India Air Charter Services Market Overview

India Air Charter Services Market Size was estimated at 2.99 (USD Billion) in 2023. The India Air Charter Services Market Industry is expected to grow from 4.18(USD Billion) in 2024 to 9.21 (USD Billion) by 2035. The India Air Charter Services Market CAGR (growth rate) is expected to be around 7.446% during the forecast period (2025 - 2035).

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Key India Air Charter Services Market Trends Highlighted

The India Air Charter Services Market is witnessing significant growth driven by several key market drivers. The increasing demand for air travel, particularly in remote areas where commercial flights are limited, is propelling the need for charter services. Business travel is also on the rise as more companies are looking for efficient transportation solutions to facilitate meetings, transporting goods, and corporate events. The expansive development of the aviation sector in India, supported by the government's initiatives, such as the UDAN scheme, is enhancing regional connectivity and making air travel more accessible. Opportunities in the market are broadening as the government continues to work on improving airport infrastructure, which is likely to attract more charter operators.Furthermore, the change in how consumers prefer to travel to be more personal gives an opening for service differentiation among charter service providers. The increasing growth of travel and tourism in India, especially in destinations like Goa and the Andaman Islands, provides better opportunities as people look for easy and fast modes of transport. There are noticeable growth patterns for digitization in the India Air Charter Services Market. The emergence of websites and mobile apps comes with convenience and options suitable to a diversity of preferences. There is also growth in concern for the environment, which translates to interest in sustainable aviation practices in the charter segment.

Overall, the combination of technological advancements, improved infrastructure, and a shift in consumer behavior is shaping the future of the air charter industry in India.

India Air Charter Services Market Drivers

Increasing Demand for Time-efficient Travel

The India Air Charter Services Market Industry is experiencing significant growth due to the increasing demand for time-efficient travel among business travelers and high-net-worth individuals. India has seen a surge in its business environment, with the country ranked 63rd in the World Bank's Ease of Doing Business index in 2020, improving from 77th in 2018. This improvement is indicative of an expanding economy where businesses value time savings for travel.Additionally, data from the Federation of Indian Chambers of Commerce and Industry (FICCI) suggests that there has been a 20% increase in the usage of charter services over the past three years, largely driven by the need for quicker access to remote locations and flexibility in travel schedules. Such dynamics highlight the growing attractiveness of air charter services as a viable option for business travel in India, thereby propelling the market forward.

Growth in Tourism Sector

The tourism sector in India has been witnessing rapid growth, which significantly boosts the India Air Charter Services Market Industry. According to the Ministry of Tourism, the country recorded over 10.93 million foreign tourist arrivals in 2019, representing a growth rate of 3.2% over the previous year. In light of the ongoing recovery from the pandemic, this sector is expected to rebound, attracting more travelers who seek personalized and exclusive travel experiences facilitated by charter services.Established entities like Thomas Cook and MakeMyTrip have expanded services that incorporate air charter arrangements for luxury tourism, further driving demand for charter flights and stimulating the market growth in this segment.

Regulatory Support for General Aviation

The Indian government has been implementing regulatory reforms aimed at the general aviation sector to enhance its growth, benefitting the India Air Charter Services Market Industry. The Directorate General of Civil Aviation (DGCA) has initiated measures to simplify the process for obtaining permits and licenses, which has resulted in a reported increase in charter operators by 15% over the last five years. The National Civil Aviation Policy (NCAP) supports initiatives that favor growth in air charter services through enhanced air connectivity.Such favorable regulations encourage investment and operational viability for both new and existing charter service providers, thus bolstering market prospects in India.

Emergence of Luxury Service Demand

There is a noticeable surge in demand for luxury services within the India Air Charter Services Market Industry, spurred by the affluent classes seeking premium travel experiences. The Knight Frank Wealth Report indicates that the number of high-net-worth individuals (HNWIs) in India rose by approximately 11% in recent years, contributing to the growth of luxury lifestyles that include private air travel. Notably, companies like JetSetGo and Air Charter Service are responding to this trend by introducing tailored charter flight services that cater specifically to the needs of luxury travelers.This burgeoning market segment represents a critical driver for air charter services in India and offers substantial growth potential.

