India E-Wallet Market Overview:

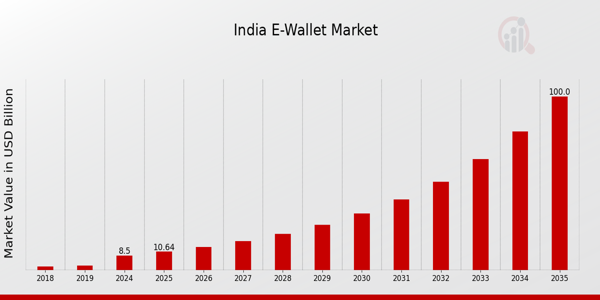

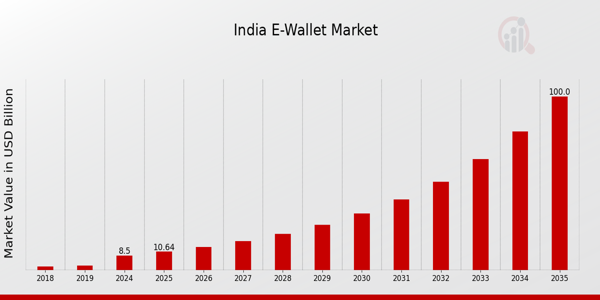

As per MRFR analysis, the India E-Wallet Market Size was estimated at 6.38 (USD Billion) in 2023. The India E-Wallet Market Industry is expected to grow from 8.5(USD Billion) in 2024 to 100 (USD Billion) by 2035. The India E-Wallet Market CAGR (growth rate) is expected to be around 25.12% during the forecast period (2025 - 2035).

Key India E-Wallet Market Trends Highlighted

The India E-Wallet Market has seen significant growth driven by various key market drivers. The increasing penetration of smartphones and internet services, supported by government initiatives such as Digital India, has led more consumers to adopt digital payment solutions. Mobile payment solutions are gaining traction as people look for convenience, speed, and security in their transactions. The government's push for a cashless economy, especially post-demonetization, has further propelled the acceptance of e-wallets among consumers and merchants alike.

Recent trends indicate a shift towards integrating e-wallets with various services such as online shopping, utility bill payments, and even transportation services, enhancing user experience and encouraging more frequent usage.

The rise of contactless payments, particularly after the pandemic, is significant, as many users prefer quick and safe transaction methods. The presence of numerous players in the market has fostered a competitive environment, pushing companies to innovate and provide added features like loyalty programs, cashback offers, and financial services, driving user engagement. Opportunities in the Indian e-wallet market remain abundant. With the rise of digital literacy, there is a substantial opportunity to reach rural areas where traditional banking services are still limited.

The growing trend of small businesses and vendors going digital presents a chance for e-wallet providers to expand their user base.Additionally, collaborations with fintech companies could lead to the introduction of advanced features such as peer-to-peer payments and crypto-wallets, further broadening the scope of services available to consumers. Overall, the continuous adaptation to consumer needs and addressing security concerns will be critical to the growth of e-wallets in India.

Fig 1: India E-Wallet Market Overview

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

India E-Wallet Market Drivers

Increasing Smartphone Penetration

The increase in smartphone penetration in India is a crucial factor driving the India E-Wallet Market Industry. According to the Telecom Regulatory Authority of India, India will have over 760 million smartphone users by 2022, reflecting a 20% year-over-year increase. This growth allows a higher proportion of the population to use digital payment methods like E-Wallets. Major firms like Paytm and Google Pay have tapped into this trend, successfully targeting this rising user base. Smartphones' increased accessibility and convenience are expected to promote E-Wallet use, indicating a better development trajectory for the sector.

Government Initiatives Promoting Digital Payments

The Indian government has been strongly advocating for digital payments through various initiatives like Digital India and the introduction of the Unified Payments Interface (UPI). The government aims to increase cashless transactions, targeting a $1 trillion digital economy by 2025. As per the National Payments Corporation of India, UPI transactions surged to over 45 billion in 2022, marking a significant increase in digital payment adoption. By increasing infrastructure and offering incentives for E-Wallet use, the government is solidifying the foundation for the India E-Wallet Market Industry to expand significantly.

Rapid Growth of E-Commerce Sector

The rapid expansion of the e-commerce sector in India is a pivotal driver for the India E-Wallet Market Industry. In 2021, the e-commerce market was valued at approximately USD 84 billion and is projected to reach USD 200 billion by 2026, as reported by various industry associations. With the rise of online shopping platforms such as Flipkart and Amazon India, which offer seamless payment integrations for digital wallets, consumers are increasingly opting for E-Wallets for transactional convenience.This trend contributes to an ongoing positive cycle of E-Wallet adoption as consumers appreciate the simplicity it offers.

