Research Methodology on Identity Verification Market

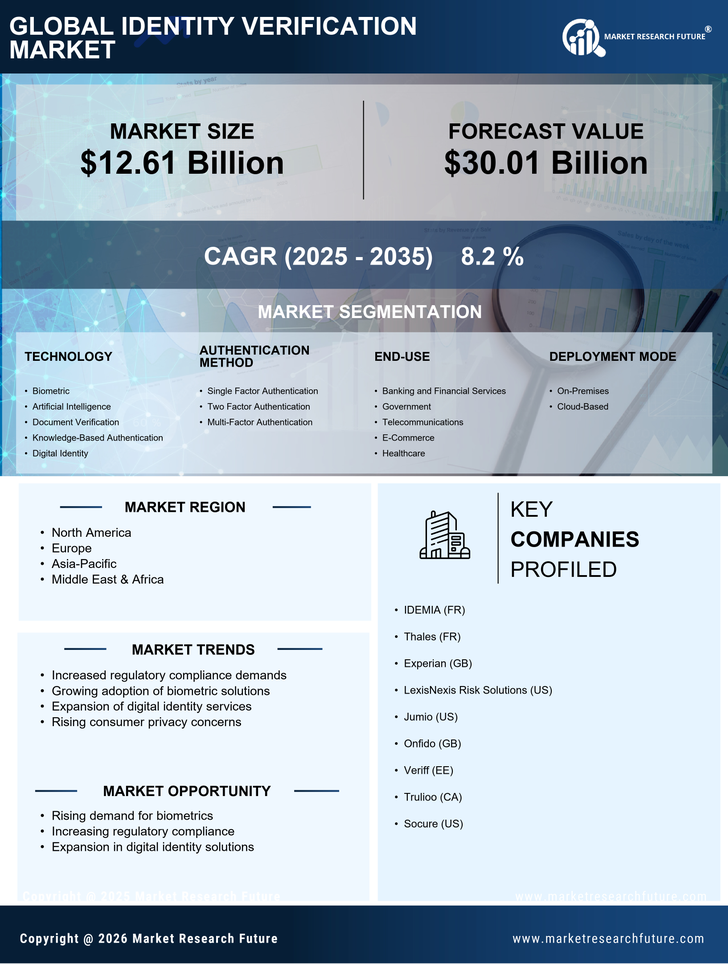

This research report on the global identity verification market provides an extensive analysis of the current and upcoming market trends, opportunities, and challenges pertaining to the global identity verification market. The market report encompasses an all-inclusive study of the global identity verification market, accompanied by a detailed analysis of the market segments such as type, deployment mode, and vertical.

The data and insights obtained from the research report are derived after a thorough primary and secondary research. Market data gathered in this study is analyzed and validated by market experts.

Market Analysis

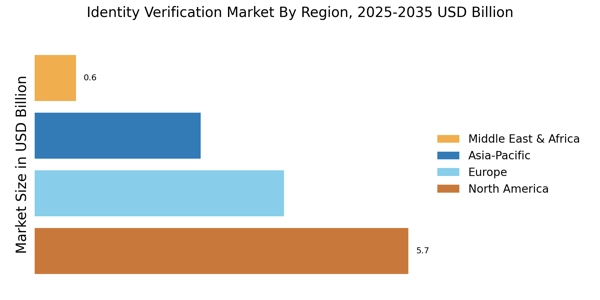

The market size and data are derived from the CAGR of the respective market forecast periods. A comprehensive approach to segmentation, based on various factors such as type, deployment mode, and vertical, is done to understand the market dynamics and thus, gain comprehensive insights into the market. Market insights obtained from this research report assists the readers to comprehend the market trends and challenges in the global identity verification market.

Market Scenario

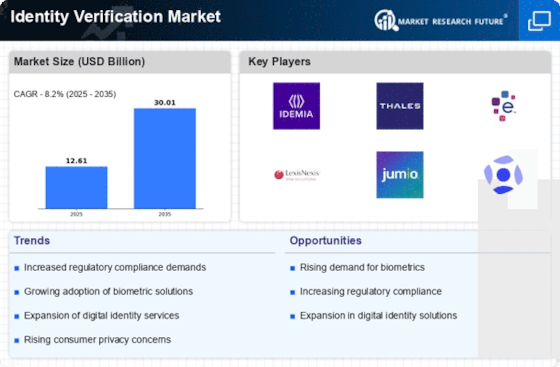

The global identity verification market is expected to experience significant growth in the forecast period 2023 to 2030. This growth is attributed to the need for organizations to comply with stringent identity-related regulations, reduction in identity frauds, increasing government initiatives, and the emergence of digital financial technologies. Moreover, the rising importance of e-commerce, social media platforms, and gaming are also anticipated to drive the demand for identity verification solutions.

Primary Research

In this research report, a thorough primary research is conducted by experts from various organizations. Primary research activities include interviewing key industry professionals, conducting surveys, and arranging focus group discussions. This allows us to capture the field-level insights about the market and identify various opportunities for growth in the market.

Secondary Research

This research report also includes inputs from secondary sources such as analyst reports, financial reports, and other industry-related sources. This allows us to build a realistic and comprehensive dataset of information related to the market. Data obtained from secondary sources is used to validate and cross-check the data collected from primary sources.

Market Size Estimation

The estimated market size is derived after a thorough estimation of the market which is conducted via market analysis. Factors such as the type, deployment mode, and vertical are taken into consideration while estimating the market size. The estimated market size is further validated through interviews conducted with industry experts, which also helps to identify the key trends prevailing in the market.

Data Triangulation

The data triangulation method is used to verify the data obtained from multiple sources and to create a consensus in the market. Data triangulation not only helps to identify the key market trends but also provides an accurate picture of the market.

Market Forecast

The forecasts of the market are conducted using various statistical and econometric models. Statistical models are used to predict the market size for the forecast period 2023 to 2030. The econometric models are used to identify the future trends in the market, helping the readers to gain comprehensive insights into the market and identify various growth opportunities in the market.