Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Indian Data Center Market Drivers

Increasing Demand for Cloud Services

The rapid adoption of cloud computing services in India is a major driver for the Indian Data Center Market. According to the National Association of Software and Service Companies (NASSCOM), the cloud market in India is expected to reach approximately INR 1 trillion by 2025, driven by the growing number of small and medium enterprises (SMEs) transitioning to cloud solutions. In a country where digital transformation is accelerating, organizations like Microsoft and Amazon Web Services are expanding their presence in India, further enhancing the demand for robust data centers. As businesses increasingly rely on cloud infrastructure for storage, computing, and application services, this trend is fueling investments in data centers across the country, significantly impacting market growth. The drive towards digitalization, especially after the COVID-19 pandemic, has been significant, with reports suggesting an increased internet user base of 700 million in India, necessitating more data handling and storage capabilities.

Rise in Data Consumption

India is witnessing an exponential increase in data consumption, driven by the proliferation of smartphones and affordable internet access. According to the Telecom Regulatory Authority of India (TRAI), the country's internet subscribers reached over 800 million in 2022, with an average mobile data consumption of around 13 GB per user per month. This surge in data usage is compelling businesses and service providers to invest in more data centers to cater to the growing demand for data storage and processing solutions. Established organizations like Jio and Airtel are leading this revolution, further contributing to the expansion of the Indian Data Center Market by enhancing connectivity and creating a higher demand for efficient data management facilities.

Government Initiatives and Policies

The Indian government is actively promoting the digital economy through various initiatives, which is a significant driver for the Indian Data Center Market. Policies such as the Digital India initiative aim to transform India into a digitally empowered society, encouraging numerous investments in IT and data infrastructure. The government has also introduced measures to simplify the process of setting up data centers in the country. For example, the Ministry of Electronics and Information Technology (MeitY) announced plans to create dedicated data center parks in 2021, facilitating the development of state-of-the-art facilities. Such initiatives not only stimulate market growth but also attract foreign investment from global players like Google and Facebook, reinforcing the demand for data center capabilities.

Indian Data Center Market Segment Insights

Data Center Market Type Insights

The Indian Data Center Market is experiencing significant growth, driven by increasing digitalization and a growing dependence on data across various industries. Within this market, two prominent types are Corporate data centers and Web hosting data centers, both playing crucial roles in the broader technological ecosystem. Corporate data centers are often tailored to meet the specific needs of a business, facilitating enhanced security, control, and optimizing operations for large enterprises. They provide companies with dedicated resources and infrastructure to manage data effectively, aligning closely with India's push towards becoming a Digital India, thus driving overall Indian Data Center Market revenue.

On the other hand, Web hosting data centers cater to a diverse clientele, ranging from small businesses to large-scale platforms requiring reliable web presence and online services. The rise of e-commerce and digital services in India has led to a robust demand for such hosting solutions, enabling users to establish and maintain their online identities with ease. This segment not only improves accessibility to information but also enhances operational efficiency for businesses, thus significantly impacting the Indian Data Center Market statistics. Both Corporate data centers and Web hosting data centers are witnessing a surge in investment as organizations strive for improved performance, scalability, and sustainability in their operations.

Furthermore, the accelerating use of cloud services highlights the importance of these data centers, where Corporate data centers often transition to hybrid networks, incorporating both on-premises infrastructure and cloud resources. The growing need to comply with data sovereignty regulations and manage massive data flows further reiterates the significance of these types in the industry. However, the market also faces challenges such as rising operational costs and the demand for skilled labor, which can hinder the scalability and efficiency of data center operations. Despite these challenges, opportunities remain abundant as emerging technologies like Artificial Intelligence and the Internet of Things continue to shape the landscape of data management in India.