Growing Awareness of Contactless Transactions

There is a growing awareness and acceptance of contactless payment methods among consumers in India, which is significantly benefitting the India E-Wallet Market Industry. The COVID-19 pandemic has fundamentally shifted consumer behavior, with a marked increase of 36.2% in contactless transactions reported in 2021, as per the Reserve Bank of India. Prominent players like PhonePe and Mobikwik have seen increased usage due to the emphasis on safety and convenience during the pandemic.As more consumers embrace contactless payments, E-Wallets are expected to see sustained growth, further driving the overall market.

India E-Wallet Market Segment Insights:

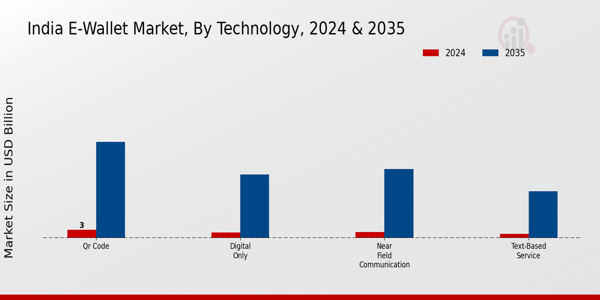

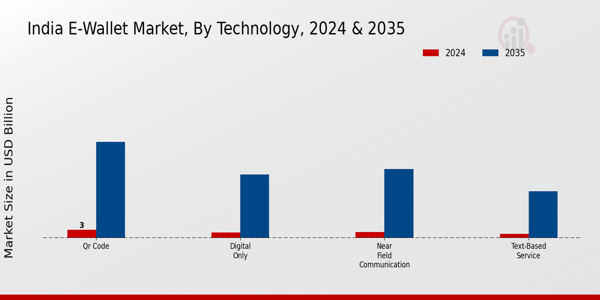

E-Wallet Market Technology Insights

The India E-Wallet Market is experiencing a transformative phase within the Technology segment, showcasing significant growth and innovation driven by varying payment technologies. The rise of mobile internet usage and improved digital infrastructure in India has contributed to the accelerated adoption of e-wallet services. Near Field Communication (NFC) technology is gaining traction for its ability to facilitate quick, tap-to-pay transactions, making it popular among consumers for seamless payments at retail locations.

QR codes are also pivotal in this market, revolutionizing customer interactions by allowing users to complete transactions quickly by scanning codes displayed on screens or printed materials, thus improving efficiency and convenience in everyday purchases.Text-based services offer another dimension by catering to users who prefer SMS notifications for transactions, thus ensuring accessibility even for those with minimal smartphone functionality.

Furthermore, Digital Only solutions are significant in today’s fast-paced environment, meeting the demands of tech-savvy customers who rely heavily on mobile applications for their everyday financial transactions. The consistent growth in smartphone penetration and favorable regulatory frameworks have spurred market progress, fostering an ecosystem that encourages both business and consumer engagement in the digital wallet domain.Emerging trends indicate a strong inclination towards integrating advanced security measures and fostering collaborations with fintech firms, enhancing the customer experience and driving loyalty in the India E-Wallet Market.

Each of these technologies plays a crucial role in the segmentation of the India E-Wallet Market, contributing to the diverse offerings that cater to varied consumer preferences, thus envisioning a future where digital transactions become more prevalent and standardized in the Indian economy. The potential for these services extends into rural areas as well, providing valuable opportunities for greater financial inclusivity and accessibility across the country.

Fig 2: India E-Wallet Market Insights

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

E-Wallet Market Application Insights

The India E-Wallet Market is witnessing robust growth in the Application segment, driven by the increasing adoption of digital payment methods across various sectors. Retail and E-Commerce sectors play a pivotal role, as the convenience of e-wallets enhances customer experience and boosts sales through seamless transactions. The Hospitality and Transportation segments are equally significant, with e-wallets facilitating hassle-free payments for services such as hotels and ride-sharing, thus fostering customer loyalty.

Meanwhile, the Banking sector's integration with e-wallets is reshaping financial transactions, making banking services more accessible to the masses.Additionally, the use of e-wallets in vending machines has simplified microtransactions, promoting cashless interactions in public spaces. Surveillance of trends indicates a growing consumer preference towards secure and quick payment solutions, further bolstered by government initiatives promoting digital economy literacy. These factors highlight the diverse applications of e-wallet technology in India, capturing a significant share of the overall market and paving the way for continuous innovation in the digital payments landscape.

India E-Wallet Market Key Players and Competitive Insights:

The India E-Wallet Market has experienced rapid growth and transformation, driven by an increase in smartphone penetration, improved internet connectivity, and a shift towards cashless transactions across various sectors. The competitive landscape is marked by numerous players who offer unique features, tailored services, and user-friendly interfaces aimed at attracting both consumers and businesses. These players range from traditional banking institutions to technology-driven firms that leverage digital solutions to capture market share. The competitive insights reveal various strategies employed, such as partnerships, innovative service offerings, and customer engagement initiatives, which are being utilized to stand out in a crowded marketplace.

