Global Green Bond Market Overview:

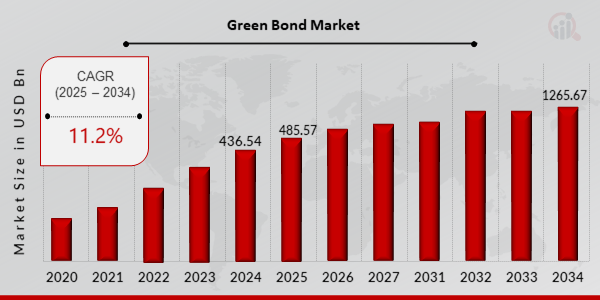

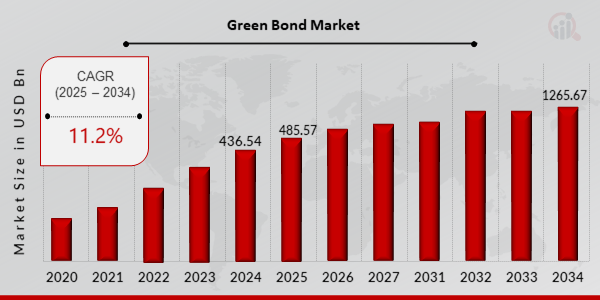

Green Bond Market Size was estimated at 436.54 (USD Billion) in 2024. The Green Bond Market Industry is expected to grow from 485.57 (USD Billion) in 2025 to 1265.67 (USD Billion) till 2034, exhibiting a compound annual growth rate (CAGR) of 11.2% during the forecast period (2025 - 2034)

Key Green Bond Market Trends Highlighted

The green bond market is witnessing a surge in demand due to rising environmental concerns and the need for sustainable investments. Key drivers include government regulations promoting green projects, growing investor awareness about climate change, and the increasing availability of green bonds from various issuers.

Opportunities lie in expanding the issuance of green bonds in emerging markets, developing standards for green bond issuance and reporting, and creating innovative green bond products that meet specific investor needs. In recent times, the green bond market has seen the emergence of thematic green bonds, such as blue bonds for ocean conservation and social bonds for social impact projects.

The trend towards transparency and disclosure is also shaping the market, with investors demanding greater assurance that their green bond investments are truly aligned with environmental goals. This has led to the development of green bond frameworks and reporting guidelines that provide investors with detailed information about the use of proceeds and the environmental impact of green bonds.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Green Bond Market Drivers

Growing Demand for Sustainable Investments

The market drivers today include the areas where demand for growth is rising. One of those areas is the Green Bond Market Industry. “Green bonds are bonds specifically earmarked to be used for the financing of projects that have a positive impact on the environment or climate based on the issuer’s definitions”. The demand for green bonds is increasing due to the fact that more and more investors want to have something out of bad – the ability to align their funds with their vision of society and nature as a whole.Start investing in the direction of your heart.

Government Support for Green Bonds

This factor can exist and can be seen in the type of support the government provides. Green bonds have been around for over a decade, and over those years, governmental bodies around the world have recognized the benefits of this investment tool and have started showing significant support for them. This can be in the form of tax breaks, regulations, projects, subsidies, and a bunch of other reasons. This is a huge driver of growth because it creates an incentive not only for companies to want to issue more green bonds but also for investors to want to invest in those bonds.

Technological Advancements

Also aiding the growth of the Green Bond Market Industry is the development of new technology. Present-day technology is facilitating tracking of the environmental as well as social impact of green bond projects. An increasing number of investors are now being drawn towards green bonds since they have the confidence that their investments are leading to a positive change.

Green Bond Market Segment Insights:

