India Ethanol Market Overview

The India Ethanol Market Size was estimated at 7.02 (USD Billion) in 2023. The India Ethanol Industry is expected to grow from 8.5(USD Billion) in 2024 to 18.0 (USD Billion) by 2035. The India Ethanol Market CAGR (growth rate) is expected to be around 7.059% during the forecast period (2025 - 2035).

Key India Ethanol Market Trends Highlighted

Many important market factors are driving notable expansion in India Ethanol Industry. Policies supporting the use of ethanol as a substitute fuel result from the government's concentration on renewable energy and lowering reliance on fossil fuels. Projects like the National Biofuel Policy seek to raise ethanol's mixing percentage in gasoline, therefore promoting a better environment. Furthermore, helping the market to grow is the increase in sugarcane output as ethanol's feedstock. The growing need for fuel economy and the possibility of lowering greenhouse gas emissions support ethanol's acceptance even more. Possibilities to be investigated include improving infrastructure for ethanol manufacture and delivery, therefore benefiting the fuel and agriculture sectors alike.

Driving agricultural development, there is an increasing focus on helping farmers guarantee a consistent supply of feedstock for ethanol manufacture. Furthermore, diversifying sources and improving sustainability by using agrarian wastes beyond sugarcane will help feedstocks vary. Latest trends show a growing interest in the integration of technology into the ethanol production process, therefore improving capacity and efficiency. Private companies working with government agencies to support biofuels have become active, resulting in a strong ecosystem. Moreover, India is positioned to react appropriately when global sustainability trends align with greener substitutes, thereby matching its ethanol market.

The group initiatives to enhance the biofuel scene show an initiative-taking attitude in tackling energy security issues and supporting rural development.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

India Ethanol Market Drivers

Government Policy Support

Several initiatives the Indian government has implemented seek to encourage ethanol's usage as a substitute fuel. By 2030, the National Biofuel Policy of 2018 seeks to have ethanol blended into petrol at 20%. Initiatives of the Ministry of Petroleum and Natural Gas support this ambitious aim by providing financial incentives for distilleries and farmers to participate in ethanol generation. The government is also pushing investments in new distilleries to increase local ethanol output capacity.

According to the Ministry of Environment, Forest and Climate Change, these steps complement India's objectives for energy security and a general decrease in greenhouse gas emissions. The program promotes rural development and job creation by allowing farmers to turn extra sugar and other agricultural waste into ethanol, therefore strengthening the part the India Ethanol Market plays in improving economic stability.

Growing Demand for Clean Fuel

India's demand for clean fuels like ethanol has seen a notable rise due to growing environmental issues and the drive towards sustainable energy sources. The Ministry of Petroleum and Natural Gas claims that by 2030, the nation wants to cut carbon emissions by thirty-three. Considered a cleaner substitute for traditional fuels, ethanol is expected to be used necessary to reach these environmental goals. Furthermore, the growing number of cars in India has resulted in a proportionately higher need for gasoline. Hence, switching to ethanol fuel mixes is essential.

The rising curiosity about electric cars (EVs) also emphasizes the necessity of alternate fuels, particularly ethanol, in the transition to renewable energy. As the India Ethanol Market responds to changing energy needs, the trends show a bright future for it.

Increased Agricultural Production

The backbone of India's economy, the agriculture sector, is clearly driving the rise in ethanol generation. With India's sugar output rising from 30 million tons in 2015 to 35 million tons in 2020, the Food and Agriculture Organization said that this offers a significant feedstock for ethanol. By giving farmers another source of income, this increase in agricultural output not only supports ethanol generation but also helps the rural economy.

The Indian Sugar Mills Association underlines that a good network of sugar and crop production guarantees a constant and reasonably affordable raw material supply for the India Ethanol Market. Moreover, the need for commodities like sugarcane and maize for ethanol generation drives better farming methods and industry creativity.

