Advancements in Battery Technology

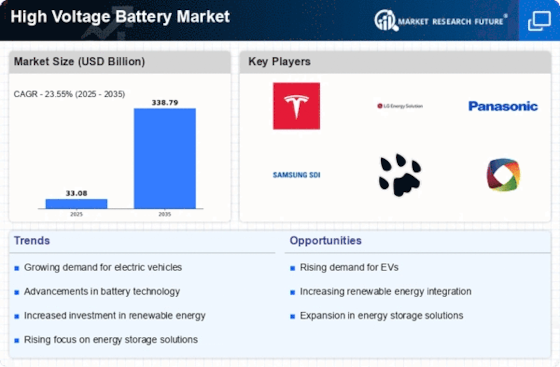

Technological innovations in battery chemistry and design are propelling the High Voltage Battery Market forward. Recent advancements, such as solid-state batteries and lithium-sulfur technologies, promise higher energy densities and improved safety profiles. These innovations are crucial as they address the limitations of traditional lithium-ion batteries, which have dominated the market. In 2025, the market for advanced battery technologies is anticipated to grow at a compound annual growth rate (CAGR) of over 15%. This growth indicates a robust interest in enhancing battery performance, which is essential for applications in electric vehicles and renewable energy storage. As manufacturers continue to invest in research and development, the High Voltage Battery Market is poised for significant transformation.

Rising Demand for Electric Vehicles

The increasing demand for electric vehicles (EVs) is a primary driver of the High Voltage Battery Market. As consumers become more environmentally conscious, the shift towards EVs accelerates. In 2025, the number of electric vehicles on the road is projected to surpass 30 million units, significantly boosting the need for high voltage batteries. This trend is further supported by various governments implementing incentives for EV purchases, which enhances market growth. The High Voltage Battery Market is expected to expand as automakers invest heavily in battery technology to improve performance and reduce costs. Consequently, the demand for high voltage batteries is likely to rise, creating opportunities for manufacturers and suppliers in this evolving landscape.

Government Regulations and Incentives

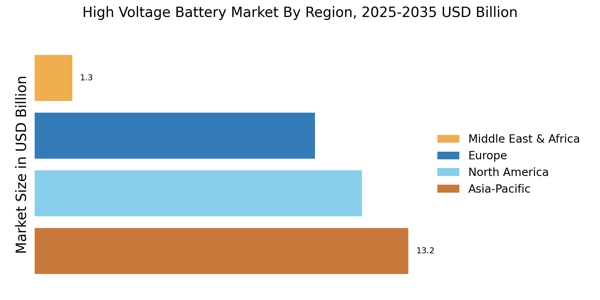

Government regulations aimed at reducing carbon emissions are significantly influencing the High Voltage Battery Market. Many countries are implementing stringent emissions standards, which compel automotive manufacturers to adopt electric and hybrid vehicles. In 2025, it is estimated that over 50% of new vehicle sales in certain regions will be electric or hybrid, driven by these regulations. Additionally, various governments are offering financial incentives for consumers to purchase electric vehicles, further stimulating demand for high voltage batteries. This regulatory environment not only supports the growth of the High Voltage Battery Market but also encourages innovation among manufacturers to meet evolving standards.

Integration of Renewable Energy Sources

The integration of renewable energy sources into the power grid is a significant driver for the High Voltage Battery Market. As the world shifts towards sustainable energy solutions, the need for efficient energy storage systems becomes paramount. High voltage batteries play a crucial role in storing energy generated from solar and wind sources, ensuring a stable supply. In 2025, the energy storage market is projected to reach a value of over 20 billion USD, with high voltage batteries accounting for a substantial share. This trend indicates a growing recognition of the importance of energy storage in achieving energy independence and sustainability goals, thereby enhancing the prospects for the High Voltage Battery Market.

Increased Investment in Energy Storage Solutions

Investment in energy storage solutions is rapidly increasing, which is a key driver for the High Voltage Battery Market. As industries and utilities seek to enhance grid reliability and efficiency, high voltage batteries are becoming essential components of energy storage systems. In 2025, investments in energy storage technologies are expected to exceed 30 billion USD, reflecting a strong commitment to developing robust energy infrastructure. This influx of capital is likely to spur innovation and drive down costs, making high voltage batteries more accessible for various applications. Consequently, the High Voltage Battery Market stands to benefit from this trend, as it aligns with the broader movement towards sustainable energy practices.

Leave a Comment