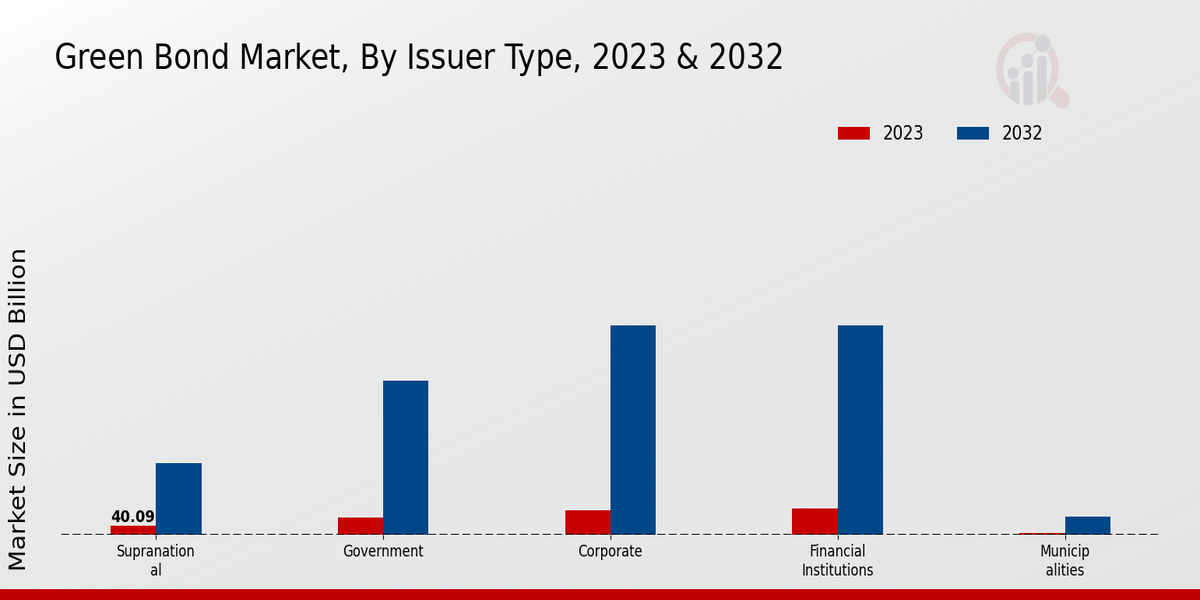

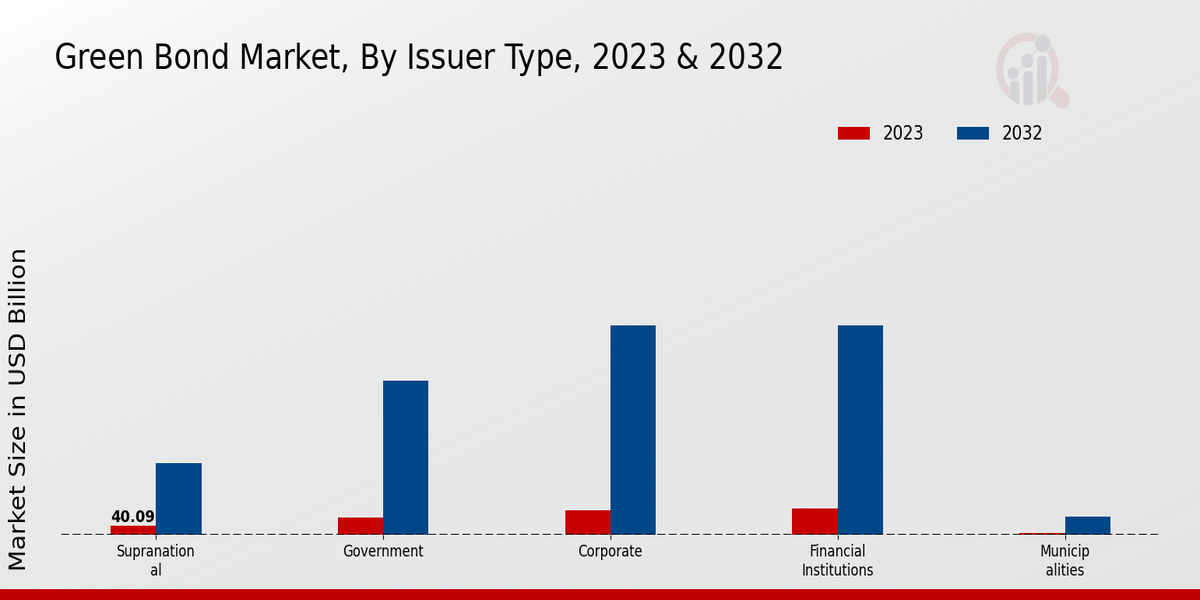

Green Bond Market Issuer Type Insights

The Issuer Type segment of the Green Bond Market is classified into Supranational, Government, Corporate, Financial Institutions, and Municipalities. Supranational issuers held the largest share of the market in 2023, with a revenue of USD 352.82 billion. This development is due to increasing government activities to expand sustainable infrastructure and renewable power. Corporates also have a large share of the market and, in turn, have a high CAGR of 9.52%. This increasing demand for green financing by companies to meet their environmental, social, and governance objectives.Financial institutions have a CAGR of 8.65%, whereas for Municipalities, it is 7.89%. The outlook for the Green Bond Market is very positive, and its rapid growth in the upcoming years. This is due to the high demand for green financing from all industries, as well as government activities to promote sustainable growth. As seen, this means that the market is expected to reach a valuation of USD 920.0 billion by 2032.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Green Bond Market Use of Proceeds Insights