Technological Advancements in Production

Technological developments are significantly improving the cost-effectiveness and efficiency of ethanol manufacturing in India. From agricultural waste, bio-refinery technologies and enzymatic processes have raised ethanol's output and helped lower manufacturing costs. Companies such as the Indian Institute of Technology and other agricultural colleges are researching fermentation technology to maximize ethanol extraction, therefore enabling distillery-size manufacturing more practically.

Second-generation biofuels also provide fresh opportunities for using non-food feedstocks to generate ethanol. This technical change offers an excellent possibility for the India Ethanol Market to be competitive and sustainable in line with worldwide developments in the biofuel sector.

India Ethanol Market Segment Insights

Ethanol Market Insights

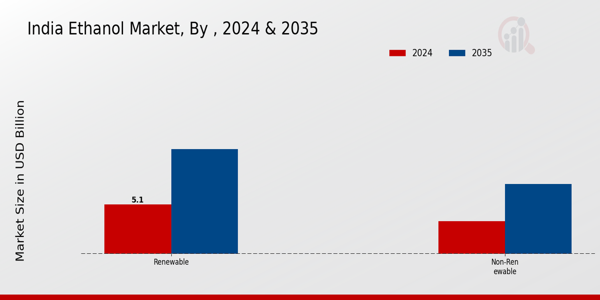

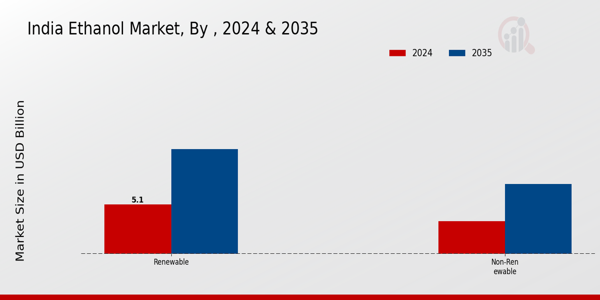

The India Ethanol Market is witnessing considerable evolution, primarily driven by growing environmental concerns and government initiatives aimed at promoting cleaner fuel alternatives. The market is broadly segmented into Renewable and Non-Renewable sources, each contributing uniquely to the overall dynamics of ethanol production and consumption in India. Renewable ethanol, largely derived from biomass, plays a pivotal role in reducing greenhouse gas emissions and enhancing energy security in the country. This segment has gained traction with robust governmental policies encouraging the production of biofuels as a means of achieving energy independence and sustainability goals.

On the other hand, the Non-Renewable segment, primarily focused on the conventional production methods, remains significant in meeting immediate energy demands, although it faces challenges related to environmental sustainability and resource depletion. The blend of these two segments reflects a transitional phase in the Indian energy landscape, where the balance between utilizing fossil fuels and embracing renewable solutions is crucial. As the government targets a higher ethanol blending percentage in gasoline, the Renewable segment is likely to experience accelerated growth, driven by advancements in technology and infrastructure for production and distribution.

Furthermore, the growing consumer awareness regarding the environmental impact of energy sources is fostering a favorable shift towards renewable options. The Renewable segment's importance is underscored by initiatives aimed at solidifying India’s position in the global renewable energy market while supporting rural development through the creation of jobs in biofuel production. Overall, the segmentation in the India Ethanol Market reveals the ongoing transition towards sustainable energy practices, addressing both the country's need for energy security and its commitment to reducing carbon emissions. The market growth is further supported by favorable policies and technological advancements, which aim to bolster the production and adoption of ethanol across the nation.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Ethanol Market Feedstock Insights

The Feedstock segment in the India Ethanol Market is pivotal, comprising both Renewable and Non-Renewable categories. The Renewable Feedstock, primarily sourced from agricultural crops, plays a crucial role in promoting sustainability and reducing carbon emissions in the country's energy sector. Given India's vast agricultural landscape, the potential for expanding crop-based feedstock is significant, aligning with government initiatives to enhance biofuel production as part of energy security and pollution reduction strategies. On the other hand, Non-Renewable Feedstock, though often viewed as less sustainable, remains essential in meeting immediate ethanol production demands, especially in specific industrial applications.

