India Health and Wellness Product Market Overview

As per MRFR analysis, the India Health and Wellness Product Market Size was estimated at 40.69 (USD Billion) in 2023. The India Health and Wellness Product Market Industry is expected to grow from 44.64(USD Billion) in 2024 to 160 (USD Billion) by 2035. The India Health and Wellness Product Market CAGR (growth rate) is expected to be around 12.306% during the forecast period (2025 - 2035).

Key India Health and Wellness Product Market Trends Highlighted

The India Health and Wellness Product Market is undergoing substantial changes as a result of the growing health consciousness of the population and the increasing disposable income. There is a significant demand for organic, natural, and holistic products as more Indians become aware of the advantages of maintaining a healthy lifestyle. Consumers are increasingly seeking preventive healthcare alternatives due to the increasing prevalence of lifestyle diseases, such as cardiovascular conditions and diabetes. This awareness has had an impact on both urban and rural areas, where traditional holistic knowledge is combining with contemporary health solutions.

Particularly in the niche segments of health supplements, functional foods, and fitness-related products, there are numerous opportunities to be investigated.

The proliferation of e-commerce has opened up a new channel for businesses, enabling consumers to access a diverse selection of health and wellness products from the comfort of their residences. Furthermore, the market growth potential is further enhanced by government initiatives that promote fitness and nutrition, such as the Fit India Movement, which encourages individuals to adopt healthier lifestyles. In recent years, there has been a significant increase in the development of new products, as brands have prioritized sustainable practices and transparency in the procurement of ingredients.

This trend is particularly appealing to younger consumers, who prioritize products that are consistent with their values. The variegated cultural landscape of India has also led to an increase in the adaptation of health food and supplement formulations to local flavors and preferences.The interconnectedness of community influence and personal health choices in shaping the market dynamics is further underscored by the rise of wellness and fitness influencers on social media platforms, which drives consumer interest.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

India Health and Wellness Product Market Drivers

Increasing Health Awareness Among Consumers

In India, there has been a notable rise in health awareness among consumers, significantly driving the India Health and Wellness Product Market. A survey conducted by the Ministry of Health and Family Welfare indicates that approximately 70% of urban consumers are actively seeking healthier food options and lifestyle choices. This shift in consumer behavior is driven by increasing access to information through digital media and rising health concerns due to lifestyle-related diseases, such as diabetes and hypertension.

Prominent companies like Himalaya Wellness and Patanjali Ayurved are capitalizing on this trend by expanding their range of health and wellness products. Additionally, the government’s 'Fit India Movement', launched in 2019, aims to encourage citizens to prioritize fitness and well-being, further contributing to a healthier consumer base and boosting market growth.

Government Initiatives and Policies

The Indian government's commitment to improving public health plays a crucial role in enhancing the India Health and Wellness Product Market Industry. Initiatives like the National Health Mission and the Ayushman Bharat Scheme aim to increase access to health services and raise awareness about preventive healthcare. With the launch of the Ayushman Bharat Scheme, there is a projected increase in the demand for wellness products, as more individuals are covered under health insurance.

This initiative is expected to cover over 500 million citizens, which will create a larger market for wellness products. Established organizations such as the Food Safety and Standards Authority of India are also working towards regulating and standardizing health products, ensuring quality and safety, thereby fostering consumer trust and encouraging market growth.

Growth of E-commerce Platforms

The rapid growth of e-commerce in India is a significant driver for the India Health and Wellness Product Market. The Indian e-commerce sector is projected to reach around USD 200 billion by 2026, as reported by the India Brand Equity Foundation. Major e-commerce players like Amazon and Flipkart are investing heavily in health and wellness product categories, providing consumers with expanded access to a wide variety of products. This ease of access and the convenience of online shopping are changing consumer purchasing habits, with a noticeable shift towards online platforms for health products.

Additionally, the pandemic has accelerated this trend, with many consumers now preferring online purchases over traditional retail, indicating a strong future growth potential for the market.

