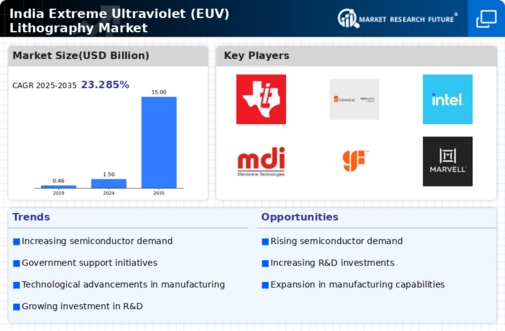

Market Growth Projections

The Global India Extreme Ultraviolet (EUV) Lithography Market Industry is projected to experience substantial growth in the coming years. With a market value anticipated to reach 1500 USD Million in 2024 and further expanding to 5000 USD Million by 2035, the industry is on a trajectory of significant development. This growth is underpinned by a compound annual growth rate (CAGR) of 11.57% from 2025 to 2035, indicating a robust demand for EUV technology in semiconductor manufacturing. The increasing reliance on advanced lithography techniques to produce smaller, more efficient chips suggests that the market will continue to evolve, driven by technological advancements and changing industry needs.

Technological Advancements

The Global India Extreme Ultraviolet (EUV) Lithography Market Industry is propelled by rapid technological advancements in semiconductor manufacturing. As the demand for smaller, more powerful chips increases, EUV lithography emerges as a critical technology for producing advanced nodes. For instance, the transition to 5nm and below processes necessitates EUV systems, which enable higher resolution and improved yield. This shift is expected to contribute significantly to the market, with projections indicating a market value of 1500 USD Million in 2024. The continuous evolution of EUV technology suggests that manufacturers will increasingly adopt these systems to maintain competitiveness in the global semiconductor landscape.

Growing Demand for Semiconductors

The Global India Extreme Ultraviolet (EUV) Lithography Market Industry experiences robust growth driven by the surging demand for semiconductors across various sectors. Industries such as automotive, consumer electronics, and telecommunications are increasingly reliant on advanced semiconductor technologies. This demand is projected to escalate, with the market expected to reach 5000 USD Million by 2035. The proliferation of IoT devices and the expansion of 5G networks further amplify this demand, necessitating advanced manufacturing techniques like EUV lithography. Consequently, the industry is likely to witness a compound annual growth rate (CAGR) of 11.57% from 2025 to 2035, reflecting the critical role of EUV in meeting future semiconductor needs.

Market Dynamics and Global Trends

The Global India Extreme Ultraviolet (EUV) Lithography Market Industry is shaped by various market dynamics and global trends. Factors such as supply chain disruptions, geopolitical tensions, and shifts in consumer preferences significantly impact the semiconductor landscape. The increasing complexity of chip designs necessitates advanced lithography techniques, with EUV emerging as a solution to address these challenges. Furthermore, the global push towards sustainability and energy efficiency influences manufacturing practices, prompting the adoption of EUV technology. As the industry adapts to these dynamics, the market is expected to grow, reflecting the interconnected nature of global semiconductor supply chains and the critical role of EUV lithography.

Government Initiatives and Support

Government initiatives play a pivotal role in shaping the Global India Extreme Ultraviolet (EUV) Lithography Market Industry. The Indian government has recognized the strategic importance of semiconductor manufacturing and is actively promoting policies to enhance domestic capabilities. Initiatives such as the Production Linked Incentive (PLI) scheme aim to attract investments in semiconductor fabrication and related technologies, including EUV lithography. This support is likely to foster a conducive environment for industry growth, encouraging both domestic and foreign players to invest in EUV technologies. As a result, the market is poised for expansion, aligning with national objectives to establish India as a global semiconductor hub.

Rising Competition in Semiconductor Manufacturing

The Global India Extreme Ultraviolet (EUV) Lithography Market Industry is influenced by the intensifying competition among semiconductor manufacturers. As companies strive to achieve technological leadership, the adoption of EUV lithography becomes increasingly vital. Major players are investing heavily in EUV systems to enhance their production capabilities and meet the demands of advanced applications. This competitive landscape drives innovation and efficiency, compelling manufacturers to integrate EUV technology into their processes. The resulting advancements not only improve yield but also reduce production costs, positioning companies favorably in the global market. The industry's evolution suggests a sustained focus on EUV as a key differentiator in semiconductor manufacturing.