India Healthcare Cold Chain Logistics Market

India Healthcare Cold Chain Logistics Market Research Report By Mode of Delivery (Last-Mile Delivery, Hubs-to-Distributor), By Product (Vaccines, Biopharmaceuticals, Clinical Trial Materials), By Services (Transportation, Storage, Packaging, Labeling, Others), By End User (Hospitals Clinics, Pharmaceutical, Biopharmaceutical, Biotechnology Companies, Others) and By Temperature Range (Ambient, Refrigerated, Frozen, Cryogenic)- Forecast to 2035

India Healthcare Cold Chain Logistics Market Trends

The India Healthcare Cold Chain Logistics Market is experiencing significant growth driven by several key market drivers. The increasing demand for temperature-sensitive pharmaceuticals, vaccines, and biologics is one of the primary factors boosting the need for efficient chain logistics. As the Indian government prioritizes healthcare access, initiatives such as the National Healthcare Mission and vaccination drives necessitate robust logistics frameworks to ensure that sensitive medical products remain within required temperature ranges during storage and transportation.

Opportunities to be explored in this market include the adoption of technology advancements such as IoT, which can enhance tracking and monitoring throughout the supply chain.Additionally, as more companies invest in cold storage infrastructures, there is a demand for specialized packaging solutions that can maintain temperature during transit. The surge in e-commerce has also opened avenues for cold chain service providers to cater to both the B2B and B2C segments of pharmaceuticals and health products. Trends in recent times show an increased emphasis on sustainability within the cold chain logistics sector.

The rise of eco-friendly packaging and energy-efficient refrigeration systems aligns with India's commitment to reduce environmental impact while enhancing operational efficiency. Moreover, the integration of software solutions for real-time data analytics has become prevalent, allowing stakeholders to make informed decisions, ensure regulatory compliance, and improve overall service quality.The growth of telemedicine and remote healthcare services is also leading to a higher volume of cold chain logistics required to deliver medicinal products directly to consumers, further solidifying the importance of cold chain systems in India's healthcare landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Market Segment Insights

India Healthcare Cold Chain Logistics Market Segment Insights

Healthcare Cold Chain Logistics Market Mode of Delivery Insights

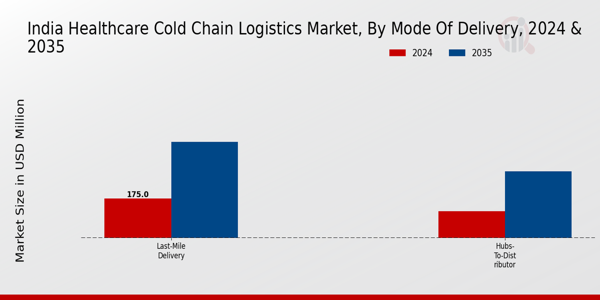

The India Healthcare Cold Chain Logistics Market, particularly focusing on the Mode of Delivery, plays a pivotal role in ensuring the safe transport of temperature-sensitive medical products across the region. The market is characterized by several delivery mechanisms, with Last-Mile Delivery and Hubs-to-Distributor being significant components. Last-Mile Delivery is crucial as it encompasses the final step in the logistics process, ensuring that healthcare products reach healthcare facilities and consumers in a timely and efficient manner.

This segment has gained importance due to the rise in e-commerce and increased demand for direct-to-patient deliveries, particularly in urban areas where healthcare access is evolving. In a country like India, with its diverse geography and varying levels of infrastructure, the effectiveness of Last-Mile Delivery systems is essential for maintaining product integrity and meeting rising expectations from customers.

Hubs-to-Distributor serves as the backbone of the logistics network, facilitating the flow of medical goods from centralized distribution hubs to various stakeholders in the healthcare ecosystem. This segment ensures that products are stored and distributed efficiently, minimizing delays and preserving the quality of sensitive healthcare products. In India's context, where the logistics infrastructure is still maturing, robust Hubs-to-Distributor networks can enhance supply chain reliability, resulting in better service to healthcare providers and patients alike. There is a growing emphasis on enhancing cold chain efficiency through digitization and automation in both Last-Mile Delivery and Hubs-to-Distributor processes.

This trend is driven by advancements in technology, which enable real-time tracking and monitoring of temperature-sensitive shipments, thus ensuring compliance with stringent regulatory requirements related to the transportation of pharmaceuticals and vaccines.

The market growth is supported by increasing healthcare spending and the expansion of the pharmaceutical sector, further underlined by recent government initiatives aimed at improving healthcare logistics infrastructure in India. The integration of innovative solutions in cold chain logistics has opened up opportunities for companies to differentiate themselves and provide better services in delivering essential medical products. As the demand for biologics and temperature-sensitive medicines grows globally, India’s healthcare cold chain logistics market stands to benefit significantly from these advancements, particularly within the Mode of Delivery framework.

