Growing Industrial Applications

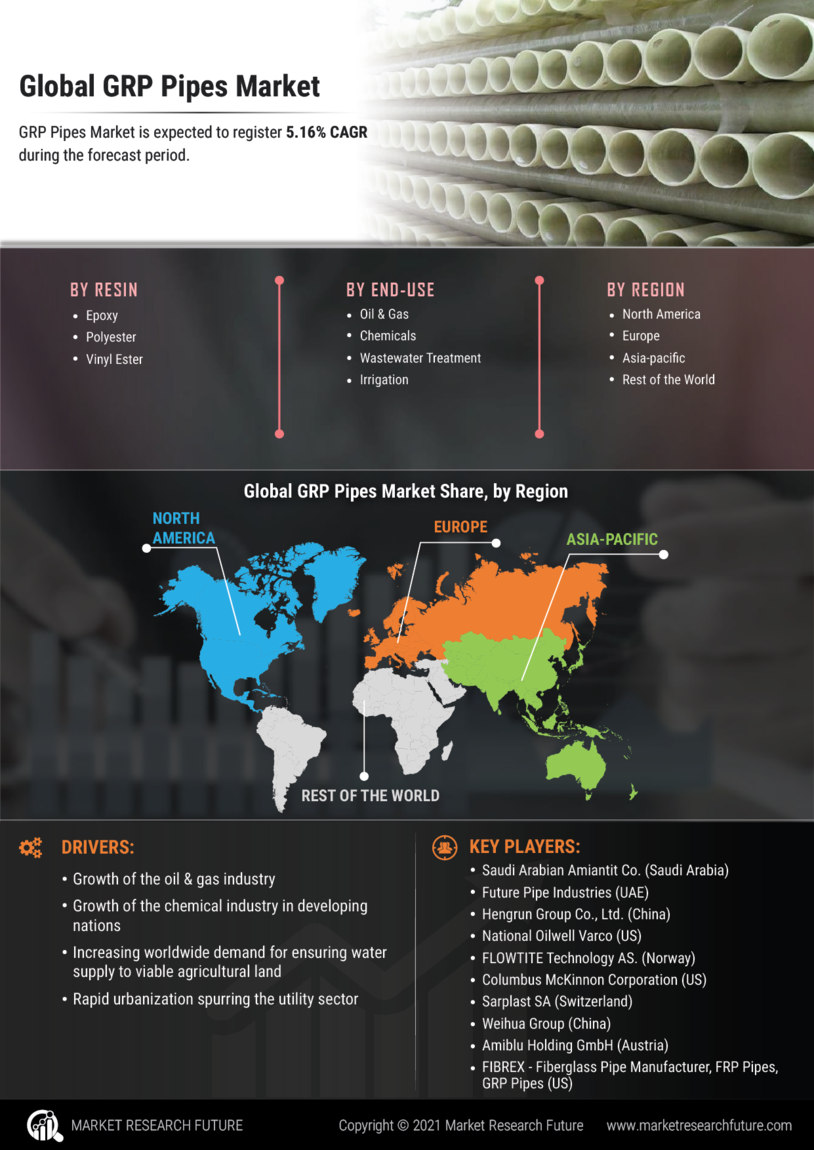

The GRP Pipes Market is witnessing a significant expansion in industrial applications, particularly in sectors such as oil and gas, chemicals, and wastewater management. The unique properties of GRP pipes, including their resistance to chemicals and high durability, make them an ideal choice for various industrial processes. Recent statistics indicate that the industrial segment is anticipated to account for a substantial share of the GRP pipes market, with a projected growth rate of around 5% annually. This trend is driven by the increasing need for efficient and reliable piping solutions in harsh environments. As industries continue to prioritize safety and efficiency, the demand for GRP pipes is likely to rise, further solidifying their position in the GRP Pipes Market.

Rising Awareness of Corrosion Resistance

The GRP Pipes Market is experiencing heightened awareness regarding the benefits of corrosion resistance in piping solutions. Industries such as water treatment, oil and gas, and chemical processing are increasingly recognizing the long-term cost savings associated with using GRP pipes, which are less susceptible to corrosion compared to traditional materials. This awareness is driving demand, as companies seek to minimize maintenance costs and extend the lifespan of their infrastructure. Recent studies suggest that the market for corrosion-resistant materials, including GRP pipes, is expected to grow at a rate of approximately 6% annually. As more stakeholders become informed about the advantages of GRP pipes, the market is likely to expand, reinforcing the position of GRP pipes as a preferred choice in various applications.

Increasing Demand for Water Infrastructure

The GRP Pipes Market is experiencing a notable surge in demand due to the increasing need for efficient water infrastructure. As urbanization accelerates, the requirement for reliable water supply systems becomes paramount. GRP pipes, known for their corrosion resistance and lightweight properties, are increasingly favored for water distribution networks. According to recent data, the water infrastructure sector is projected to grow at a compound annual growth rate of approximately 6% over the next few years. This growth is likely to drive the adoption of GRP pipes, as municipalities and private entities seek durable and cost-effective solutions to meet the rising water demand. Furthermore, the emphasis on sustainable practices in water management is expected to further bolster the GRP Pipes Market, as these pipes contribute to reduced leakage and improved efficiency.

Technological Innovations in Manufacturing

The GRP Pipes Market is poised for growth due to ongoing technological innovations in manufacturing processes. Advances in production techniques, such as automated winding and advanced resin formulations, are enhancing the quality and performance of GRP pipes. These innovations not only improve the mechanical properties of the pipes but also reduce production costs, making GRP pipes more competitive against traditional materials. Market analysis indicates that the adoption of these technologies could lead to a reduction in manufacturing costs by up to 15%, thereby increasing the market penetration of GRP pipes. As manufacturers continue to invest in research and development, the GRP Pipes Market is likely to see a rise in product offerings that cater to diverse applications and customer needs.

Regulatory Support for Sustainable Materials

The GRP Pipes Market is benefiting from increasing regulatory support aimed at promoting sustainable materials in construction and infrastructure projects. Governments are implementing stringent regulations to reduce environmental impact, which encourages the adoption of eco-friendly materials like GRP pipes. These pipes are not only recyclable but also contribute to lower carbon emissions during production compared to traditional materials. Recent policy initiatives suggest that the market for sustainable construction materials, including GRP pipes, could grow by approximately 7% in the coming years. This regulatory environment is likely to enhance the attractiveness of GRP pipes, as stakeholders seek to comply with sustainability mandates while ensuring high performance in their projects.

Leave a Comment