Global Green Mining Market Overview

The Green Mining Market Size was estimated at 8.26 (USD Billion) in 2023. The Green Mining Industry is expected to grow from 8.91(USD Billion) in 2024 to 20.5 (USD Billion) by 2035. The Green Mining Market CAGR (growth rate) is expected to be around 7.87% during the forecast period (2025 - 2035).

Key Green Mining Market Trends Highlighted

The Green Mining Market is experiencing significant shifts driven by increased awareness of environmental impacts and a strong push towards sustainable practices. One key market driver is the rising demand for eco-friendly technologies that minimize waste and energy consumption in mining operations. Companies are increasingly investing in renewable energy sources, such as solar and wind, to power their mining activities, aligning with sustainability goals. This transition fosters operational efficiency while reducing carbon footprints.

Opportunities in the Green Mining Market are expanding as more governments and organizations incentivize sustainable mining practices.Policies encouraging the adoption of green technologies are promoting innovations in mineral extraction processes and waste management. Additionally, there is a growing consumer demand for responsibly sourced minerals, prompting mining companies to adopt greener practices to gain a competitive edge. In recent times, trends show a surge in research and development focused on improving the efficiency of recycling processes and exploring alternative materials.

Technologies like automation, artificial intelligence, and blockchain are being integrated into mining operations to enhance transparency and traceability in the supply chain. This not only increases operational efficiency but also addresses various challenges related to environmental compliance and social responsibility.The collective movement towards sustainability is gradually reshaping the industry, making green mining a viable and necessary approach in the market landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Green Mining Market Drivers

Growing Environmental Regulations

The Green Mining Market is expanding rapidly as governments throughout the world enforce more environmental laws. For example, the European Union has legislated harsher mining industry restrictions, with the goal of reducing carbon emissions by 55% by 2030. According to the United Nations Framework Convention on Climate Change, more than 190 nations have pledged to reduce greenhouse gas emissions.The move toward tougher rules is encouraging mining businesses to embrace more sustainable methods. According to a World Economic Forum poll, approximately 80% of mining executives believe that regulatory restrictions are a significant motivation for incorporating sustainability into their operations.

As a consequence, this trend not only supports the use of greener mining technologies but also accelerates the growth of the Green Mining Market as firms strive to invest in cleaner technologies and processes in order to comply with these requirements.

Technological Advancements in Mining Processes

Innovations and technological advancements are another key factor driving the expansion of the Green Mining Market Industry. Technologies such as automation, artificial intelligence, and blockchain are increasingly being integrated into mining operations to improve efficiency and reduce environmental impact. A study by the International Council on Mining and Metals (ICMM) found that implementing automated systems can decrease energy consumption in mines by up to 30%.This adoption not only enhances operational efficiency but also significantly reduces the ecological footprint of mining activities.

Moreover, as companies such as Rio Tinto and BHP invest heavily in Research and Development (R&D) to develop these technologies, the capabilities to transition to greener mining practices are being enhanced. Hence, technological innovation is expected to continue to be a major driver in the Green Mining Market.

Rising Demand for Sustainable Materials

The surge in consumer preference for sustainable products is significantly influencing the Green Mining Market Industry. As stakeholders prioritize sustainability, the demand for materials sourced through environmentally responsible methods continues to rise. Reports suggest that 66% of consumers are willing to pay more for sustainable goods. For example, the demand for ethically sourced batteries, especially for electric vehicles, is projected to grow by 20% annually as more countries focus on clean energy.Major companies like Tesla are emphasizing the need for sustainably sourced minerals, and this shift is compelling mining firms to adapt by implementing green mining practices.

With the anticipated growth in green consumerism, the market for sustainable mining operations will likely attract significant investments, thus propelling the Green Mining Market.

