recycle recovered materials back into the production cycle.

Consumer behavior is shifting toward greater knowledge and accountability when it comes to handling electronic trash, according to recent trends. Campaigns by municipalities and environmental groups have encouraged more Germans to participate in collection and recycling programs.

Digital platforms are increasingly being used to help collect e-waste and educate customers about the negative effects incorrect disposal has on the environment.

A wider dedication to sustainability in German society is also shown in the growing popularity of the circular economy concept, which promotes the design of electronics with longer lifespans and recyclability in mind. Together, these elements influence Germany's e-waste management environment and set the stage for a future that is more accountable and resource-efficient.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Germany E-Waste Management Market Drivers

Increasing E-Waste Generation in Germany

Germany is witnessing a significant rise in electronic waste due to rapid technological advancements and consumer behavior trends. In 2021, approximately 1.8 million metric tons of e-waste were generated in Germany, marking a 25% increase over the last decade.

The Federal Environment Agency reported that this increase is driven by higher consumption rates of electronic devices, particularly smartphones and home appliances. As technology continues to evolve at an unprecedented pace, the demand for efficient e-waste management solutions will surge.

This trend positions the Germany E-Waste Management Market for robust growth as both consumers and businesses opt for responsible disposal methods to comply with strict regulations enforced by the government, including the Electrical and Electronic Equipment Act (ElektroG).

With growing awareness among consumers regarding the environmental impact of improper e-waste disposal, the necessity for established e-waste management organizations is becoming more pronounced.

Government Regulations Promoting E-Waste Recycling

The German government has established stringent regulations to bolster e-waste recycling initiatives, significantly contributing to the growth of the Germany E-Waste Management Market. Under the extended producer responsibility (EPR) principle, manufacturers are mandated to bear the costs associated with e-waste collection, recycling, and environmentally sound disposal.

Recent updates to the ElektroG Act emphasize the reduction of electronic waste and the improvement of recycling rates, with Germany targeting a 65% recycling rate by 2024. This initiative aligns with the European Union's Waste Electrical and Electronic Equipment Directive, pushing the market for efficient e-waste management solutions.

Major organizations such as the German Electronic Waste Management Association actively support these regulations by providing resources and partnerships for businesses to comply, thereby enhancing market growth potential.

Rising Consumer Awareness and Demand for Sustainable Practices

There has been a notable shift in consumer behavior towards sustainability in Germany. A recent survey indicated that over 70% of German consumers are willing to pay a premium for eco-friendly products and services. This increasing awareness aligns with the global trend towards environmental conservation, significantly impacting the Germany E-Waste Management Market.

Organizations like the German Recycling Company have initiated campaigns to educate the public about the environmental impacts of e-waste and the importance of recycling. As consumers become more environmentally conscious, they are actively seeking certified e-waste management services that adhere to stringent ecological standards, propelling market growth as businesses strive to meet this demand.

Technological Innovations in E-Waste Management Processes

Technological advancements are revolutionizing the e-waste management processes in Germany, facilitating more efficient recycling and disposal techniques. Innovations such as automated sorting and advanced data destruction technologies enable the recovery of valuable materials while ensuring ecological safety.

A report from the International Institute of Sustainable Development suggests that more than 30% of electronic devices contain recoverable materials, and with improved technologies, companies could increase recovery rates significantly.

Leading e-waste management firms are investing in Research and Development initiatives to enhance their operational capabilities, thereby providing a competitive edge. This trend underscores the potential for growth in the Germany E-Waste Management Market as businesses adopt innovative solutions to meet increasing regulatory demands and consumer expectations.

Germany E-Waste Management Market Segment Insights

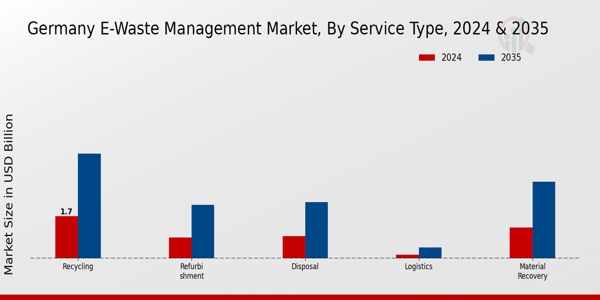

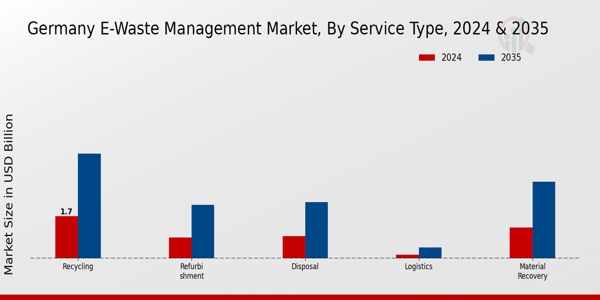

E-Waste Management Market Service Type Insights

The Germany E-Waste Management Market showcases a developing landscape for various service types, which play a pivotal role in the handling of electronic waste.

