- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

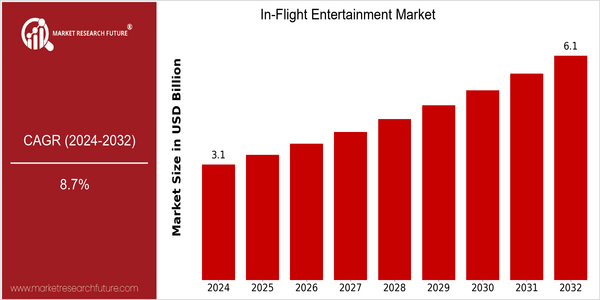

| Year | Value |

|---|---|

| 2024 | USD 3.146 Billion |

| 2032 | USD 6.13 Billion |

| CAGR (2024-2032) | 8.7 % |

Note – Market size depicts the revenue generated over the financial year

The global in-flight entertainment (IFE) market is poised for significant growth, with a current market size of USD 3.146 billion in 2024, projected to reach USD 6.13 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 8.7% over the forecast period. The increasing demand for enhanced passenger experiences, coupled with advancements in technology, is driving this upward trend. Airlines are increasingly recognizing the importance of IFE systems as a key differentiator in a competitive market, leading to substantial investments in innovative solutions. Several factors are propelling the growth of the IFE market, including the rising adoption of wireless streaming services, the integration of high-definition displays, and the expansion of content libraries that cater to diverse passenger preferences. Additionally, the shift towards more personalized and interactive entertainment options is reshaping the landscape. Key players in the industry, such as Panasonic Avionics, Thales Group, and Gogo Inc., are actively pursuing strategic initiatives, including partnerships and product launches, to enhance their service offerings and capture a larger market share. For instance, recent collaborations between airlines and content providers have resulted in enriched entertainment experiences, further solidifying the market's growth trajectory.

Regional Market Size

Regional Deep Dive

The In-Flight Entertainment (IFE) market is experiencing significant transformation across various regions, driven by technological advancements, changing consumer preferences, and competitive pressures among airlines. In North America, the market is characterized by high demand for personalized and interactive entertainment options, while Europe is witnessing a surge in partnerships between airlines and tech companies to enhance passenger experience. The Asia-Pacific region is rapidly adopting advanced IFE systems, influenced by a growing middle class and increasing air travel. Meanwhile, the Middle East and Africa are focusing on luxury and premium services, and Latin America is gradually modernizing its IFE offerings to meet international standards. Each region presents unique opportunities and challenges that shape the overall landscape of the IFE market.

Europe

- Airlines such as Lufthansa and British Airways are collaborating with tech firms like Panasonic and Thales to integrate advanced IFE solutions, including virtual reality and augmented reality experiences, enhancing passenger engagement.

- The European Union's Green Deal is pushing airlines to adopt more sustainable practices, influencing the development of eco-friendly IFE systems that minimize energy consumption and waste.

Asia Pacific

- Airlines in the Asia-Pacific region, such as Singapore Airlines and Qantas, are leading the way in implementing cutting-edge IFE technologies, including AI-driven content recommendations and multi-language support to cater to diverse passenger demographics.

- The region's rapid growth in air travel, particularly in countries like China and India, is prompting airlines to invest in modern IFE systems to attract and retain customers, significantly impacting market dynamics.

Latin America

- LATAM Airlines is modernizing its fleet with upgraded IFE systems that include streaming services and improved connectivity, aiming to enhance the travel experience for its passengers.

- Regulatory changes in Brazil are encouraging airlines to adopt more advanced IFE technologies, which is expected to stimulate competition and innovation in the market.

North America

- Major airlines like Delta and American Airlines are investing heavily in upgrading their IFE systems to include high-speed internet and on-demand content, reflecting a shift towards more personalized passenger experiences.

- The Federal Aviation Administration (FAA) has introduced new regulations that encourage the use of wireless IFE systems, allowing airlines to reduce weight and improve fuel efficiency, which is expected to drive innovation in the sector.

Middle East And Africa

- Emirates Airlines is setting a benchmark in the IFE market by offering one of the most extensive entertainment libraries, including over 4,500 channels, which enhances its competitive edge in the luxury travel segment.

- The region's focus on tourism and business travel is driving investments in IFE systems, with governments supporting initiatives to improve air travel infrastructure and passenger experience.

Did You Know?

“Did you know that the average passenger spends over 3 hours on in-flight entertainment during long-haul flights, making it a critical factor in airline customer satisfaction?” — International Air Transport Association (IATA)

Segmental Market Size

The In-Flight Entertainment (IFE) segment plays a crucial role in enhancing passenger experience and is currently experiencing stable growth. Key drivers of demand include the increasing consumer expectation for personalized entertainment options and the competitive pressure on airlines to differentiate their services. Additionally, advancements in wireless technology and the proliferation of mobile devices are reshaping how content is delivered during flights. Currently, the IFE segment is in a mature adoption stage, with airlines like Delta and Emirates leading the way in offering advanced systems that include streaming services and interactive gaming. Primary applications include seatback screens, personal device streaming, and in-flight Wi-Fi, which enhance passenger engagement. Trends such as the push for sustainability are catalyzing the adoption of more energy-efficient systems, while the COVID-19 pandemic has accelerated the shift towards contactless entertainment solutions. Technologies like 5G connectivity and cloud-based content delivery are pivotal in shaping the future of IFE, enabling richer, more diverse content offerings.

Future Outlook

The In-Flight Entertainment (IFE) Market is poised for significant growth from 2024 to 2032, with a projected market value increase from $3.146 billion to $6.13 billion, reflecting a robust compound annual growth rate (CAGR) of 8.7%. This growth trajectory is underpinned by the increasing demand for enhanced passenger experiences, driven by the rising expectations of travelers for high-quality entertainment options during flights. As airlines continue to invest in modernizing their fleets, the integration of advanced IFE systems is expected to become a standard feature, leading to higher penetration rates among both short-haul and long-haul carriers. By 2032, it is anticipated that over 70% of commercial aircraft will be equipped with state-of-the-art IFE systems, significantly enhancing the overall travel experience. Key technological advancements, such as the proliferation of high-speed in-flight Wi-Fi and the adoption of streaming services, are set to reshape the IFE landscape. Airlines are increasingly partnering with content providers to offer a diverse range of entertainment options, including movies, TV shows, and gaming, which cater to the varied preferences of passengers. Additionally, the growing emphasis on sustainability and cost-efficiency is driving airlines to explore innovative solutions, such as wireless IFE systems that reduce weight and maintenance costs. Emerging trends, including personalized content delivery and the integration of augmented reality (AR) experiences, are expected to further elevate the IFE market, making it a critical component of the overall airline service offering in the coming years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 2.6 Billion |

| Market Size Value In 2023 | USD 2.86 Billion |

| Growth Rate | 10.00% (2023-2032) |

In-flight Entertainment Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.