- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

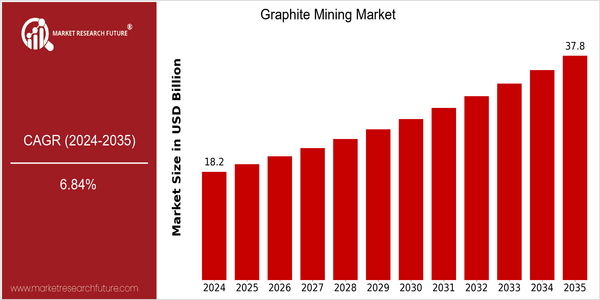

| Year | Value |

|---|---|

| 2024 | USD 18.25 Billion |

| 2035 | USD 37.8 Billion |

| CAGR (2025-2035) | 6.84 % |

Note – Market size depicts the revenue generated over the financial year

The global graphite mining market is poised for significant growth, with a current market size of USD 18.25 billion in 2024, projected to reach USD 37.8 billion by 2035. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 6.84% from 2025 to 2035. The increasing demand for graphite, driven by its essential role in various applications such as batteries for electric vehicles, lubricants, and advanced materials, is a key factor propelling this market expansion. As industries pivot towards sustainable and high-performance materials, the need for high-quality graphite is becoming increasingly critical. Technological advancements in mining techniques and processing methods are also contributing to the market's growth. Innovations such as automated mining equipment and enhanced purification processes are improving efficiency and reducing costs, making graphite extraction more viable. Key players in the graphite mining sector, including companies like Syrah Resources, Northern Graphite, and Mason Graphite, are actively pursuing strategic initiatives such as partnerships and investments to bolster their production capabilities and expand their market reach. These efforts, combined with the rising global emphasis on renewable energy and electric mobility, are expected to sustain the upward momentum of the graphite mining market in the coming years.

Regional Market Size

Regional Deep Dive

The Graphite Mining Market is experiencing significant dynamics across various regions, driven by increasing demand for graphite in battery production, particularly for electric vehicles (EVs) and renewable energy storage. Each region exhibits unique characteristics influenced by local regulations, economic conditions, and technological advancements. The Asia-Pacific region, for instance, is a major player due to its vast natural reserves and growing industrial applications, while North America is focusing on sustainable mining practices and domestic production to reduce reliance on imports. Europe is witnessing a surge in innovation and investment in graphite processing technologies, aligning with its green energy goals. Overall, the market is poised for growth as industries seek to secure supply chains and enhance sustainability.

Europe

- The European Union has introduced regulations aimed at increasing the use of sustainable materials, which has led to a rise in investments in graphite recycling technologies, particularly in countries like Germany and Sweden.

- Companies such as Talga Group and Graphite One are advancing projects that not only focus on mining but also on developing advanced materials for battery applications, reflecting Europe's commitment to a circular economy.

Asia Pacific

- China continues to dominate the graphite mining sector, with recent government policies aimed at consolidating smaller mines to improve efficiency and environmental standards, impacting global supply dynamics.

- Australia is emerging as a significant player with projects like the Siviour Graphite Project, which aims to meet the growing demand for high-quality graphite in battery manufacturing, supported by favorable mining regulations.

Latin America

- Brazil is seeing increased exploration activities in graphite mining, with companies like Brazil Graphite focusing on sustainable extraction methods to meet both local and international demand.

- Regulatory frameworks in countries like Argentina are evolving to support mining investments, which is expected to boost graphite production and attract foreign capital.

North America

- The U.S. government has initiated programs to promote domestic graphite production, including funding for research and development in sustainable mining technologies, which is expected to enhance local supply chains.

- Key players like Syrah Resources and Northern Graphite are expanding their operations in North America, focusing on environmentally friendly extraction methods that align with increasing regulatory scrutiny on mining practices.

Middle East And Africa

- Countries like Mozambique are attracting foreign investment in graphite mining, with companies such as Triton Minerals advancing projects that leverage the region's rich mineral deposits.

- The African Continental Free Trade Area (AfCFTA) is expected to enhance intra-regional trade in graphite, facilitating collaboration among mining companies and improving market access.

Did You Know?

“Graphite is one of the few materials that can conduct electricity, making it essential for various applications, including batteries, lubricants, and even nuclear reactors.” — U.S. Geological Survey

Segmental Market Size

The graphite mining segment plays a crucial role in the overall market, currently experiencing stable growth due to increasing demand for high-purity graphite in various applications. Key drivers include the rising need for electric vehicle (EV) batteries, which require high-quality graphite for anode production, and the expansion of renewable energy technologies, such as wind and solar, that utilize graphite in energy storage systems. Additionally, regulatory policies promoting sustainable mining practices are shaping the industry's landscape, encouraging companies to adopt eco-friendly methods. Currently, the adoption stage of graphite mining is transitioning towards scaled deployment, with notable players like Syrah Resources in Australia and Northern Graphite in Canada leading the charge. Primary applications include battery manufacturing, lubricants, and refractory materials, with companies like Tesla and Panasonic heavily investing in graphite supply chains. Trends such as the global push for carbon neutrality and advancements in mining technologies, including automated extraction and processing methods, are catalyzing growth in this segment, ensuring its relevance in the evolving energy landscape.

Future Outlook

The Graphite Mining Market is poised for significant growth from 2024 to 2035, with a projected market value increase from $18.25 billion to $37.8 billion, reflecting a robust compound annual growth rate (CAGR) of 6.84%. This growth trajectory is primarily driven by the escalating demand for graphite in various applications, particularly in the electric vehicle (EV) and renewable energy sectors. As the global shift towards sustainable energy solutions accelerates, the need for high-quality graphite for lithium-ion batteries is expected to surge, with usage rates in battery production projected to reach over 40% of total graphite consumption by 2035, up from approximately 25% in 2024. Key technological advancements and supportive policies will further bolster the market. Innovations in mining techniques and processing technologies are anticipated to enhance yield and reduce environmental impact, making graphite mining more sustainable and economically viable. Additionally, government initiatives aimed at promoting green technologies and reducing carbon footprints are likely to create a favorable regulatory environment for graphite mining operations. Emerging trends, such as the increasing adoption of graphene in various industries, will also contribute to market expansion, as the unique properties of graphene open new avenues for application in electronics, materials science, and healthcare. Overall, the Graphite Mining Market is set to experience a dynamic evolution, driven by both demand-side factors and supply-side innovations.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.80% (2023-2032) |

Graphite Mining Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.