This market segment encompasses activities such as Material Recovery, Refurbishment, Recycling, Disposal, and Logistics, each contributing significantly to the overall efficacy and sustainability of e-waste management strategies within the country.

With the growing public awareness regarding environmental sustainability, the Material Recovery process emerges as vital, as it focuses on reclaiming valuable materials from discarded electronics, thus reducing resource depletion and minimizing environmental impact.

Refurbishment services have gained traction, emphasizing the importance of prolonging product life cycles and promoting a circular economy by repairing and reusing devices that might otherwise contribute to e-waste.

The Recycling efforts within Germany are extensive due to stringent regulations mandating responsible disposal and material recovery, ensuring that hazardous substances are handled appropriately while recovering metals and other useful materials, therefore creating a closed-loop system that benefits both the environment and economy.

Additionally, Disposal services are essential for ensuring compliance with existing legal requirements, safeguarding public health, and environmental safety by providing safe and responsible disposal options for end-of-life electronics.

Meanwhile, Logistics in e-waste management entails the efficient transportation and processing of electronic waste, highlighting a growing need for integrated supply chain solutions to manage the influx of e-waste generated by consumers and businesses alike.

These service types reflect the trends in the Germany E-Waste Management Market, where evolving consumer behavior, coupled with governmental initiatives targeting sustainability and increased recycling rates, exhibits a comprehensive strategy to mitigate the ecological footprint of e-waste.

The growth drivers include technological advancements, regulatory pressures, and increasing environmental awareness among the population.

As Germany continues to lead in technological innovation and sustainability practices, the importance of each service type will only amplify, providing opportunities for market players to enhance their operations, thereby contributing to a more sustainable e-waste management ecosystem.

The evolving landscape underscores the necessity for stakeholders to adopt efficient practices that can aid in attaining both economic and environmental goals in a rapidly changing technological environment.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

E-Waste Management Market Source of E-Waste Insights

The Source of E-Waste segment within the Germany E-Waste Management Market plays a pivotal role in addressing the growing concern of electronic waste disposal. Household appliances contribute substantially to the overall e-waste due to their short life cycles and rapid technological advancements.

Consumer electronics also generate a significant portion of e-waste, driven by trends in upgrading devices and consumer demand for the latest technologies. IT equipment forms another critical source as businesses continuously replace outdated systems, leading to increased electronic waste.

Telecommunications equipment, influenced by advancements in communication technologies, also adds to the e-waste landscape, with a notable uptick in discarded devices. Lastly, industrial equipment, encompassing a variety of electronics in manufacturing processes, represents a vital area requiring effective waste management solutions.

The market is propelled by regulatory policies in Germany aimed at enhancing recycling practices, reducing environmental impact, and promoting sustainability. With the increasing awareness of e-waste hazards, opportunities arise for innovative recycling technologies and responsible disposal methods, underscoring the importance of this segment in the overall e-waste management framework.

Overall, understanding the dynamics of various sources of e-waste allows stakeholders to develop more targeted and effective waste management strategies.

E-Waste Management Market End-user Insights

The Germany E-Waste Management Market, particularly in terms of the End-user segment, showcases a diverse range of contributors to the industry, characterized by sectors such as Residential, Commercial, Industrial, and Government.

The Residential sector is a key driver in promoting e-waste recycling initiatives, reflecting growing consumer awareness regarding the environmental impact of electronic waste. Additionally, the Commercial sector plays a significant role as businesses are increasingly adopting sustainable practices and focusing on proper disposal methods for obsolete electronics.

The Industrial segment also has notable importance, as manufacturing and technological applications lead to considerable e-waste generation, prioritizing the need for effective management solutions. Government involvement is crucial in reinforcing regulations and policies to enforce e-waste management frameworks, thereby facilitating responsible e-waste disposal and recycling.

Each segment holds unique value in the overall dynamic of the Germany E-Waste Management Market, contributing to its growth, alongside evolving consumer behavior and enhanced regulatory pressures that push for sustainable practices in the management of electronic waste.

E-Waste Management Market Material Type Insights

The Germany E-Waste Management Market is characterized by its diverse Material Type segment, which includes Metals, Plastics, Glass, and Circuit Boards. This segmentation plays a crucial role in the overall market dynamics, as each material type contributes uniquely to the e-waste lifecycle.

Metals are critical due to their high recovery rates and economic value, with various industries relying on recycled metals for production, thus driving demand for efficient e-waste recycling processes. Plastics, comprising a significant portion of e-waste, present challenges in recycling due to their complex compositions, yet they also offer opportunities for advancements in recycling technologies.

Glass, although less prevalent, is recyclable and essential due to its use in consumer electronics, playing a part in reducing landfill waste. Circuit Boards are vital for their dense metal content, making them a target for recovery efforts due to their significant contribution to the overall e-waste volume.