Green Mining Market Segment Insights

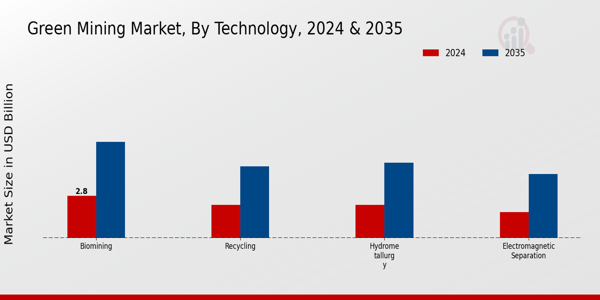

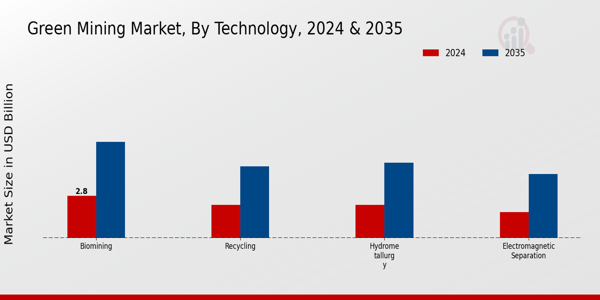

Green Mining Market Technology Insights

The Green Mining Market, particularly within the Technology segment, is experiencing a significant evolution driven by sustainable practices in resource extraction. In 2024, the market is poised to be valued at 8.91 USD Billion, growing steadily as awareness of environmental impacts increases. Key technologies within this segment include Biomining, Hydrometallurgy, Recycling, and Electromagnetic Separation, each contributing uniquely to the overall market dynamics.

Biomining, with a valuation of 2.8 USD Billion in 2024, leverages biological processes to extract metals, presenting a sustainable alternative to traditional mining methods.By 2035, its value is projected to reach 6.4 USD Billion, reflecting its increasing importance due to lower environmental footprints. Hydrometallurgy, valued at 2.2 USD Billion in 2024, employs aqueous chemical processes for metal recovery, gaining traction due to its efficiency and reduced energy consumption, expected to expand to 5.0 USD Billion by 2035.

Recycling also plays a vital role, valued at 2.21 USD Billion in 2024, emphasizing resource conservation and waste reduction, with a projected growth to 4.75 USD Billion in 2035, which highlights its essential contribution to a circular economy.Lastly, Electromagnetic Separation, valued at 1.7 USD Billion in 2024, focuses on utilizing magnetic fields for the effective separation of minerals, expected to grow to 4.25 USD Billion by 2035, showcasing its significance in enhancing efficiency.

Collectively, these technologies underscore the importance of sustainability in the mining sector, reflecting an increasing trend towards eco-friendly practices while addressing the demand for essential minerals and metals. The Green Mining Market revenue is supported by advancements in these technologies, driving efficiency and minimizing ecological impact while providing opportunities for innovation and economic growth in the industry.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Green Mining Market Method Insights

The Green Mining Market is witnessing a transformative phase, with the Method segment playing a pivotal role in driving sustainability in mining operations. By 2024, the market value is projected to be 8.91 USD Billion, reflecting the increasing emphasis on environmentally friendly mining practices. This segment consists of various methods such as Open-Pit Mining, Underground Mining, and In-Situ Mining, each exhibiting unique characteristics and advantages.

Open-Pit Mining, known for its efficiency in resource extraction, is particularly significant due to its ability to minimize waste and enhance land reclamation efforts.Meanwhile, Underground Mining offers a less disruptive approach, reducing surface impacts and conserving biodiversity. In-Situ Mining is gaining traction as it allows the extraction of minerals with a minimal environmental footprint, aligning with sustainability goals. The growing demand for eco-friendly mining operations, combined with technological advancements, is becoming a substantial growth driver for the Green Mining Market. However, the industry faces challenges such as regulatory compliance and the need for skilled labor.

Overall, the Method segment's innovations and strategies are crucial in shaping the future landscape of sustainable mining practices globally.

Green Mining Market Material Type Insights

The Green Mining Market, particularly focusing on the Material Type segment, is witnessing significant growth driven by the increasing demand for sustainable mining practices. In 2024, the market is expected to be valued at approximately 8.91 USD Billion, reflecting a shift towards eco-friendly technologies and practices in the mining industry. The material types of interest include Precious Metals, Base Metals, Rare Earth Elements, and Industrial Minerals, each playing a crucial role in promoting sustainable development.

Precious Metals, known for their high economic value, are particularly important as their extraction methods are evolving to minimize environmental impact.Base Metals, essential for various industrial applications, are also increasingly being sourced through greener practices. Rare Earth Elements are vital for modern technology and renewable energy applications, making their sustainable extraction critical for future advancements. Industrial Minerals support a variety of industries, reinforcing their significance in promoting green initiatives. Overall, the Green Mining Market segmentation reveals a strong trend towards enhancing sustainability across all these material types, aligning with efforts towards reducing carbon footprints and enhancing resource efficiency.