The increasing focus on clean energy has prompted investments in advancing technologies for converting both types of feedstock into ethanol, showcasing the industry's adaptability to changing energy landscapes. The interplay between these two segments highlights the evolving dynamics of the India Ethanol Market, with ongoing demand for alternative energy solutions driving innovations and opportunities. The strategic emphasis on these segments not only influences the India Ethanol Market revenue but also shapes the overarching trends in the industry's transition towards a more sustainable future.

Ethanol Market Type Insights

The India Ethanol Market, categorized by Type, prominently includes Extra Neutral Ethanol (EN), Neutral Ethanol, Bioethanol, and Others, each possessing unique characteristics and applications. Extra Neutral Ethanol plays a crucial role due to its purity and versatility, often utilized in the beverage and cosmetic industries. Similarly, Neutral Ethanol features broad applicability, serving as a key ingredient in pharmaceuticals and industrial applications. Bioethanol, derived from renewable sources, is gaining traction as a sustainable alternative, aligning with India's commitment to renewable energy and reducing carbon emissions.

This segment is pivotal given the increasing demand for eco-friendly fuel options in the country. The Others category includes various forms of ethanol that cater to niche markets, further enriching the overall landscape. The ongoing push for biofuels in India, primarily supported by government initiatives, drives notable interest in these types, emphasizing their significance in supporting the country's energy goals and promoting sustainable economic growth. Overall, the India Ethanol Market segmentation reflects a diverse and growing industry aligned with both traditional usage and evolving consumer preferences for greener energy solutions.

Ethanol Market Grade Insights

The Grade segment of the India Ethanol Market encompasses various classifications, including Fuel Grade, Pharmaceutical Grade, Industrial Grade, and others. Fuel Grade ethanol has emerged as a dominant category, driven by the Indian government's push for renewable energy sources, particularly in transportation, aimed at reducing dependence on fossil fuels and enhancing energy security. Meanwhile, the Pharmaceutical Grade segment remains significant due to its crucial applications in the production of medicines and sanitizers, a demand that surged during health crises.

Additionally, the Industrial Grade ethanol plays a vital role in producing chemicals and solvents, highlighting the versatility of ethanol across different sectors. The others category represents a variety of other applications that contribute to the overall market's growth, showcasing the diverse utility of ethanol in India's economy. With the ongoing trends towards sustainability and green energy, the India Ethanol Market segmentation indicates a robust potential for growth across these grades, reflecting changing consumer behaviors and governmental policies aimed at fostering an eco-friendly industrial landscape.

This evolution opens up opportunities for innovation and investment within the sector, steadily bolstering the market’s overall development.

Ethanol Market Application Insights

The Application segment of the India Ethanol Market plays a crucial role in shaping the industry's landscape. As of 2024, this sector supports various applications such as Fuel Blending, Alcoholic Beverages Production, and Chemical Intermediates. Fuel Blending is particularly significant in India, driven by government initiatives to promote cleaner fuel alternatives to reduce emissions and dependence on fossil fuels. The Alcoholic Beverages Production segment benefits from the growing consumer base and evolving drinking habits across urban demographics.

Furthermore, the Solvents and Chemical Intermediates segment is gaining traction, supported by the rising demand from various industries, including pharmaceuticals and agrochemicals, highlighting ethanol's versatility. Meanwhile, the increasing focus on hygiene has positioned Disinfectants and Sanitizers as a vital segment, particularly following the global health crisis, leading to heightened demand across households and institutions. Overall, the India Ethanol Market demonstrates diverse applications that collectively contribute to its growth, driven by regulatory support and shifting consumer preferences, ensuring a dynamic industry landscape.