Given the vast expanse of the country and varying needs across urban and rural areas, both Last-Mile Delivery and Hubs-to-Distributor emerge as foundational components of an effective healthcare supply chain, ensuring that citizens have access to vital medications in a dependable manner.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Healthcare Cold Chain Logistics Market Product Insights

The India Healthcare Cold Chain Logistics Market showcases a diverse array of products essential for maintaining the integrity of temperature-sensitive healthcare materials. Within this segment, vaccines play a crucial role due to the increasing immunization programs and a growing emphasis on preventive healthcare across India.

Biopharmaceuticals, characterized by their complex storage requirements, have witnessed significant growth, fueled by the rise in personalized medicine and advanced drug therapies, thereby necessitating stringent cold chain logistics to ensure product efficacy.Additionally, clinical trial materials require precise temperature control throughout their distribution to uphold compliance with regulatory standards, making cold chain logistics vital in ensuring the reliability of clinical outcomes. The combination of these factors highlights the importance of robust logistics solutions in enhancing accessibility and efficiency within the Indian healthcare system.

With the government's initiatives towards strengthening healthcare infrastructure, the market is poised for significant advancements supporting each of these pivotal product categories.The evolving landscape of the India Healthcare Cold Chain Logistics Market demonstrates the need for continued innovation and investment to meet the demands of this critical sector.

Healthcare Cold Chain Logistics Market Services Insights

The Services segment within the India Healthcare Cold Chain Logistics Market plays a critical role in ensuring the effective management of temperature-sensitive medical products. This segment encompasses various essential activities, including Transportation, Storage, Packaging, Labeling, and others, which collectively contribute to maintaining product integrity and compliance with regulatory standards. Transportation is crucial as it involves the safe transit of pharmaceuticals and vaccines, often requiring specialized vehicles equipped with temperature control mechanisms.Storage services are equally significant, focusing on the preservation of products in controlled environments to prevent spoilage.

Packaging and Labeling ensure that products are not only secure during transit but also clearly marked with critical information regarding handling and storage. The improvement of supply chain processes, driven by technological advancements and stringent government regulations, further enhances the effectiveness of these services. As the demand for efficient healthcare logistics grows, the Services segment is expected to play a pivotal role in supporting the sustainability and reliability of the overall India Healthcare Cold Chain Logistics Market, responding to the evolving needs of healthcare providers and patients alike.

Healthcare Cold Chain Logistics Market End User Insights

The ser segment of the India Healthcare Cold Chain Logistics Market plays a crucial role in the efficient delivery of temperature-sensitive products. Hospitals Clinics represent a significant portion of this market, as they require reliable logistics for various medical supplies and vaccines, ensuring patient safety and treatment efficacy. The Pharmaceutical and Biopharmaceutical industries also dominate this landscape, driven by the increasing demand for vaccines and advanced therapies needing strict temperature control during storage and transportation.Biotechnology Companies are emerging as significant contributors, capitalizing on innovative products that often require transportation under controlled conditions.

Key Players and Competitive Insights

The India Healthcare Cold Chain Logistics Market is characterized by its rapid growth and increasing demand for temperature-sensitive products, particularly vaccines, pharmaceuticals, and biotechnological goods. This market is driven by factors such as the rising prevalence of chronic diseases, a growing pharmaceutical industry, and the increasing focus on ensuring product integrity throughout the supply chain. As healthcare companies increasingly rely on cold chain logistics to maintain the quality and efficacy of their products, competitive dynamics among logistics providers are intensifying.

Key players in this market are continually innovating and expanding their services, catering to the specific needs of the healthcare sector while ensuring compliance with regulatory standards. This competitive landscape necessitates a keen focus on operational efficiency, technological advancements, and strategic partnerships to enhance capability and customer satisfaction.FedEx Corporation has established a significant presence in the India Healthcare Cold Chain Logistics Market by leveraging its extensive network and innovative services. With a focus on providing temperature-controlled transportation and storage solutions, FedEx has been able to cater effectively to the requirements of healthcare clients in India.

The company stands out due to its advanced tracking systems and capabilities that ensure real-time monitoring of shipments, minimizing the risk of temperature excursions. FedEx's commitment to quality service and operational excellence enables it to meet the stringent demands of the pharmaceutical and biotechnology sectors. Additionally, its strong network of facilities across India provides easy access and swift delivery, enhancing its competitiveness in the cold chain logistics landscape.Agility Logistics has carved a niche for itself in the India Healthcare Cold Chain Logistics Market by offering a comprehensive range of services tailored to the healthcare sector.