The use of proceeds is the most interesting in the Green Bond Data segment Key Projects. It allocates the funds raised through green bonds to different environmental projects or activities. Thus, in 2023, Renewable Energy, including solar, wind, and geothermal energy, was the greatest part of the Green Bond Market and was equal to $132.58 bn. Energy Efficiency in terms of reducing energy use in buildings and industry became the second-largest part. Green Buildings with sustainable construction and energy-efficient components were an important part of the green bond investment, as well.The use of battery electric vehicles and public transportation increased. Water and Wastewater, as well as the Agri-Food, is the fast-growing part because of water scarcity and pollution.

Green Bond Market Bond Type Insights

The Green Bond Market is segmented into Fixed Income, Variable Income, Convertible, Perpetual, and High-Yield bond types. Fixed Income bonds account for the largest share of the market, with a revenue of USD 352.82 billion in 2023 and a projected CAGR of 11.23% to reach USD 920.0 billion by 2032. Variable Income bonds are expected to experience the fastest growth, with a CAGR of 12.5% from 2023 to 2032. Convertible bonds are hybrid securities that offer the potential for both fixed income and equity returns, while Perpetual bonds have no maturity date and pay regular interest payments.High-Yield bonds are bonds with a higher risk of default and offer higher yields to compensate investors for the increased risk.

Green Bond Market Currency Insights

The Green Bond Market is segmented by Currency, with the major currencies being USD, EUR, CNY, GBP, and JPY. In 2023, the USD segment accounted for the largest share of the market, with a revenue of 187.22 USD Billion. The EUR segment is expected to grow at a CAGR of 12.34% during the forecast period, reaching a revenue of 122.36 USD Billion by 2032. The CNY segment is also expected to witness significant growth, with a CAGR of 13.12% during the same period, reaching a revenue of 83.51 USD Billion by 2032. The GBP and JPY segments are expected to grow at a moderate pace, with CAGRs of 10.36% and 9.89%, respectively, reaching revenues of 38.63 USD Billion and 28.34 USD Billion by 2032.