Green Mining Market End Use Insights

The Green Mining Market is poised for significant growth, driven by its various end-use applications across diverse industries including Construction, Electronics, Automotive, and Energy. In 2024, the overall market is expected to be valued at 8.91 billion USD, reflecting the increasing demand for sustainable mining practices. The construction sector plays a pivotal role, utilizing eco-friendly materials derived from green mining, while the electronics industry relies heavily on responsibly sourced minerals for technological advancements.The automotive sector prioritizes sustainable materials as it shifts towards electric vehicles, driving innovations in mining processes to meet environmental regulations.

Meanwhile, the energy sector is embracing green mining techniques to secure essential resources for renewable energy technologies. This diverse end-use segmentation allows for tailored strategies that enhance the overall efficiency and sustainability of operations. The collective emphasis on sustainability across these industries underscores the vital role of the Green Mining Market in addressing environmental concerns while meeting market demands, highlighting its importance in modern industry and contributing significantly to economic trends.

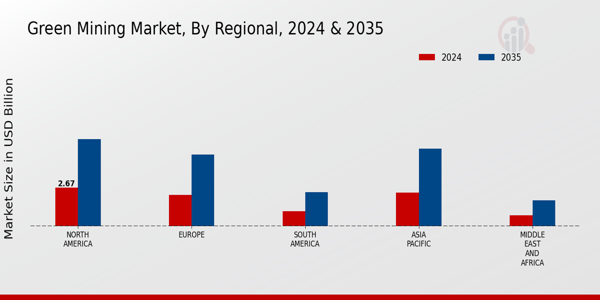

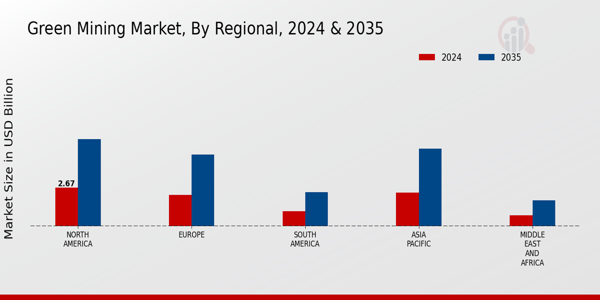

Green Mining Market Regional Insights

The Regional segmentation of the Green Mining Market illustrates significant variations in market dynamics across different regions. By 2024, North America is expected to lead with a valuation of 2.67 USD Billion, reflecting a robust commitment to sustainable practices in mining. Europe follows closely with a market value of 2.16 USD Billion in the same year, indicating strong regulatory support for environmentally friendly mining technologies.

The Asia Pacific region, valued at 2.32 USD Billion, is rapidly adopting green mining techniques due to increasing mining activities and environmental concerns.South America, although smaller with a valuation of 1.02 USD Billion, plays a crucial role due to its rich mineral resources and potential for sustainable extraction methods. The Middle East and Africa, valued at 0.74 USD Billion, represent emerging opportunities in green mining, driven by advancements in technology and resource management.

Overall, North America and Europe dominate the market, showcasing their majority holding in the Green Mining Market revenue through stringent regulations and investment in innovative technologies that promote sustainability.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Green Mining Market Key Players and Competitive Insights

The competitive landscape of the Green Mining Market is rapidly evolving as environmental sustainability becomes a pivotal concern for the mining industry. As various stakeholders become increasingly aware of the environmental impacts of traditional mining practices, the demand for green mining solutions has intensified. This shift is further driven by regulatory frameworks that encourage sustainable practices, incentivizing companies to adopt innovative technologies and methodologies that minimize ecological footprints. In this dynamic market, leading players are establishing strategic partnerships, investing in sustainable technologies, and focusing on resource-efficient practices to maintain a competitive edge.

The competition is marked by an emphasis on research and development, which is crucial for advancing green mining technologies and methodologies that align with sustainability goals.FreeportMcMoRan is a significant participant in the Green Mining Market, recognized for its commitment to responsible mining practices. The company has implemented various initiatives aimed at reducing its environmental impact while ensuring the efficient extraction of resources. A core strength of FreeportMcMoRan lies in its advanced mining technologies that facilitate lower emissions and resource conservation.

