- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

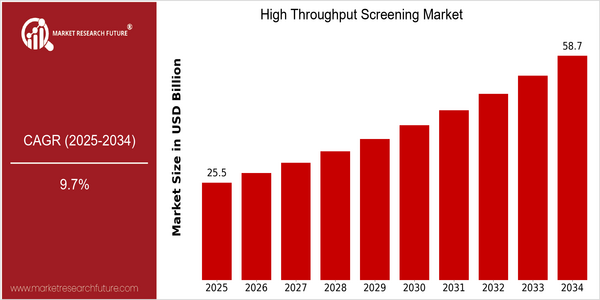

| Year | Value |

|---|---|

| 2025 | USD 25.51 Billion |

| 2034 | USD 58.71 Billion |

| CAGR (2025-2034) | 9.7 % |

Note – Market size depicts the revenue generated over the financial year

High-throughput screening (HTS) is expected to reach $25.5 billion by 2025, with an expected growth to $58.7 billion by 2034. This reflects a robust CAGR of 9.7% over the forecast period. In addition, the increasing demand for fast and effective drug discovery and the technological advancements in automation and data analysis are expected to drive the growth of this market. As a result, the screening of thousands of compounds in a fraction of the time taken by the traditional method is increasing. Artificial intelligence and machine learning in HTS platforms will further enhance the capabilities of these systems and help in predicting the outcome of screening. These are the main reasons why some of the major players in the HTS market, such as Thermo Fisher Scientific, PerkinElmer, and Agilent, are investing in research and development, forming strategic alliances, and launching new products. The recent collaborations, which are aimed at enhancing the data analysis capabilities of HTS platforms, are a clear example of the industry's efforts to make drug discovery more efficient and effective.

Regional Market Size

Regional Deep Dive

High-throughput screening (HTS) is experiencing strong growth across various regions of the world. This growth is primarily driven by technological advancements, an increase in demand for drug discovery, and a growing focus on personalized medicine. Each region has its own characteristics, influenced by the local economic conditions, regulations, and research capabilities. North America is the most advanced in terms of innovation and investment. Europe is the most advanced in terms of regulations and collaboration. Asia-Pacific is rapidly developing its capabilities in biotechnology and pharmaceuticals. Middle East and Africa are gradually emerging as new players, building on the investment in health care. Latin America is seeing an increase in research driven by government support.

Europe

- The European Medicines Agency (EMA) has introduced new guidelines that encourage the adoption of HTS technologies in drug development, fostering innovation and compliance among pharmaceutical companies.

- Collaborative projects such as the Innovative Medicines Initiative (IMI) are driving research in HTS, with participation from major pharmaceutical companies and academic institutions, enhancing the region's capabilities in drug discovery.

Asia Pacific

- China is rapidly advancing its HTS capabilities, with government-backed initiatives aimed at boosting biotechnology research, leading to increased investments in HTS technologies.

- Companies like Hitachi High-Technologies are developing cutting-edge HTS systems tailored for the Asian market, which are expected to enhance local drug discovery efforts significantly.

Latin America

- Brazil's government has initiated programs to support biotechnology research, which includes funding for HTS projects, thereby enhancing the region's research landscape.

- Collaborations between local universities and pharmaceutical companies are on the rise, focusing on HTS technologies to address regional health challenges, particularly in infectious diseases.

North America

- The U.S. National Institutes of Health (NIH) has launched several initiatives to enhance drug discovery processes, significantly impacting the HTS market by promoting collaboration between academia and industry.

- Key players like Thermo Fisher Scientific and PerkinElmer are investing heavily in automation and software solutions, which are streamlining HTS processes and improving throughput and accuracy.

Middle East And Africa

- The UAE has launched the Dubai Science Park, which aims to foster innovation in life sciences, including HTS, by providing infrastructure and support for biotech startups.

- South Africa is seeing increased investment in research facilities that focus on drug discovery, with local universities collaborating with international firms to enhance HTS capabilities.

Did You Know?

“High Throughput Screening can test thousands of compounds in a single experiment, significantly speeding up the drug discovery process compared to traditional methods.” — Journal of Medicinal Chemistry

Segmental Market Size

High-throughput screening is a critical area in the process of drug discovery and development. The HTS market is currently growing rapidly, driven by the growing demand for rapid and efficient screening. A number of factors are contributing to this growth, including the increasing prevalence of chronic diseases, which requires a faster drug development, and the technological development of automation, which increases the efficiency of screening. In addition, the government's policy towards new drug discovery methods is a driving force for the market. High-throughput screening technology has now reached the mature stage of development, and the leading companies such as Thermo Fisher Scientific and PerkinElmer are mainly engaged in the North American and European markets. High-throughput screening has been used in the fields of pharmaceutical research, toxicology, and biotechnology. It is mainly used to find new drugs and determine the effectiveness of drugs. The main trend is that the trend of personalized medicine and the integration of artificial intelligence into the screening process, which can improve the efficiency of data analysis and decision-making. In addition, the development of microfluidics and lab-on-a-chip will help to improve the screening accuracy and scale.

Future Outlook

High-throughput screening is expected to grow from $25.51 billion to $58.71 billion from 2025 to 2034, with a strong CAGR of 9.7%. This growth is mainly due to the increasing demand for drug discovery and development processes, especially in the pharmaceutical and biotechnological industries. As the world population ages and the number of chronic diseases increases, the need for more efficient and rapid screening methods will increase, and thus the use of high-throughput screening in various applications such as oncology, infectious diseases, and personal medicine will also increase. Besides, the key technological developments such as the integration of artificial intelligence and machine learning into high-throughput screening platforms are expected to increase the data analysis ability and improve the screening accuracy. High-throughput screening, and the automation of laboratory processes will also help to increase the screening efficiency and reduce the operating costs, and thus become more available to smaller research institutions and biotech companies. The trend of increasing the use of biological drugs and increasing the public and private investment in R & D will also lead to the development of high-throughput screening. High-throughput screening will become an indispensable tool for drug discovery in 2034, and the penetration rate of the top 20 pharmaceutical companies will exceed 75%, and the role of high-throughput screening in promoting medical progress will be further established.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 9.70% (2023-2032) |

High Throughput Screening Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.