The insights reflect the industry's adaptability and its strategic importance in the larger context of sustainable development and economic resilience.

Ethanol Market End-Use Industry Insights

The End-Use Industry segment of the India Ethanol Market has shown significant momentum, reflecting a fundamental shift towards sustainable and eco-friendly practices across various sectors. The cosmetics industry increasingly utilizes ethanol as a key ingredient in a variety of products, enhancing formulations while meeting rising consumer demand for natural ingredients. In pharmaceuticals, ethanol serves not only as a solvent but also plays a critical role in developing medicinal products, thus ensuring quality and efficacy. The chemicals sector relies heavily on ethanol for various applications, supporting the manufacturing of specialty chemicals, while the Food Beverages industry utilizes it for flavor extraction and preservation, representing a vital component in processing.

The automotive industry also capitalizes on ethanol as a biofuel alternative, contributing to India’s push for cleaner energy solutions. Furthermore, the "Others" category encompasses a diverse range of applications, comprising sectors that benefit from ethanol's versatility. Overall, these insights into the End-Use Industry illustrate the significant role ethanol plays in promoting innovation, sustainability, and efficiency in India's economic landscape. As the market expands and evolves, a deeper understanding of these segments will facilitate informed decision-making for stakeholders across the board.

India Ethanol Market Key Players and Competitive Insights

The India Ethanol Market is experiencing significant transformation driven by government initiatives aimed at promoting renewable energy and reducing dependence on fossil fuels. The Indian government has set ambitious targets for ethanol blending in petrol, which is accelerating the growth of this sector. This has attracted numerous players looking to capitalize on the increasing demand for clean energy sources. The competitive landscape within the market is characterized by both large-scale manufacturers and smaller enterprises, each vying for a substantial share. Companies are continuously innovating and expanding their production capacities to meet regulatory requirements and consumer preferences, providing a dynamic and competitive environment.

Shree Renuka Sugars stands out in the India Ethanol Market due to its strategic focus on producing sugar and ethanol, establishing it as a significant player in the renewable energy sector. With robust production facilities located in advantageous regions, Shree Renuka Sugars has effectively leveraged its sugarcane supply chain to enhance ethanol production. The company benefits from scale efficiencies and has invested in expanding its ethanol plants, which positions it favorably amidst growing government support for renewable fuels. Its established reputation for quality and compliance with environmental standards further strengthens its market position, making it a key contributor to the Ethanol sector in India.

Gujarat State Fertilizers and Chemicals has carved a niche for itself within the India Ethanol Market through its integrated production strategy that leverages its strong presence in the fertilizers sector. The company not only manufactures a variety of fertilizers but also engages in the production of ethanol, which complements its core business model. By utilizing waste products and renewable resources, Gujarat State Fertilizers and Chemicals maximizes the efficiency of its operations. Its commitment to sustainability is evident in its innovation toward eco-friendly production processes. Recent mergers and acquisitions have also enabled the company to expand its market presence and improve its technological capabilities, solidifying its status as a competitive player in the Indian Ethanol landscape while maximizing synergies within its operational framework.