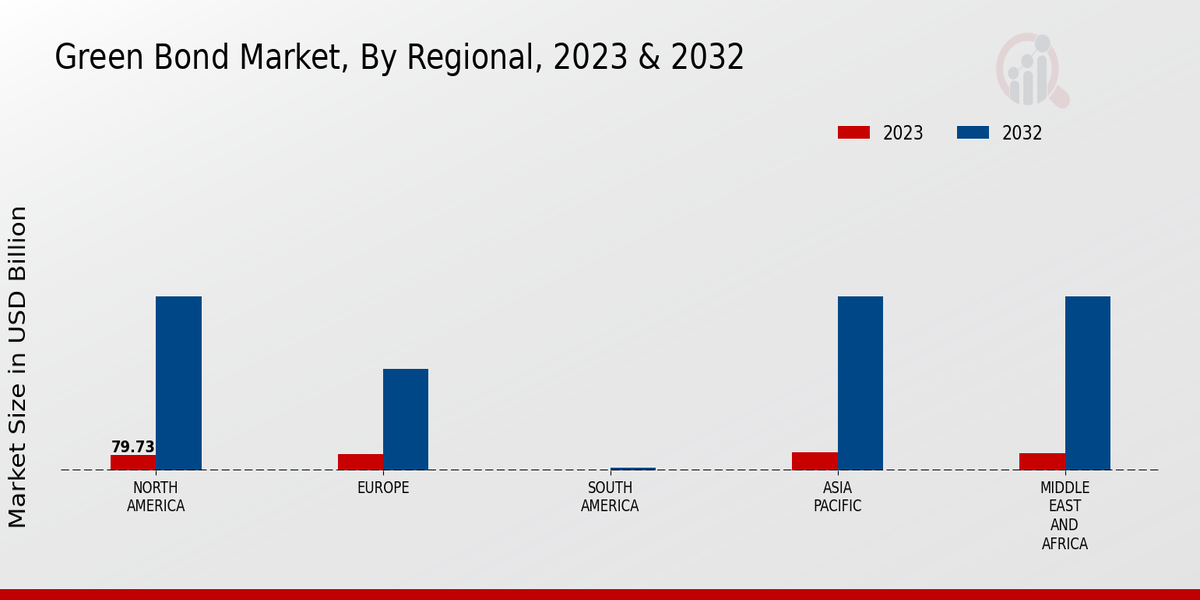

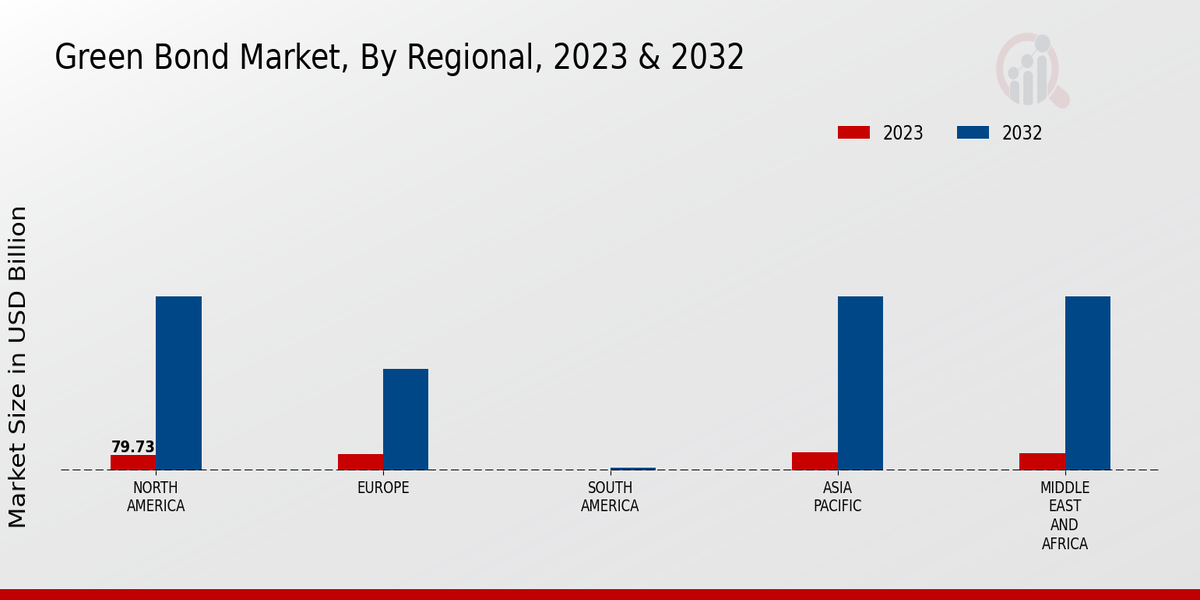

Green Bond Market Regional Insights

Regionally, North America held the largest share of the Green Bond Market in 2023, accounting for 39.1% of the global market. Europe accounted for 27.6%, followed by APAC with 22.5%, South America with 8.4%, and MEA with 2.4%. The growth of the Green Bond Market in North America is primarily attributed to the increasing demand for sustainable investments and the growing awareness of environmental, social, and governance (ESG) factors among investors. Europe is another major market for Green Bonds due to the region's strong focus on sustainability and climate change mitigation.APAC is also a rapidly growing market for Green Bonds, driven by the increasing demand for infrastructure development and the growing awareness of ESG factors among investors.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Green Bond Market Key Players And Competitive Insights:

Leading players in the industry are increasingly adopting acquisitions, partnerships, and collaborations to enhance their presence in the global market and diversify their offerings. In the competitive Green Bond Market, leading players concentrate on developing and offering innovative financial solutions to cater to the demand of investors for an increased portfolio of sustainable finance. In addition, the green bond industry comprises many leading companies and new entrants; thereby, these organizations focus on expanding their presence in the market. R&D investments enhance the ability of companies to offer diversified products. The acquisition enhances their offerings and allows access to new markets, whereas the collaboration and partnership leverage the strength of various players. The trend of acquisitions is expected to increase as the level of consolidation in the industry is expected to increase.