With the government initiatives promoting tech innovations and foreign investments poised to have a lasting impact, both Corporate and Web hosting data centers are set to remain pivotal in the ongoing transformation of the Indian Data Center Market. As the country emphasizes building robust digital infrastructure, the significance of these segments becomes clearer, presenting varied opportunities for growth and innovation in line with global standards. The growing usage of mobile devices, coupled with a rise in the number of startups looking for reliable hosting solutions, underscores the potential for sustained market growth within the Indian Data Center Market domain, ultimately strengthening the overall framework of data management in regional and global contexts.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Data Center Market Density Insights

The Indian Data Center Market, focusing on the Density segment, showcases a diverse landscape with varying configurations that cater to different operational needs. The market is experiencing a significant shift, driven by increasing digitalization and the burgeoning demand for data storage and processing capabilities. Among the Density categories, Low density solutions often serve traditional businesses with moderate data needs, while Medium density configurations are favored by firms pushing towards hybrid architectures. High density setups are increasingly vital for enterprises looking to maximize space efficiency and resource utilization, especially in urban areas facing real estate constraints.

Meanwhile, Extreme density offerings cater to hyperscale data centers, providing massive computational power and cooling capabilities, crucial for cloud service providers and large corporations. This segmentation of the Indian Data Center Market not only reflects the differing customer requirements but also indicates a strategic approach for stakeholders to harness advancements in technology and infrastructure. Furthermore, the country's emphasis on digital transformation and government initiatives promoting smart cities significantly contribute to the ongoing growth and evolution within this segment, leading to expanded opportunities for innovation and investment. Overall, the Indian Data Center Market segmentation is pivotal in addressing the unique challenges and demands of a rapidly evolving digital landscape.

Data Center Market Vertical Insights

The Indian Data Center Market, particularly within the vertical segment, plays a pivotal role in the nation’s digital transformation. With the increasing demand for data storage and processing, industries such as Banking and Financial Services have emerged as key participants, driven by stringent compliance requirements and the necessity for high-speed transactions. Telecom IT contribute significantly, reflecting the surge in digital services and cloud adoption, critical in supporting India's growing economy. Government initiatives toward digital governance and e-governance demonstrate a commitment to transparency and efficiency, heightening the demand for data centers.

Healthcare is also becoming a crucial sector as the need for secure and reliable data management increases, especially in light of public health initiatives and patient data privacy. These segments collectively illustrate the Indian Data Center Market's dynamic landscape, influenced by innovation, regulatory frameworks, and the rising appetite for digital solutions across all sectors. As this market evolves, it presents both challenges and opportunities, including the balance of environmental sustainability and energy consumption in data management practices.

Indian Data Center Market Key Players and Competitive Insights

The Indian Data Center Market has become increasingly competitive due to the rapid digital transformation and growing demand for cloud services across various sectors. With a surge in data generation and consumption, numerous players are vying for market share, including global giants and local providers. This competitive landscape is characterized by innovation, investments in advanced technology, and strategic partnerships aimed at enhancing service offerings. Factors such as government initiatives to boost the digital economy, rising internet penetration, and increased emphasis on data security have further fueled the expansion of data centers in the region. The market dynamics are shaped by the presence of key players who contribute to the growth trajectory through their unique value propositions and operational efficiencies. In the context of the Indian Data Center Market, Google Cloud has established a significant presence by leveraging its global infrastructure and expertise in cloud computing services.

The company's strengths lie in its comprehensive suite of data analytics, machine learning capabilities, and high-performance computing solutions. Google Cloud's investment in energy-efficient data centers is also noteworthy, as it aligns with the growing emphasis on sustainability among enterprises. Furthermore, the integration of innovative security measures and compliance with local regulations reinforce its standing as a trusted partner for businesses looking to adopt cloud solutions. Google Cloud's continual enhancements to its offerings, along with strategic collaborations with local enterprises, enhance its competitive edge in this rapidly evolving landscape.

Web Werks has carved a niche for itself in the Indian Data Center Market by offering a diversified range of services that includes colocation, cloud hosting, and managed services tailored to meet the unique needs of Indian businesses. The company is known for its robust infrastructure, which includes Tier IV data centers designed for maximum uptime and reliability. Web Werks has also made strides in establishing partnerships and collaborations within the industry to expand its service offerings and strengthen its market position. The company places a strong emphasis on customer-centric solutions, allowing it to cater effectively to the varying demands across sectors such as IT, e-commerce, and finance. Recent mergers and acquisitions undertaken by Web Werks have further fortified its capabilities, enabling it to broaden its service portfolio and enhance operational efficiencies within the Indian market.

