Rising Healthcare Expenditure

The increase in healthcare expenditure in Germany is a notable driver for the neuropathic pain market. With the government and private sectors investing more in healthcare services, there is a greater focus on pain management and treatment options. In 2025, healthcare spending is projected to reach approximately €500 billion, reflecting a commitment to improving patient care. This financial investment facilitates research and development of new therapies and medications for neuropathic pain, potentially leading to more effective treatment options. Additionally, increased funding for healthcare services allows for better access to pain management specialists, which could enhance patient outcomes. The upward trend in healthcare expenditure is likely to bolster the neuropathic pain market, providing opportunities for growth and innovation.

Increasing Awareness of Neuropathic Pain

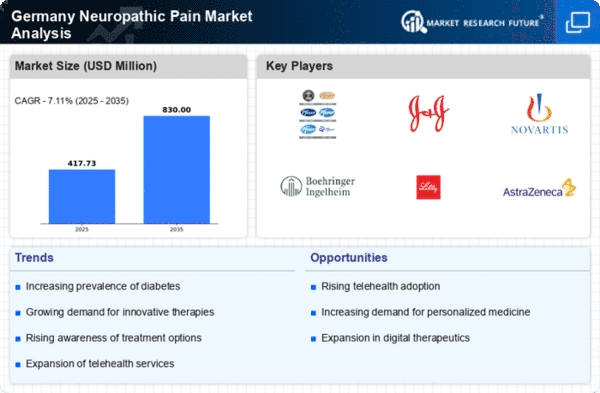

The growing awareness surrounding neuropathic pain is a crucial driver for the neuropathic pain market in Germany. Educational campaigns by healthcare organizations and patient advocacy groups have significantly improved understanding of neuropathic conditions. This heightened awareness leads to earlier diagnosis and treatment, which is essential for effective management. As more individuals recognize symptoms such as burning or tingling sensations, the demand for specialized treatments increases. In Germany, it is estimated that around 7-8% of the population suffers from neuropathic pain, indicating a substantial market potential. Furthermore, healthcare professionals are increasingly trained to identify and manage these conditions, further propelling the market's growth. The emphasis on patient education and awareness is likely to continue influencing the neuropathic pain market positively.

Technological Innovations in Pain Management

Technological advancements are reshaping the neuropathic pain market in Germany. Innovations such as neuromodulation devices, wearable pain management technologies, and telemedicine solutions are becoming increasingly prevalent. These technologies offer new avenues for pain relief and management, enhancing patient outcomes. For instance, neuromodulation techniques have shown promise in treating chronic neuropathic pain, leading to a potential increase in market share for these products. The integration of digital health solutions allows for remote monitoring and personalized treatment plans, which could improve adherence and effectiveness. As the healthcare landscape evolves, the adoption of these technologies is likely to drive growth in the neuropathic pain market, catering to the needs of both patients and healthcare providers.

Aging Population and Associated Health Issues

Germany's aging population is a significant driver of the neuropathic pain market. As individuals age, the prevalence of chronic conditions, including neuropathic pain, tends to rise. The demographic shift indicates that by 2030, approximately 25% of the German population will be over 65 years old. This demographic is particularly susceptible to neuropathic pain due to conditions such as diabetes and post-surgical complications. Consequently, the demand for effective pain management solutions is expected to increase. The healthcare system in Germany is adapting to this trend by focusing on geriatric care and pain management strategies, which could lead to a more robust neuropathic pain market. The intersection of an aging population and the need for specialized treatments presents a compelling opportunity for market growth.

Regulatory Support for Pain Management Solutions

Regulatory support for pain management solutions is emerging as a key driver in the neuropathic pain market. The German government has implemented policies aimed at improving access to pain management therapies, including neuropathic pain treatments. Initiatives to streamline the approval process for new medications and devices are likely to encourage innovation within the market. Furthermore, the establishment of guidelines for the treatment of neuropathic pain ensures that patients receive evidence-based care. This regulatory framework not only enhances patient safety but also fosters a competitive environment for pharmaceutical and medical device companies. As regulations evolve to support advancements in pain management, the neuropathic pain market is expected to benefit from increased product availability and improved treatment options.