The company specializes in temperature-controlled transportation, warehousing, and supply chain management solutions designed to safeguard sensitive medical products. Agility's strengths lie in its robust infrastructure, which includes specialized storage facilities and a fleet equipped for temperature-sensitive deliveries. The company has built strategic partnerships and collaborations that enhance its service offerings and extend its reach within India. Agility Logistics is known for its proactive approach adopting innovative technologies to streamline operations and improve efficiency.

Furthermore, the company has engaged in various mergers and acquisitions, strengthening its market position and expanding its service capabilities to better serve the growing needs of the Indian healthcare market.

Industry Developments

The India Healthcare Cold Chain Logistics Market has seen significant developments recently, fueled by the surge in demand for temperature-sensitive healthcare products, particularly during the ongoing healthcare challenges. FedEx Corporation has expanded its cold chain capabilities in India, investing in advanced technologies to improve efficiency in transporting pharmaceuticals and vaccines. Meanwhile, Agility Logistics has strengthened its position by partnering with local firms to enhance its cold storage solutions. In June 2023, Kuehne + Nagel announced collaborations to optimize its network for healthcare logistics, focusing on compliance and sustainability.

Additionally, Blue Dart Express’s enhancement of its express air network supports timely distribution of medical supplies across regions.

Notably, in August 2023, Gati Limited reported an upward trend in market valuation driven by increased demand for their cold chain services, impacting their overall logistics operations positively. Major players like DHL Supply Chain and Mahindra Logistics are also adapting their strategies to meet growing industry needs, including advancements in real-time monitoring technology. The market's growth trajectory is also reflected in significant acquisitions and partnerships aimed at boosting operational efficiency and expanding service delivery networks within India’s dynamic healthcare landscape.

Market Segmentation

Outlook

- Ambient

- Refrigerated

- Frozen

- Cryogenic

Report Scope

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2023 | 281.25(USD Million) |

| MARKET SIZE 2024 | 293.75(USD Million) |

| MARKET SIZE 2035 | 728.75(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 8.611% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Million |

| KEY COMPANIES PROFILED | FedEx Corporation, Agility Logistics, Coldman Logistics, DHL Supply Chain, Gati Limited, Kuehne + Nagel, Intercontinental Logistics, Société Générale de Surveillance, Xpressbees, Sealed Air Corporation, Mahindra Logistics, Ryder System, TNT Express, Allcargo Logistics, Blue Dart Express |

| SEGMENTS COVERED | Mode of Delivery, Product, Services, End User, Temperature Range |

| KEY MARKET OPPORTUNITIES | Increased demand for vaccines, Growth of biopharmaceuticals, E-commerce in healthcare, Technological advancements in tracking, Expansion of healthcare infrastructure |

| KEY MARKET DYNAMICS | Rising demand for vaccines , Strict regulatory compliance , Growth of e-commerce healthcare , Advanced temperature monitoring solutions , Expansion of infrastructure investments |

| COUNTRIES COVERED | India |

FAQs

What is the expected market size of the India Healthcare Cold Chain Logistics Market in 2024?

The market is expected to be valued at 293.75 USD Million in 2024.

What is the projected market size for the India Healthcare Cold Chain Logistics Market by 2035?

By 2035, the market is anticipated to reach 728.75 USD Million.

What is the expected compound annual growth rate (CAGR) for the India Healthcare Cold Chain Logistics Market from 2025 to 2035?

The expected CAGR for this market during that period is 8.611%.

Which delivery mode holds a significant market share in India Healthcare Cold Chain Logistics by 2035?

Last-Mile Delivery is projected to be valued at 430.0 USD Million by 2035.

What will be the market value for Hubs-to-Distributor delivery mode in 2035?

The Hubs-to-Distributor segment is expected to be valued at 298.75 USD Million in 2035.

Who are the key players in the India Healthcare Cold Chain Logistics Market?

Major players include FedEx Corporation, DHL Supply Chain, and Mahindra Logistics among others.

What is the expected market size for Last-Mile Delivery in 2024?

The market size for Last-Mile Delivery is expected to be 175.0 USD Million in 2024.

What factors are driving the growth of the India Healthcare Cold Chain Logistics Market?

Key growth drivers include increased healthcare demand and rising pharmaceutical products requiring cold chain logistics.

What are the challenges facing the India Healthcare Cold Chain Logistics Market?

Challenges include maintaining temperature control and managing logistics costs.

What market growth rate can be expected for the North region of India in this segment?

The specific growth rate for regions like the North is expected to be in line with the overall market CAGR of 8.611%.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment