Rising Disposable Income

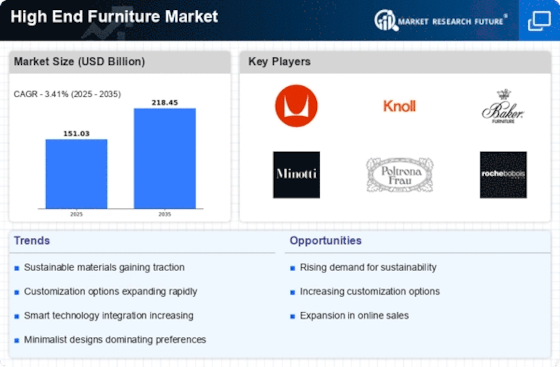

The increasing disposable income among consumers appears to be a pivotal driver for the High End Furniture Market. As individuals experience enhanced financial stability, they are more inclined to invest in premium furniture that reflects their lifestyle and status. This trend is particularly evident in emerging economies, where a burgeoning middle class is seeking luxury items. According to recent data, the luxury furniture segment is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This growth indicates a robust demand for high-end products, suggesting that consumers are prioritizing quality and craftsmanship in their purchasing decisions.

Influence of Interior Design Trends

The influence of contemporary interior design trends significantly impacts the High End Furniture Market. As consumers become more design-conscious, they seek furniture that aligns with current aesthetics, such as minimalism and organic materials. This trend is further fueled by social media platforms, where design inspiration is readily available. Recent statistics suggest that the luxury furniture market is experiencing a surge, with a projected growth rate of 6% annually, driven by the desire for unique and stylish pieces that enhance home interiors. This indicates that consumers are willing to invest in high-end furniture that reflects their personal style and the latest design trends.

Sustainability and Ethical Sourcing

Sustainability has emerged as a crucial consideration for consumers in the High End Furniture Market. As awareness of environmental issues grows, many buyers are prioritizing furniture made from sustainably sourced materials and produced through ethical practices. This shift is prompting manufacturers to adopt eco-friendly processes and materials, which can enhance brand reputation and appeal to environmentally conscious consumers. Market analysis reveals that the demand for sustainable furniture is expected to increase by 8% over the next few years, indicating a strong preference for products that align with consumers' values regarding sustainability and ethical consumption.

Urbanization and Space Optimization

Urbanization continues to reshape living environments, leading to a growing demand for high-end furniture that maximizes space without compromising on aesthetics. In densely populated urban areas, consumers are increasingly seeking multifunctional and stylish furniture solutions that cater to smaller living spaces. The High End Furniture Market is responding to this trend by offering innovative designs that blend functionality with luxury. Market data indicates that the demand for space-saving furniture is expected to rise by 7% annually, reflecting a shift in consumer preferences towards products that enhance both utility and elegance in urban settings.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are transforming the High End Furniture Market. Innovations such as 3D printing and automated production techniques are enabling manufacturers to create intricate designs with precision and efficiency. These advancements not only reduce production costs but also allow for greater customization options, appealing to consumers who desire unique pieces tailored to their specifications. Data suggests that the integration of technology in furniture production could lead to a market growth rate of 5% annually, as consumers increasingly seek high-quality, bespoke furniture solutions that leverage modern manufacturing capabilities.