India Air Charter Services Market Segment Insights

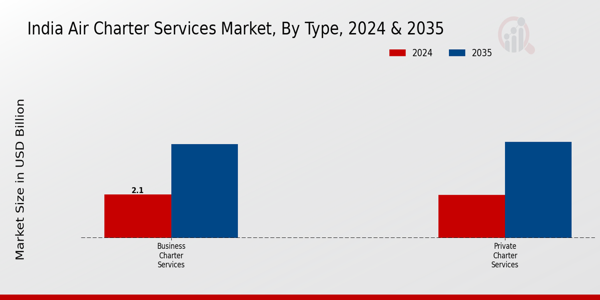

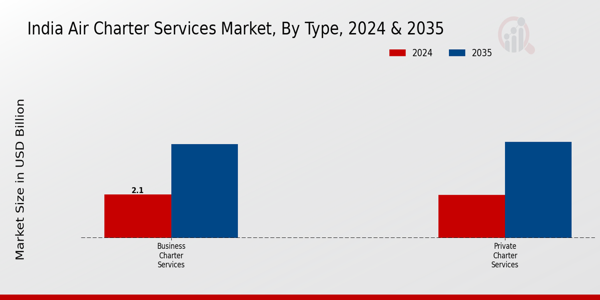

Air Charter Services Market Type Insights

The India Air Charter Services Market demonstrates a significant growth trajectory, with the Type segment encompassing diverse and dynamic offerings that cater to various customer needs. The market is characterized by the presence of Business Charter Services and Private Charter Services, which play pivotal roles in shaping its landscape. Business Charter Services are increasingly favored by corporate clients seeking efficiency and convenience for their travel needs, enabling them to access remote locations in a timely manner. These services often provide tailored solutions for executive travel, facilitating essential connections that are crucial for negotiations, meetings, and strategic planning.The rise in globalization and India’s booming economy has spurred demand in this area, emphasizing the importance of speedy logistics and personalized services in competitive business environments. Meanwhile, Private Charter Services cater to affluent individuals and family travelers looking for discretion, luxury, and flexibility. This sector is characterized by bespoke travel experiences, ensuring clients enjoy a high level of comfort and privacy while also avoiding the hassles of commercial aviation. Growth drivers for both services include an increasing number of HNIs (High Net-worth Individuals), expanding tourism, and a rising trend towards experiential travel in India.The advantages of air charter services are several; they offer flexible itineraries, time-saving benefits, and direct access to smaller airports that commercial airlines do not service. However, the market does encounter challenges, such as regulatory scrutiny and fluctuating fuel prices, which can affect operational costs. Overall, the segmentation within the India Air Charter Services Market reflects a robust structure where Business Charter Services and Private Charter Services hold significant potential for growth, demonstrating increasing relevance in a fast-paced economic context.As India continues to develop its infrastructure and regulatory framework, opportunities are ripe for innovation and expansion across these segments, positioning them as key players in the overall air travel paradigm.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Air Charter Services Market Application Insights

The Application segment of the India Air Charter Services Market is critical to understanding the overall dynamics of the industry. This segment encompasses Charter Passenger services, which offer flexible and expedited travel options, catering primarily to business executives, tourists, and groups requiring personalized travel solutions. Furthermore, Charter Freight plays a vital role in serving industries that depend on timely and efficient logistics for cargo transport, including e-commerce, pharmaceuticals, and perishable goods. This dual focus enables the sector to cater to diverse consumer needs, with Charter Passenger services significantly contributing to the luxury travel experience, while Charter Freight is essential for sustaining supply chains amidst growing demand.The increasing reliance on air travel for both personal and commercial purposes in India, along with the rise of businesses seeking rapid delivery options, fuels the growth of these segments. The India Air Charter Services Market is thus positioned for notable expansion, driven by both rising disposable incomes and advancing logistics capabilities, attracting investments and innovations within the industry.

India Air Charter Services Market Key Players and Competitive Insights

The India Air Charter Services Market is a rapidly growing sector that encompasses a wide range of services catering to various client needs, including business travel, medical emergencies, and freight transport. The competitive landscape in this market is characterized by a mix of established players and new entrants, all striving to capture a share of the increasing demand for air charter services. Factors such as the growth of the Indian economy, rising disposable incomes, and a greater emphasis on time efficiency among travelers contribute significantly to the market's expansion. Companies in this space are continuously innovating and enhancing their service offerings to provide personalized experiences while also maintaining compliance with regulations and safety standards. The competition is intense, driven by the varied client requirements and the necessity to differentiate services in a dynamic market environment.Graphite Aviation has established itself as a formidable player in the India Air Charter Services Market, leveraging its considerable operational strengths and strategic market presence. The company's expertise lies in providing customized charter solutions tailored to meet the unique needs of its clientele, which includes both corporate entities and individual travelers. Graphite Aviation's strengths include its extensive fleet of aircraft, which enables it to offer a diverse range of travel options, from small private jets to larger aircraft for group travel.