Key Companies in the India Ethanol Market Include

- Shree Renuka Sugars

- Gujarat State Fertilizers and Chemicals

- Praj Industries

- EID Parry

- Madhya Pradesh State Cooperative Marketing Federation

- Dalmia Bharat Sugar and Industries

- Bharat Petroleum Corporation

- Indian Oil Corporation

- Triveni Engineering and Industries

- Nectar Lifesciences

- Sidul India

- Hindustan Petroleum Corporation

- Tata Chemicals

- Balrampur Chini Mills

- Sagar Sugar Works

India Ethanol Market Industry Developments

The India Ethanol Market has been experiencing significant developments, marked by government initiatives to increase production capacity as part of an effort to achieve a blend of 20% ethanol in petrol by 2025. Companies such as Shree Renuka Sugars and Balrampur Chini Mills are ramping up production capacities to meet this demand. In May 2023, Madhya Pradesh State Cooperative Marketing Federation announced plans to enhance its ethanol manufacturing capabilities, indicating regional growth in production. Praj Industries has also been in the news with advancements in biofuel technology, positioning itself as a leader in sustainable ethanol production. No recent mergers or acquisitions have been publicly reported within the key companies like EID Parry or Triveni Engineering related to the ethanol segment. The market valuation of companies like Bharat Petroleum Corporation and Indian Oil Corporation has seen growth due to strategic investments in ethanol blending infrastructure. Recent trends suggest a growing interest in achieving self-sufficiency in energy, with reports highlighting the rising global demand for ethanol. It’s evident that regulatory support and private investments are driving this dynamic sector in India. Major happenings over the past few years include a sharp rise in ethanol production from 3.3 billion liters in 2020 to over 4.5 billion liters by early 2023.

Ethanol Market Segmentation Insights

Ethanol Market Outlook

Ethanol Market Feedstock Outlook

Ethanol Market Type Outlook

- Extra Neutral Ethanol (EN)

- Neutral Ethanol

- Bioethanol

- Others

Ethanol Market Grade Outlook

- Fuel Grade

- Pharmaceutical Grade

- Industrial Grade

- Others

Ethanol Market Application Outlook

- Fuel Blending

- Alcoholic Beverages Production

- Solvents and Chemical Intermediates

- Disinfectants and Sanitizers

- Others

Ethanol Market End-Use Industry Outlook

- Cosmetics

- Pharmaceuticals

- Chemicals

- Food Beverages

- Automotive

- Others

| Report Attribute/Metric |

Details |

| Market Size 2018 |

7.02(USD Billion) |

| Market Size 2024 |

8.5(USD Billion) |

| Market Size 2035 |

18.0(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

7.059% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Shree Renuka Sugars, Gujarat State Fertilizers and Chemicals, Praj Industries, EID Parry, Madhya Pradesh State Cooperative Marketing Federation, Dalmia Bharat Sugar and Industries, Bharat Petroleum Corporation, Indian Oil Corporation, Triveni Engineering and Industries, Nectar Lifesciences, Sidul India, Hindustan Petroleum Corporation, Tata Chemicals, Balrampur Chini Mills, Sagar Sugar Works |

| Segments Covered |

, Feedstock, Type, Grade, Application, End-Use Industry |

| Key Market Opportunities |

Government incentives for biofuels, Expanding fuel blending mandates, Growing demand for green energy, Increasing agricultural feedstock availability, Rising consumer awareness on sustainability |

| Key Market Dynamics |

Rising fuel demand, Government policies supporting ethanol, Sugarcane production capacity, Environmental sustainability initiatives, Investment in biofuel technology |

| Countries Covered |

India |

Frequently Asked Questions (FAQ) :

The India Ethanol Market is expected to be valued at 8.5 billion USD by the year 2024.

By 2035, the India Ethanol Market is anticipated to reach a valuation of 18.0 billion USD.

The anticipated compound annual growth rate for the India Ethanol Market from 2025 to 2035 is 7.059%.

In 2024, the renewable segment is valued at 5.1 billion USD, while the non-renewable segment is worth 3.4 billion USD.

The renewable segment of the India Ethanol Market is projected to be valued at 10.8 billion USD by the year 2035.

The non-renewable segment is expected to reach a valuation of 7.2 billion USD by 2035.

Key players in the India Ethanol Market include Shree Renuka Sugars, Praj Industries, EID Parry, and Bharat Petroleum Corporation among others.

The India Ethanol Market has been experiencing a steady growth, with an expected CAGR of 7.059% from 2025 to 2035.

The main applications driving the growth include fuel blending, chemical production, and beverage alcohol industries.

Challenges impacting the India Ethanol Market include fluctuating raw material costs and competition from other energy sources.