Gummy Candies Size

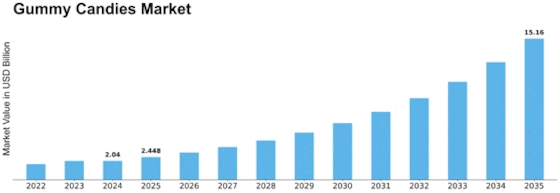

Gummy Candies Market Growth Projections and Opportunities

The Gummy Candies market is influenced by a variety of market factors that contribute to its growth and dynamics. One of the key drivers is the universal appeal of gummy candies across diverse age groups. These chewy and flavorful treats have widespread popularity among both children and adults, creating a consistent and broad consumer base. As a result, the demand for gummy candies remains resilient, fostering market growth.

Government regulations and compliance standards also play a significant role in shaping the Gummy Candies market. Stringent regulations related to food safety, labeling, and quality control impact the manufacturing, packaging, and distribution of gummy candies. Manufacturers need to adhere to these standards to ensure the safety and quality of their products, gaining the trust of consumers. Navigating these regulatory requirements is essential for companies operating in the Gummy Candies market to maintain a strong market position.

Consumer preferences and trends are pivotal factors influencing the Gummy Candies market. As consumers increasingly seek indulgent and innovative confectionery options, gummy candies have evolved beyond traditional shapes and flavors. The market witnesses a constant influx of new and exotic flavors, shapes, and textures to cater to changing consumer preferences. Staying attuned to these trends and offering unique and exciting products are crucial for companies to stand out in a competitive market.

Innovation and product development are driving forces within the Gummy Candies market. Manufacturers invest in research and development to introduce novel formulations, including organic, natural, and functional ingredients. The incorporation of health-conscious elements, such as vitamins and antioxidants, appeals to consumers looking for both enjoyment and nutritional value in their sweet treats. Continuous innovation ensures that companies remain competitive and meet the evolving demands of health-conscious consumers.

Economic factors also contribute to the dynamics of the Gummy Candies market. Economic stability and disposable income levels influence consumer spending on non-essential items like confectionery. During periods of economic growth, consumers are more likely to indulge in sweet treats, positively impacting the market. Conversely, economic downturns may lead to shifts in consumer spending patterns, challenging market growth. Companies in the Gummy Candies market must be adaptable to fluctuations in economic conditions to maintain resilience.

The competitive landscape is shaped by factors such as marketing strategies, brand recognition, and product differentiation. Companies engage in strategic marketing campaigns, emphasizing factors like unique flavors, packaging, and promotional activities to capture consumer attention. Building a strong brand presence and offering distinct products enable companies to carve out their niche in the competitive Gummy Candies market.

Geopolitical factors also play a role, especially in the sourcing and pricing of raw materials. Trade policies, tariffs, and geopolitical tensions can impact the cost of ingredients and production, influencing the overall market dynamics. Companies need to monitor these geopolitical developments and strategically manage their supply chains to mitigate potential risks and maintain cost efficiency.

Leave a Comment