As digital payment systems evolve, understanding the nuances of the competitive landscape becomes essential for companies looking to thrive in this dynamic environment.Axis Bank stands prominently in the India E-Wallet Market due to its established reputation as a reliable banking institution. The bank integrates its banking services with advanced digital payment solutions to streamline the user experience, making it easier for customers to conduct transactions. Axis Bank effectively utilizes its extensive branch network and customer base to promote e-wallet services.

The bank’s strengths lie in its security features and customer service, ensuring that users trust the platform for their digital transactions. Furthermore, the bank has invested significantly in technology to enhance its digital platforms, thereby making its e-wallet solutions more accessible and efficient for consumers across different demographics in India. These advantages position Axis Bank as a strong player in the e-wallet sector, catering to a diverse range of customer needs.Google Pay, a significant competitor in the India E-Wallet Market, offers a comprehensive digital payment solution that has seen widespread adoption among Indian users.

The platform enables seamless peer-to-peer money transfers, bill payments, and in-store transactions, thereby encompassing a wide array of services that appeal to a large customer base. Google Pay’s strength lies in its integration with multiple banking partners and its ability to offer rewards and cash-back incentives, enhancing user engagement.

The platform stands out for its user-friendly interface and robust security features, contributing to a positive user experience. In terms of market presence, Google Pay has engaged in strategic partnerships and has continually evolved its product offerings to include features tailored specifically for the Indian market. These efforts, along with the backing of Google’s technological prowess and infrastructure, have positioned Google Pay as a formidable player in India’s increasingly competitive e-wallet landscape.

Key Companies in the India E-Wallet Market Include:

- Axis Bank

- Google Pay

- Yono SBI

- HDFC Bank

- PayPal

- Razorpay

- Paytm

- BHIM

- Mobikwik

- Freecharge

- PhonePe

- ICICI Bank

- Amazon Pay

- CitiBank

India E-Wallet Market Industry Developments

In recent months, the India E-Wallet Market has witnessed significant developments. In October 2023, Paytm reported a substantial growth in its user base, surpassing 500 million registered users, contributing to the overall expansion of digital payment modes in India. Meanwhile, PhonePe secured additional funding in September 2023, enhancing its market position. Yono SBI continues to innovate with new features aimed at business users, thereby increasing its appeal in a competitive landscape. HDFC Bank and Axis Bank have been actively integrating advanced technology to improve transaction efficiencies.

On the acquisition front, in March 2023, PayPal announced its partnership with Razorpay to leverage fintech solutions aimed at SMEs, showing the ongoing trend of collaboration in this sector. Furthermore, MobiKwik has expanded into insurance technology, diversifying its services and appealing to a broader customer base. Overall, the E-Wallet market is experiencing rapid digitalization, driven by government initiatives such as Digital India, fostering an environment conducive to innovation and growth among prominent players like ICICI Bank, Google Pay, and Amazon Pay, which all continue to evolve and expand their offerings in response to increasing consumer demand.

India E-Wallet Market Segmentation Insights

E-Wallet Market Technology Outlook

- Near Field Communication

- QR Code

- Text-based Service

- Digital Only

E-Wallet Market Application Outlook

- Retail & E-Commerce

- Hospitality & Transportation

- Banking

- Vending Machine

Report Scope:

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

6.38(USD Billion) |

| MARKET SIZE 2024 |

8.5(USD Billion) |

| MARKET SIZE 2035 |

100.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

25.12% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Axis Bank, Google Pay, Yono SBI, HDFC Bank, PayPal, Razorpay, Paytm, BHIM, Mobikwik, Freecharge, PhonePe, ICICI Bank, Amazon Pay, CitiBank |

| SEGMENTS COVERED |

Technology, Application |

| KEY MARKET OPPORTUNITIES |

Mobile payment integration, Internet penetration growth, Rising smartphone adoption, Government digitization initiatives, Enhanced security features |

| KEY MARKET DYNAMICS |

increased smartphone penetration, rising digital payment adoption, government-backed digital initiatives, competitive pricing strategies, focus on customer experience |

| COUNTRIES COVERED |

India |

Frequently Asked Questions (FAQ):

The India E-Wallet Market is expected to be valued at 8.5 billion USD in 2024.

By 2035, the India E-Wallet Market is projected to reach a valuation of 100.0 billion USD.

The expected CAGR for the India E-Wallet Market from 2025 to 2035 is 25.12%.

The QR Code segment is expected to dominate the market, valued at 35.0 billion USD in 2035.

The Digital Only segment is projected to be valued at 2.0 billion USD in 2024 and 23.0 billion USD in 2035.

Major players in the India E-Wallet Market include Paytm, Google Pay, PhonePe, and HDFC Bank.

The Text-based Service segment is projected to reach 17.0 billion USD by 2035.

The Near Field Communication segment is anticipated to be valued at 25.0 billion USD by 2035.

The growth drivers include increasing smartphone penetration and evolving consumer preferences for contactless payments.

The competitive landscape is expected to consolidate with significant contributions from leading players like PayPal and Amazon Pay.