India Health and Wellness Product Market Segment Insights

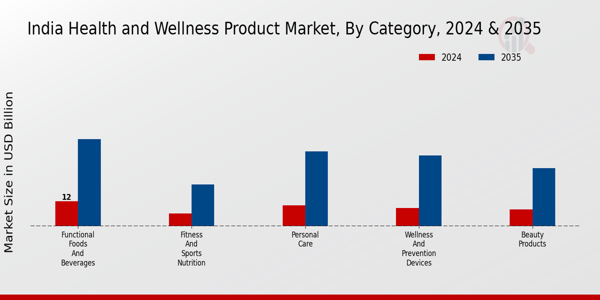

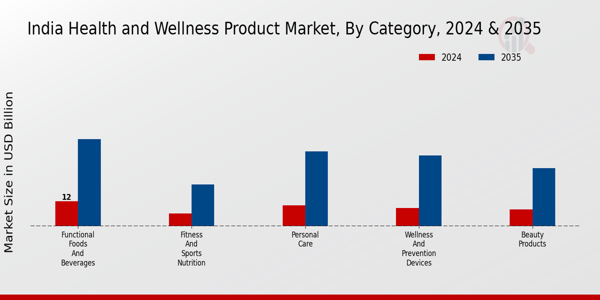

Health and Wellness Product Market Category Insights

The India Health and Wellness Product Market has witnessed substantial growth, characterized by various segments that cater to the diverse needs of consumers focused on health and well-being. The demand for Personal Care products has surged as individuals increasingly prioritize hygiene and personal grooming, leading to innovative product launches that cater to increasing consumer preferences for natural and organic ingredients. Beauty Products are also gaining traction, particularly as the Indian population becomes more conscious about skincare and cosmetics, spurred by influences from social media and a greater emphasis on personal aesthetics.

In parallel, the segment of Functional Foods and Beverages is evolving, emphasizing products that not only satisfy hunger but also provide health benefits, aligning with the global trend towards functional nutrition. Additionally, Fitness and Sports Nutrition products are rapidly becoming essential among health enthusiasts who are engaging in regular physical activities, highlighting the need for performance-enhancing supplements that support energy levels and recovery. The Wellness and Prevention Devices segment is equally vital.

It reflects a growing awareness of preventive health measures through technology-based solutions, such as fitness trackers and health monitoring devices, which empower consumers to take charge of their health outcomes.

The increasing influence of digital technology and health awareness campaigns is driving overall growth in these categories, as consumers in India seek to create a holistic approach to their health, blending traditional methods with modern advancements. Furthermore, the Government of India has been promoting initiatives to encourage healthy lifestyles and wellness among its citizens, further contributing to the burgeoning market.

The overall health and wellness trend is trending upwards, creating a promising landscape for both established brands and new entrants in these categories, supporting the evolution of the market dynamics in India.Given the increasing awareness surrounding health and wellness, the various segments within the market are expected to constantly innovate and evolve, catering to the needs of a more health-conscious population.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Health and Wellness Product Market Distribution Channel Insights

The Distribution Channel segment of the India Health and Wellness Product Market plays a crucial role in shaping consumer access to these essential products. As the market continues to expand, driven by increasing health consciousness and lifestyle changes among the population, various channels have established their significance in delivering products effectively. The Offline channel remains pivotal, with traditional retail stores, pharmacies, and health shops anchoring their presence in local communities, allowing consumers to have direct engagement with products and consultations.

Meanwhile, the Online segment has gained immense traction, becoming a preferred choice for many consumers seeking convenience and a wider selection of products. The rapid penetration of the internet and mobile technology in India has fostered this shift, enabling brands to reach customers in even remote areas. The ongoing trend of digitalization is expected to influence purchasing decisions heavily, as many consumers appreciate the ease of comparing options and accessing detailed product information online.

As both channels coexist, they each contribute uniquely to the overall growth strategies within the India Health and Wellness Product Market, catering to diverse consumer preferences and enhancing market accessibility.

Health and Wellness Product Market Consumer Type Insights

The Consumer Type segment within the India Health and Wellness Product Market showcases a diverse range of consumers, reflecting the growing awareness and demand for health-related products tailored to different demographics. Men constitute a significant proportion of this market, increasingly investing in fitness, nutrition, and wellness solutions that cater specifically to their health needs. Women represent another critical demographic, often leading in the adoption of health supplements and wellness products, driven by interests in overall well-being, beauty, and lifestyle enhancements.