The company focuses on delivering reliable and efficient services, and as a result, it has built a strong reputation for safety and customer satisfaction. This competitive advantage allows Graphite Aviation to maintain a prominent position in the Indian air charter industry and differentiate itself from its competitors.Taj Air plays a significant role in the India Air Charter Services Market, recognized for its commitment to high-quality service and customer care. The company specializes in offering a suite of services that includes private jet charters, aircraft management, and aviation consultancy, thus catering to a diverse clientele. Taj Air has made significant inroads into the market by emphasizing luxury and personalized experiences, aligning with the needs of affluent travelers. The company's strengths lie in its fleet of well-maintained aircraft, attentive crew, and a customer-first approach that prioritizes passenger comfort and convenience. Taj Air has been proactive in pursuing strategic mergers and acquisitions, aligning with other players in the aviation sector to enhance its service portfolio and market reach. This adaptability, combined with an established brand presence, positions Taj Air as a key participant within the India Air Charter Services Market, allowing it to compete effectively against both domestic and international operators.

Key Companies in the India Air Charter Services Market Include

- Graphite Aviation

- Taj Air

- Club One Air

- Air Pegasus

- JetSetGo

- Air Charter Service

- Blue Dart Aviation

- Kalinga Air

- Virat Aviation

- IndiGo

- Aero Connect

- FlyByWire

- Heligo Charters

- DHL Aviation

- Skybird Aviation

India Air Charter Services Market Industry Developments

The India Air Charter Services Market has recently seen significant developments, particularly with the growing demand for business aviation and charter services following the pandemic's impact. Companies such as Graphite Aviation and Taj Air are expanding their fleet and service offerings. In July 2023, Air Charter Service reported a 20% growth in bookings, indicating a strong recovery in the market. Additionally, JetSetGo announced plans to enhance its operational capabilities by acquiring a fleet of five new Bombardier jets in August 2023, aiming to capture a larger share of the business travel sector. Concurrently, IndiGo is diversifying its portfolio by expanding into charter services, aligning with the government's push to boost regional connectivity. Notably, in September 2023, Heligo Charters partnered with DHL Aviation to enhance logistics solutions across remote areas, further underlining the growing trend of collaborations within the market. These developments reflect an increasing market valuation as companies invest in modernization and fleet expansion, signifying a promising future for air charter services in India, driven by both corporate travel and logistics demands.

India Air Charter Services Market Segmentation Insights

- Air Charter Services MarketTypeOutlook

- Business Charter Services

- Private Charter Services

- Air Charter Services MarketApplicationOutlook

- Charter Passenger

- Charter Freight

Report Scope:

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

2.99(USD Billion) |

| MARKET SIZE 2024 |

4.18(USD Billion) |

| MARKET SIZE 2035 |

9.21(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

7.446% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Graphite Aviation, Taj Air, Club One Air, Air Pegasus, JetSetGo, Air Charter Service, Blue Dart Aviation, Kalinga Air, Virat Aviation, IndiGo, Aero Connect, FlyByWire, Heligo Charters, DHL Aviation, Skybird Aviation |

| SEGMENTS COVERED |

Type, Application |

| KEY MARKET OPPORTUNITIES |

Growing demand for business travel, Rise in tourism activities, Increased freight transport needs, Technological advancements in booking, Government initiatives for aviation growth |

| KEY MARKET DYNAMICS |

increasing demand for luxury travel, time-sensitive cargo transport needs, regulatory changes and compliance, rising disposable income, urbanization and business growth |

| COUNTRIES COVERED |

India |

Frequently Asked Questions (FAQ) :

The India Air Charter Services market is expected to be valued at 4.18 billion USD in 2024.

By 2035, the India Air Charter Services market is projected to reach a value of 9.21 billion USD.

The expected CAGR for the India Air Charter Services market from 2025 to 2035 is 7.446 percent.

By 2035, Business Charter Services is expected to be valued at 4.55 billion USD, indicating significant market dominance.

Private Charter Services are expected to reach a market valuation of 4.66 billion USD by 2035.

Key players in the market include companies such as Graphite Aviation, Taj Air, and Club One Air, among others.

There are opportunities for growth driven by increasing demand for both business and private air travel services.

Challenges include regulatory constraints and competition from traditional airlines offering charter services.

Regional demand impacts the market by driving specific service offerings tailored to local business needs.

Key applications include business travel, private travel, and emergency evacuation services.