The importance of these Material Types is further emphasized as Germany continues to enforce stringent regulations on e-waste disposal and recycling, thereby prompting companies to innovate in material recovery and recycling processes.

This commitment fosters market growth, as the demand for sustainable practices aligns with the increasing awareness of environmental issues associated with e-waste.

Germany E-Waste Management Market Key Players and Competitive Insights

The Germany E-Waste Management Market is characterized by a competitive landscape that is both diverse and rapidly evolving. This market has emerged in response to the growing concern over electronic waste and the need for sustainable disposal practices.

As technology advances, the volume of e-waste generated increases, leading to a demand for efficient recycling and disposal solutions. Companies operating in this sector are focusing on innovative methods to reclaim materials from discarded electronics while ensuring compliance with environmental regulations.

The competitive dynamics also reflect collaboration among stakeholders to enhance recycling rates and develop sustainable practices, indicating a mature market that continuously adapts to regulatory changes and ecological considerations.

Key Companies in the Germany E-Waste Management Market Include

- ECT Recycling

- Veolia

- SUEZ Recycling and Recovery

- ALBA Group

- REMONDIS

- Biffa

- Stena Recycling

- Waste Management

- Interseroh

Germany E-Waste Management Market Developments

The plant currently has robotics-enabled recovery technologies and improves precious metal extraction. In June 2024, REMONDIS opened a new e-waste electrorecycling line at its Lippe Plant in Lünen, processing electronic debris and recovering up to 30 million tons of recyclables yearly.

To enhance material separation and lower landfill rates, Veolia, SUEZ, ALBA/Interseroh, and Stena Recycling modernized their German networks in 2023 and 2024 with modular handling centers and AI-powered sorting systems; Veolia, in particular, installed smart robots in Hamburg and Frankfurt.

To improve rare-earth recovery, SUEZ deployed sensor-based tracking devices and next-generation optical sorting equipment in German facilities in April 2025.

In 2024, ECT Recycling, a specialized WEEE processor, expanded its capacity to facilitate the recycling of consumer electronics and IT in accordance with EU WEEE regulations and Germany's ElektroG. Biffa and Waste Management Inc. improved cross-border e-waste logistics, including safe data-wipe and refurbishing operations in central Germany, through European affiliates.

Thanks to strict EPR enforcement, state-of-the-art infrastructure, and well-coordinated public-private initiatives, Germany currently recycles around 69% of its municipal garbage, the highest percentage in the EU. E-waste recycling is also expanding quickly.

Germany E-Waste Management Market Segmentation Insights

E-Waste Management Market Service Type Outlook

- Material Recovery

- Refurbishment

- Recycling

- Disposal

- Logistics

E-Waste Management Market Source of E-Waste Outlook

- Household Appliances

- Consumer Electronics

- IT Equipment

- Telecommunications

- Industrial Equipment

E-Waste Management Market End-user Outlook

- Residential

- Commercial

- Industrial

- Government

E-Waste Management Market Material Type Outlook

- Metals

- Plastics

- Glass

- Circuit Boards

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

4.55(USD Billion) |

| MARKET SIZE 2024 |

4.85(USD Billion) |

| MARKET SIZE 2035 |

11.92(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

8.518% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Umweltbetrieb Hamburg, Schnitzer Steel Industries, ECT Recycling, Veolia, SUEZ Recycling and Recovery, ALBA Group, REMONDIS, Schrott24, Recup, Biffa, Fonroche, Electrolux, Stena Recycling, Waste Management, Interseroh |

| SEGMENTS COVERED |

Service Type, Source of E-Waste, End User, Material Type |

| KEY MARKET OPPORTUNITIES |

Increased recycling infrastructure investment, Growth in consumer electronics disposal, Expansion of regulatory compliance requirements, Rising awareness of sustainability practices, Development of innovative e-waste technologies |

| KEY MARKET DYNAMICS |

Regulatory compliance requirements, Increasing consumer awareness, Rapid technological advancement, Growing recycling initiatives, Market demand for sustainable solutions |

| COUNTRIES COVERED |

Germany |

Frequently Asked Questions (FAQ):

The Germany E-Waste Management Market is expected to be valued at 4.85 billion USD in 2024.

By 2035, the market is projected to reach an estimated value of 11.92 billion USD.

The market is anticipated to grow at a CAGR of 8.518% during the forecast period from 2025 to 2035.

Material Recovery is the leading service type, valued at 1.25 billion USD in 2024.

The Refurbishment segment is projected to be worth 2.15 billion USD by 2035.

The Recycling segment is estimated to be valued at 1.7 billion USD in 2024.

Key players include Umweltbetrieb Hamburg, Schnitzer Steel Industries, ECT Recycling, and Veolia, among others.

The Disposal segment is expected to reach a value of 2.25 billion USD by 2035.

The Logistics segment is projected to be worth 0.45 billion USD by 2035.

The growth is driven by increasing e-waste generation, stringent regulations, and advancements in recycling technologies.