Research Methodology on Infertility Market

Executive Summary

This study aims to review the Infertility Market, a sub-category of the reproductive healthcare market. The report offers a comprehensive view of current and future market trends in infertility treatments and interviews with healthcare practitioners to gain insights into the current market conditions.

1. Introduction

The Market Research Future is an agency that provides reports related to different industries such as healthcare, pharmaceutical, lifestyle and others. This particular report focuses on the Infertility Market, one of the most significant components of the reproductive healthcare market. The infertility Market has witnessed an increase in demand over the past years that is expected to continue to grow from 2023 to 2030.

2. Objectives of the Study

The main objective of this research is to understand the latest market trends in the Infertility Market while exploring and providing an in-depth analysis of the market data, to better understand the current state of the market and eventual market conditions. The project intends to provide an overview of the current market dynamics of the Infertility Market and gain insight into the market size and forecast for the upcoming years. In detail, the research project aims to provide the following:

- A comprehensive market analysis of the infertility treatments

- An analysis of current and emerging market trends

- A study of current market size and forecast market growth

- Results of interviews with leading healthcare practitioners

- An evaluation of government policies, regulations and initiatives

- Analyse the effect of key drivers in the market

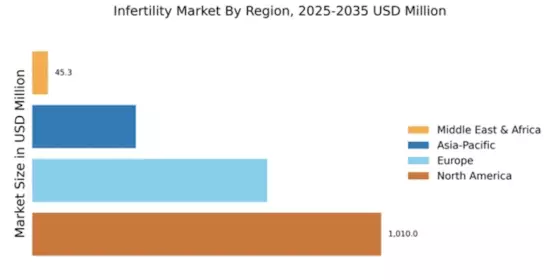

- Geographical and industry analysis

3. Methodology

The research methodology used in the report is based on a mix of secondary and primary data sources. The methods used in the initial research stage included e-mail surveys and interviews with leading health practitioners. The primary data collected is used to validate the secondary data sources and to maintain consistency with the other sources. Data related to market size and value, market segmentation, and other industry information was sourced from both published sources and industry databases.

In addition to the primary and secondary research methods, research is also conducted through desk research and data mining techniques. The data obtained through the methods are used to create models for the analysis of the market size and trends. The data gathered from the sources is collected in a database and used to explore in-depth market analysis. This includes an analysis of market dynamics, market segments, and current and upcoming trends.

4. Scope of the Study

This report covers the market performance of infertility treatments in the global market. The geographical regions that are included in the study are Europe, North America, Asia-Pacific, Latin America, and the Middle East. Furthermore, the study considers the market conditions and industry trends. Additionally, the report covers the market size and forecasts for infertility treatments, recent government policies and initiatives, and an analysis of the current market environment.

5. Conclusion

This research is conducted to gain a better understanding of the Infertility Market and trends. The primary and secondary research methods used in this report have revealed trends and details of the current market dynamics and market size. Current market trends suggest a significant increase in the demand for infertility treatments over the past years.

Furthermore, the research revealed that healthcare practitioners are looking to provide a more comprehensive approach to treating infertility and the current government policies and initiatives are likely to facilitate the growth of the market. The research is expected to benefit the market players and provide them with the necessary information to make informed decisions in the future.