- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

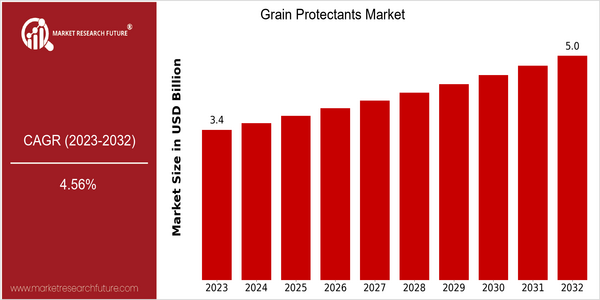

| Year | Value |

|---|---|

| 2023 | USD 3.35 Billion |

| 2032 | USD 5.0 Billion |

| CAGR (2024-2032) | 4.56 % |

Note – Market size depicts the revenue generated over the financial year

The market for grain protectants is estimated to reach $ 3.1 billion in 2023, and is expected to reach $ 5.0 billion by 2032, growing at a CAGR of 4.37% from 2024 to 2032. The market for grain protectants is expected to increase steadily, driven by the increasing need for effective pest management solutions in the agricultural sector. The use of advanced grain protectants is becoming increasingly important for ensuring food security and reducing post-harvest losses. There are several factors contributing to the market growth, including technological innovations in the formulation of products and the increasing awareness of sustainable agricultural practices. Bio-based protectants and integrated pest management strategies are gaining in popularity as they appeal to both consumers and farmers. Leading players, such as BASF, Syngenta and Bayer, are investing heavily in R & D to enhance their product offerings. Strategic initiatives, such as the establishment of joint ventures and strategic alliances, have further strengthened the competition in the grain protectants market.

Regional Market Size

Regional Deep Dive

Grain Protectants Market is experiencing dynamic growth across different regions. This growth is mainly driven by the increasing demand for food security and the need to reduce post-harvest losses. The grain protectants market in North America, Europe, Asia-Pacific, the Middle East and Africa (MEA) and Latin America is characterized by a combination of advanced agricultural practices, regulatory frameworks, and cultural attitudes towards food preservation. Each region has its own unique opportunities and challenges, influenced by local agricultural practices, economic conditions, and consumer preferences.

Europe

- The European Union's stringent regulations on pesticide use are pushing manufacturers to develop biopesticides and natural grain protectants, leading to a surge in innovation and product offerings in the market.

- Organizations such as the European Crop Protection Association (ECPA) are actively promoting sustainable practices, which is influencing farmers to adopt new grain protection technologies that align with environmental goals.

Asia Pacific

- Rapid urbanization and increasing population in countries like India and China are driving the demand for effective grain protectants to ensure food security, leading to significant investments in agricultural technology.

- Local companies, such as UPL Limited and Rallis India, are focusing on developing region-specific grain protectants that address the unique pest challenges faced by farmers in the Asia-Pacific region.

Latin America

- Brazil's growing agricultural sector is witnessing a shift towards integrated pest management practices, which include the use of advanced grain protectants, driven by both domestic and export market demands.

- Companies like FMC Corporation are expanding their presence in Latin America by introducing new grain protectant products tailored to local agricultural practices and pest challenges.

North America

- Recent regulations on the use of some grain protectants by the U.S. Environmental Protection Agency (EPA) have been revised to encourage the use of safer, more environment-friendly products, and this is expected to drive innovation in the market.

- Key players like BASF and Syngenta are investing in research and development to create advanced grain protectants that not only enhance shelf life but also cater to the growing demand for organic and sustainable farming practices.

Middle East And Africa

- The African Union's initiatives to enhance agricultural productivity are encouraging the adoption of modern grain protectants, which is crucial for reducing post-harvest losses in a region heavily reliant on agriculture.

- Innovative projects like the 'AgriTech Africa' initiative are promoting the use of technology in agriculture, including grain protection solutions, which is expected to improve food security and farmer incomes.

Did You Know?

“Did you know that approximately 30% of the world's food supply is lost or wasted each year, with a significant portion attributed to post-harvest losses in grains?” — Food and Agriculture Organization (FAO)

Segmental Market Size

In the grain-saver market, the need for pest control in agriculture is growing steadily. There are a number of factors driving the growth of this market, including growing public concern about food safety and quality and stringent government regulations that limit the use of pesticides in food products. In addition, the development of new technology for grain-saver formulations is expected to bring greater safety and effectiveness, which will further drive the market. At present, the use of grain-savers is at a mature stage, and companies such as BASF and Syngenta are leading the way in product innovation and application. The main application is the treatment of stored grains, which is an important way to prevent pests and ensure the quality of the grains. However, there are some new trends that are expected to accelerate the market, such as the development of sustainable products and the reduction of the use of pesticides in agriculture. Biopesticides and integrated pest management are expected to provide farmers with effective and sustainable grain-saving methods.

Future Outlook

The market for grain protectants is expected to grow from $3.35 billion in 2023 to $5.0 billion by 2032, at a compound annual growth rate (CAGR) of 4.56% from 2023 to 2032. This is mainly due to the increasing demand for food in the world, driven by population growth and changing eating habits. Also, as the agricultural sector places more emphasis on food security and sustainable development, the use of advanced grain protectants will become inevitable to prevent post-harvest loss and ensure the quality of stored grains. In 2032, the grain protectant penetration rate in the major markets is expected to reach about 60%, up from the current 40%, indicating a strong trend towards the improvement of agricultural technology. The development of new grain protectants, such as bio-based and environmentally friendly grain protectants, will also bring about changes in the market. The development of these new grain protectants will be driven by government regulations that encourage sustainable farming practices. The integration of digital technology in agriculture, such as precision agriculture and Internet of Things (IoT), will also make it possible to make better use of grain protectants, optimize the application and increase the efficiency of use. The use of grain protectants will be driven by a combination of the demand for sustainable development from consumers and the need for the agricultural industry to reduce food waste and improve the quality of food.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.31% (2023-2030) |

Grain Protectants Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.