The company has cultivated a solid market presence across various regions, enabled by its strategic investments in technology and sustainable practices. By prioritizing community engagement and environmental stewardship, FreeportMcMoRan not only enhances its operational efficiency but also improves its brand reputation among increasingly environmentally conscious consumers and investors.Sandvik is another key player in the Green Mining Market, known for its innovative products and services that significantly address environmental challenges in the mining sector. The company offers a range of advanced equipment and solutions designed to enhance sustainability through energy efficiency and reduced emissions.

Sandvik's market presence is bolstered by its strong focus on research and development, ensuring its offerings remain at the forefront of green mining technology. The company's strengths lie in its comprehensive portfolio of sustainable solutions, including automated systems and data-driven mining practices that enhance operational efficiency. Furthermore, Sandvik actively pursues mergers and acquisitions to expand its capabilities and enhance its sustainability offerings in the market. By aligning its business strategies with environmental goals, Sandvik solidifies its position as a leader in the push towards greener mining practices on a scale.

Key Companies in the Green Mining Market Include

- FreeportMcMoRan

- Sandvik

- Barrick Gold

- Kinross Gold

- Caterpillar

- Rio Tinto

- Glencore

- Newmont Corporation

- Teck Resources

- Anglo American

- Cameco

- FLSmidth

- BHP

- Vale

- Epiroc

Green Mining Industry Developments

-

Q3 2025: July 2025 – Rio Tinto commissioned its first fully electrified haul truck fleet at the Oyu Tolgoi copper mine in Mongolia, reducing diesel consumption by 30% and cutting CO₂ emissions by 15,000 tons annually. Rio Tinto has deployed a fully electrified haul truck fleet at its Oyu Tolgoi copper mine in Mongolia, marking a significant step in green mining by reducing diesel use and CO₂ emissions at the site.

-

Q2 2025: June 2025 – Vale S.A. launched a pilot plant in Sudbury, Canada, employing bioleaching with specialized bacteria to extract nickel and copper, eliminating sulfur dioxide emissions from smelting. Vale S.A. opened a pilot plant in Sudbury, Canada, using bioleaching technology to extract metals, which eliminates sulfur dioxide emissions typically produced by traditional smelting processes.

Green Mining Market Segmentation Insights

Green Mining Market Technology Outlook

- Biomining

- Hydrometallurgy

- Recycling

- Electromagnetic Separation

Green Mining Market Method Outlook

- Open-Pit Mining

- Underground Mining

- In-Situ Mining

Green Mining Market Material Type Outlook

- Precious Metals

- Base Metals

- Rare Earth Elements

- Industrial Minerals

Green Mining Market End Use Outlook

- Construction

- Electronics

- Automotive

- Energy

Green Mining Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

| Report Attribute/Metric |

Details |

| Market Size 2023 |

8.26(USD Billion) |

| Market Size 2024 |

8.91(USD Billion) |

| Market Size 2035 |

20.5(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

7.87% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

FreeportMcMoRan, Sandvik, Barrick Gold, Kinross Gold, Caterpillar, Rio Tinto, Glencore, Newmont Corporation, Teck Resources, Anglo American, Cameco, FLSmidth, BHP, Vale, Epiroc |

| Segments Covered |

Technology, Method, Material Type, End Use, Regional |

| Key Market Opportunities |

Renewable energy integration, Advanced waste management technologies, Sustainable mining practices demand, Regulatory incentives for green mining, Eco-friendly mineral extraction technologies |

| Key Market Dynamics |

sustainability regulations, technological advancements, rising energy costs, increasing environmental awareness, resource scarcity |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Green Mining Market Highlights:

Frequently Asked Questions (FAQ):

The Green Mining Market is expected to be valued at 8.91 USD Billion in 2024.

By 2035, the Green Mining Market is projected to reach a valuation of 20.5 USD Billion.

The expected compound annual growth rate for the Green Mining Market from 2025 to 2035 is 7.87%.

North America is anticipated to hold the largest market share, valued at 2.67 USD Billion in 2024.

Biomining technology is expected to be valued at 2.8 USD Billion in 2024 within the Green Mining Market.

Major players include Freeport McMoRan, Sandvik, Barrick Gold, and Rio Tinto among others.

By 2035, the market size for Recycling technology is projected to reach 4.75 USD Billion.

The Asia Pacific region is expected to contribute 2.32 USD Billion to the Green Mining Market in 2024.

Hydrometallurgy technology is estimated to be valued at 5.0 USD Billion by 2035.

The expected market value for the Middle East and Africa region in 2024 is 0.74 USD Billion.