Key Companies in the Indian Data Center Market Include

Indian Data Center Market Developments

The Indian Data Center Market is witnessing significant growth, driven by increasing demand for cloud computing and digital services. Recent developments include the expansion of Google Cloud and Amazon Web Services, enhancing their infrastructure to support evolving customer needs. In March 2023, NTT Global Data Centers announced plans to invest heavily in new facilities to cater to the rising demand for data services across India. Similarly, AdaniConneX is ramping up its operations with new data center facilities aimed at providing sustainable solutions. Notably, in May 2023, Sify Technologies acquired additional real estate to bolster its existing data center operations, further solidifying its position in the market. The overall market growth is supported by a surge in digital transformation initiatives across various sectors and government initiatives aimed at boosting the digital economy.

Companies like CtrlS Datacenters and Data Realty are also expanding their footprints through new investments and partnerships. As the demand for data consumption continues to surge, Tata Communications is enhancing its offerings, while Microsoft Azure is expanding its service capabilities in response to increasing customer expectations, all contributing to a dynamic and competitive landscape in the Indian data center market.

Data Center Market Segmentation Insights

| Report Attribute/Metric Source: |

Details |

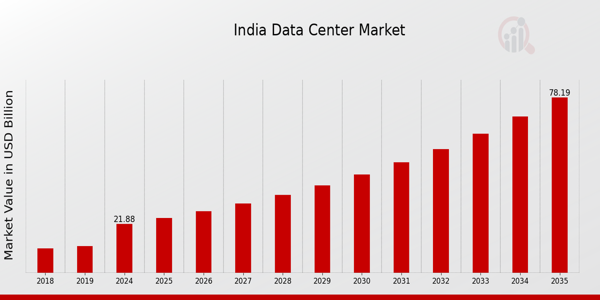

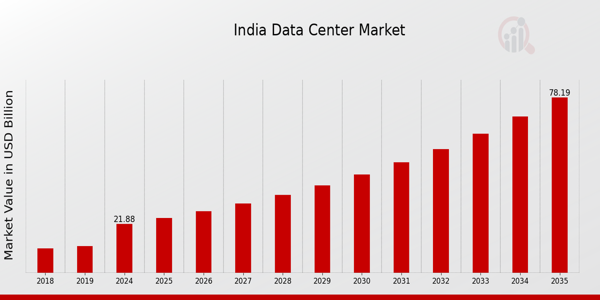

| MARKET SIZE 2018 |

18.72(USD Billion) |

| MARKET SIZE 2024 |

21.88(USD Billion) |

| MARKET SIZE 2035 |

78.19(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

12.275% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Google Cloud, Web Werks, Sify Technologies, Data Realty, CtrlS Datacenters, Amazon Web Services, Bharti Airtel, Manipal Digital Technologies, ESDS Software Solution, AdaniConneX, NTT Global Data Centers, Tata Communications, Microsoft Azure, Reliance Jio, Nextgen Datacenter |

| SEGMENTS COVERED |

Type, Density, Vertical |

| KEY MARKET OPPORTUNITIES |

Rising demand for cloud services, Growth in digital transformation initiatives, Increase in data consumption levels, Expansion of hyperscale data centers, Government support for digital infrastructure |

| KEY MARKET DYNAMICS |

rapid cloud adoption , increasing digital transformation , rising data consumption , government policy support , growing demand for colocation services |

| COUNTRIES COVERED |

India |

Frequently Asked Questions (FAQ) :

The India Data Center Market is expected to be valued at 21.88 USD Billion in 2024.

By 2035, the India Data Center Market is expected to reach a valuation of 78.19 USD Billion.

The expected CAGR for the India Data Center Market from 2025 to 2035 is 12.275%.

Both corporate data centers and web hosting data centers are valued at 10.94 USD Billion each in 2024.

The major players in the India Data Center Market include Google Cloud, Amazon Web Services, Microsoft Azure, and Tata Communications.

The corporate data centers segment is projected to grow to 39.93 USD Billion by 2035.

Emerging trends and increasing demand for digital services create significant opportunities in the India Data Center Market.

Key challenges include infrastructure costs and regulatory compliance affecting growth in the India Data Center Market.

Regional growth varies, with higher demand observed in major urban centers and IT hubs across India.

Current global trends in technology and data usage influence significant growth and investment in the India Data Center Market.