The Children segment is gaining attention as parents prioritize health-conscious products to support growth and development, highlighting the increasing focus on preventive health measures from an early age. Additionally, Age-Specific categories are becoming more prominent; with an aging population, tailored products for elderly individuals addressing issues like mobility, nutrition, and chronic conditions are gaining traction. The India Health and Wellness Product Market reveals a growing trend towards personalized health solutions, propelled by greater health awareness, urbanization, and lifestyle changes, providing ample opportunities for various consumer segments to thrive and evolve within this dynamic industry.

Health and Wellness Product Market Ingredient Type Insights

The Ingredient Type segment of the India Health and Wellness Product Market is a vital component contributing to the evolving landscape of health-oriented products. With the increasing awareness among consumers regarding healthier lifestyles, organic and natural ingredients have gained significant attention. These ingredients not only align with the growing trend of clean eating but also respond to the rising demand for transparency in food sourcing. Vegan and Plant-Based options are becoming crucial as more individuals adopt plant-based diets for ethical and health reasons, showcasing the versatility and innovation within the market.

Gluten-free ingredients cater to the growing population with dietary restrictions, reflecting a significant segment that addresses health issues related to gluten intolerance. Pharmaceutical-grade ingredients are essential as they ensure quality and safety, appealing to those seeking effective health solutions. The proliferation of these diverse ingredient types demonstrates the market's adaptability and responsiveness to consumer needs, revealing promising opportunities for growth within the India Health and Wellness Product Market.

Overall, this segmentation is essential for understanding emerging trends, consumer preferences, and the dynamic nature of the industry.

Health and Wellness Product Market Health Concern Insights

The India Health and Wellness Product Market, focused on Health Concern, exhibits a dynamic and rapidly evolving landscape, reflecting a growing awareness among consumers regarding their health and well-being. As this segment expands, various categories such as Skin Health, Hair Health, Weight Management, Anti-Aging, Stress and Sleep, and Energy and Endurance are becoming increasingly vital. Skin Health is critical, as pollution and lifestyle changes drive demand for products that enhance skin vitality and resilience. Similarly, Hair Health is garnering attention, with consumers seeking solutions for hair loss and damage resulting from a demanding lifestyle.

Weight Management products are crucial as the prevalence of obesity and related health issues continues to rise, prompting individuals to seek effective solutions. In the context of aging populations, Anti-Aging products are becoming significant, helping consumers maintain their youthful appearance. Furthermore, as stress levels rise in urban environments, solutions for Stress and Sleep are essential for improving quality of life. Energy and Endurance products cater to both fitness enthusiasts and those seeking to enhance their daily performance.

Overall, the segmentation of the Health Concern market in India not only showcases diversified consumer needs but also highlights opportunities for innovation and targeted product development within the broad scope of health and wellness.

India Health and Wellness Product Market Key Players and Competitive Insights:

The India Health and Wellness Product Market has transformed significantly in recent years, driven by a growing awareness of fitness and nutritious lifestyles among consumers. This market is characterized by a diverse range of offerings, including dietary supplements, herbal products, organic foods, and personal care items that focus on well-being. As the demand for health-conscious products surges, companies operating in this space must navigate competition with an emphasis on product innovation, branding strategies, and consumer engagement. The presence of both domestic and international players intensifies competition, requiring businesses to continuously adapt to market trends and consumer preferences.

In this landscape, players leverage technology and digital marketing to expand their reach and enhance consumer experience, making the market dynamic and ever-evolving.

Kapiva has carved out a unique position in the India Health and Wellness Product Market through a focus on Ayurveda-based products. The company's strengths lie in its commitment to the authenticity and quality of ingredients, leveraging traditional knowledge to cater to the modern consumer. Kapiva's product range spans herbal juices, supplements, and skincare items, all designed to enhance the overall well-being of individuals. Their extensive distribution network, together with strategic online marketing initiatives, has allowed them to reach a wide demographic, appealing particularly to health-conscious millennials and urban populations.

Additionally, Kapiva’s emphasis on research and development ensures that they continuously provide innovative solutions that resonate with their target audience.