One of the industry's key players, Goldman Sachs, operates as a leading global investment bank. The company is renowned for its sustainable finance group, which offers green financing solutions as part of a wide variety of products and services. The company’s credibility in the financial market is very high, and it is one of the leading green bond issuers. Some of the major deals facilitated by Goldman Sachs include the first green bonds issued by the World Bank in 2008. Citigroup is another leading competitor in the Green Bond Market. The company is a leading global financial services company that offers a variety of products and services. Citigroup has been involved in numerous green bond deals, and its record has been running for a long time. In addition, Citigroup operates a team of experts in green finance. The team is very innovative and works with the clients in developing and offering green finance products and services.

Key Companies in the Green Bond Market Include:

Green Bond Industry Developments

The Green Bond Market continues to witness steady growth, driven by increasing investor demand for sustainable investments and government initiatives promoting green financing. In 2023, the market reached a valuation of USD 352.82 billion, and projections indicate it will reach USD 920 billion by 2032, exhibiting a CAGR of 11.23%. Recent developments include the European Union's issuance of the world's largest green bond, worth EUR 12 billion, which attracted strong demand from investors. Asia-Pacific is emerging as a significant growth region, with China leading the issuance of green bonds in the region. The market is expected to benefit from supportive government policies, growing awareness of environmental issues, and increasing demand from institutional investors.

Green Bond Market Segmentation Insights

Green Bond Market Issuer Type Outlook

Green Bond Market Use of Proceeds Outlook

Green Bond Market Bond Type Outlook

Green Bond Market Currency Outlook

Green Bond Market Regional Outlook

|

Report Attribute/Metric

|

Details

|

|

Market Size 2024

|

USD 436.54 Billion

|

|

Market Size 2025

|

USD 485.57 Billion

|

|

Market Size 2034

|

USD 1265.67 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

11.2% (2025-2034)

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025-2034

|

|

Historical Data

|

2020-2023

|

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

JP Morgan Chase, UBS, BNP Paribas, Deutsche Bank, Societe Generale, Barclays, Bank of America, Royal Bank of Scotland, Morgan Stanley, Goldman Sachs, HSBC, Rabobank, Credit Suisse, Citigroup |

| Segments Covered |

Issuer Type, Use of Proceeds, Bond Type, Currency, Regional |

| Key Market Opportunities |

Growing demand for sustainable investments.Increased issuance by corporations and governments.Expansion into new markets.Development of standardized green bond frameworks.Emergence of green bond ETFs and other innovative products. |

| Key Market Dynamics |

Rising investor demand for sustainable investments.Government support and regulations.Technological advancements in green technologies.Growing awareness of climate change.Focus on ESG Environmental, Social, and Governance investing. |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ) :

The Green Bond Market is expected to reach a valuation of USD 436.54 billion in 2024 and is projected to grow to an impressive USD 1265.67 billion by 2034, exhibiting a robust CAGR of 11.2% throughout the forecast period.

The North America region is anticipated to lead the Green Bond Market, driven by the increasing demand for sustainable investments and government initiatives to promote green financing in the region.

Green Bonds are primarily utilized to finance a wide range of environmentally friendly projects, including renewable energy, energy efficiency, sustainable transportation, water management, and green buildings.

Some of the prominent players in the Green Bond Market include HSBC, Citigroup, JPMorgan Chase Co., Bank of America Merrill Lynch, and Deutsche Bank, among others.

The growth of the Green Bond Market is primarily attributed to factors such as increasing awareness about climate change, rising demand for sustainable investments, favorable government policies, and supportive regulatory frameworks.

The Green Bond Market faces certain challenges, including concerns over greenwashing, the need for standardization and transparency in reporting, and the availability of reliable data on the environmental impact of green bond-funded projects.

The future prospects for the Green Bond Market are positive, driven by increasing demand for sustainable investments, supportive government policies, and technological advancements in green technologies.

The Green Bond Market plays a significant role in environmental sustainability by providing financial resources for projects that contribute to reducing greenhouse gas emissions, mitigating climate change, and promoting renewable energy sources.

The Green Bond Market contributes to economic development by stimulating investments in green industries, creating new job opportunities, and supporting the transition to a more sustainable and resilient economy.

Key trends shaping the Green Bond Market include the integration of sustainability factors into investment strategies, the emergence of thematic green bonds, the increasing demand for green bonds from institutional investors, and the adoption of digital technologies to enhance transparency and efficiency.