Organifi is another prominent entity in the Health and Wellness Product Market in India, primarily known for its range of superfood powders and supplements. The company capitalizes on the growing trend of clean eating and natural health solutions. Their key products, which include green juice powders, protein mixes, and herbal blends, are marketed as convenient ways to achieve nutrient-rich diets. Organifi has established a solid market presence by focusing on quality and sustainability in sourcing ingredients, which appeals to environmentally conscious consumers.

They are also involved in strategic partnerships and collaborations, enhancing their visibility and appeal within the Indian wellness sector. Organifi's strengths include a robust digital marketing strategy that effectively engages consumers and emphasizes the health benefits of their products. As they continue to build brand loyalty, they are likely to explore mergers and acquisitions that will further strengthen their foothold in the Indian market.

Key Companies in the India Health and Wellness Product Market Include:

- Sundaram Medical Foundation

India Health and Wellness Product Market Industry Developments

In recent times, the India Health and Wellness Product Market has seen significant developments. In October 2023, a rise in the demand for herbal and organic products, driven by increasing consumer awareness towards health and wellness, has been notable, with companies like Himalaya Wellness and Patanjali Ayurved expanding their product lines. Additionally, Urban Platter recently launched a range of health food products aimed at the growing urban population seeking healthier lifestyle options. In terms of mergers and acquisitions, in September 2023, GNC announced its acquisition of a local health supplement brand, enhancing its footprint within the Indian market.

Furthermore, in July 2023, HealthKart successfully partnered with several regional distributors to extend its reach across different states, bolstering its market share. Since 2021, the market valuation for the health and wellness segment in India has seen compound growth, largely attributed to increased consumer spending on health products and nutrition, with notable growth in muscular supplements from companies like MUSCLEBLAZE. Such movements reflect the growing trend among Indian consumers who are increasingly prioritizing health-oriented lifestyles.

India Health and Wellness Product Market Segmentation Insights

Health and Wellness Product Market Category Outlook

- Functional Foods and Beverages

- Fitness and Sports Nutrition

- Wellness and Prevention Devices

Health and Wellness Product Market Distribution Channel Outlook

Health and Wellness Product Market Consumer Type Outlook

Health and Wellness Product Market Ingredient Type Outlook

Health and Wellness Product Market Health Concern Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

40.69(USD Billion) |

| MARKET SIZE 2024 |

44.64(USD Billion) |

| MARKET SIZE 2035 |

160.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

12.306% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Kapiva, Organifi, Himalaya Wellness, MUSCLEBLAZE, Dabur, Patanjali Ayurved, GNC, HealthKart, Nestle, Urban Platter, Sundaram Medical Foundation, Procter & Gamble, Amway, Zandu, NutraBlast |

| SEGMENTS COVERED |

Category, Distribution Channel, Consumer Type, Ingredient Type, Health Concern |

| KEY MARKET OPPORTUNITIES |

Increasing demand for organic products, Rising awareness of mental wellness, Growth in personalized nutrition offerings, Expansion of digital health platforms, Demand for Ayurvedic and natural remedies |

| KEY MARKET DYNAMICS |

increasing health awareness, rising disposable income, growing urbanization, shift towards preventive healthcare, demand for organic products |

| COUNTRIES COVERED |

India |

Frequently Asked Questions (FAQ):

The market is expected to be valued at approximately 44.64 billion USD in 2024.

By 2035, the market is anticipated to reach a value of 160.0 billion USD.

The market is projected to grow at a CAGR of 12.306% during the forecast period from 2025 to 2035.

The Functional Foods and Beverages category is projected to be valued at 42.0 billion USD by 2035.

Key players include Kapiva, Organifi, Himalaya Wellness, MUSCLEBLAZE, and Dabur among others.

The Personal Care segment is expected to reach a value of 36.0 billion USD by 2035.

The Beauty Products segment is expected to grow significantly from 8.0 billion USD in 2024 to 28.0 billion USD in 2035.

This category is projected to be valued at 20.0 billion USD by the year 2035.

Increasing health awareness and a rise in fitness trends are key drivers of market growth.

The Wellness and Prevention Devices segment is forecasted to reach a valuation of 34.0 billion USD by 2035.