Global Injection Molding Polyamide 6 Market Overview

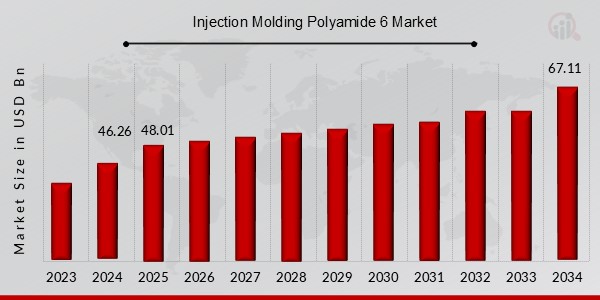

The Injection Molding Polyamide 6 Market Size was estimated at 46.26 (USD Billion) in 2024. The Injection Molding Polyamide 6 Industry is expected to grow from 48.01 (USD Billion) in 2025 to 67.11 (USD Billion) by 2034. The Injection Molding Polyamide 6 Market CAGR (growth rate) is expected to be around 3.80% during the forecast period (2025 - 2034).

Key Injection Molding Polyamide 6 Market Trends Highlighted

Injection Molding Polyamide 6 Market is set to register healthy growth in the ensuing years on account of factors like the need for lightweight and strong materials in the automotive, consumer electronics and industrial applications. Further, the market growth is expected to be driven by the increasing usage of electric vehicles and the trend towards miniaturization in electronics.

Other recent developments in the market highlight the invention of bio-based and recyclable polyamide 6 materials, which aim to satisfy the increasing need for eco-friendliness. Also, with the new technologies in injection molding, such as multi-component and micro molding, manufacturers are able to make intricate and accurate molded parts. New used in healthcare also in the aerospace industries are bringing some market growth.

Major market forces include the increasing standards and government regulations for fuel economy and emissions in the automotive sector, the rising need for lightweight and strong components in consumer electronic products and the growing penetration of polyamide 6 in machinery and equipment industrial application. Manufacturers are working on the development of polyamide 6 materials with better properties such as strength, heat and chemical resistant polyamide 6 to meet the changing market requirements.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Injection Molding Polyamide 6 Market Drivers

Growing Demand for Lightweight and Durable Materials in Automotive Applications

The automotive industry is a major consumer of Injection Molding Polyamide 6, driven by the increasing demand for lightweight and durable materials. Polyamide 6 offers excellent mechanical properties, such as high strength, stiffness, and toughness, making it an ideal choice for various automotive components. Its lightweight properties contribute to improved fuel efficiency and reduced emissions, aligning with the industry's sustainability goals. Moreover, Polyamide 6's resistance to chemicals and wear makes it suitable for demanding applications such as engine parts, interior components, and exterior body panels.The growing adoption of electric vehicles further propels the demand for Polyamide 6 due to its electrical insulation properties and ability to withstand high temperatures generated by electric motors and batteries. The Injection Molding Polyamide 6 Market Industry is expected to benefit significantly from these factors, particularly in regions with expanding automotive production.

Rising Adoption of Polyamide 6 in the Electrical and Electronics Industry

The Injection Molding Polyamide 6 Market Industry is driven by another immense growth propellant – the electrical and electronics industry. As a polymer, Polyamide 6 exhibits inherent insulation properties in addition to its flame retardancy, making it one of the preferred materials for a variety of electrical components, connectors, and housing. Because of its resistance to higher temperatures and ability to maintain dimensional stability regardless of environmental conditions, Polyamide 6 is also well-suited to serve as insulation for various electronics.Additionally, Polyamide 6's capacity to meet the most demanding performance requirements and perform well in light of the increase in the number of smart devices, the prevalence of the Internet of Things and wearable electronics further drive the growth of its demand.

Increasing Focus on Sustainability and Circular Economy

The Injection Molding Polyamide 6 Market Industry is influenced by the growing concern for sustainability and the application of circular economy principles. As a material, polyamide 6 is advantageous in terms of recyclability, and reusability, which is aligned with the market's tendency of reducing the environmental impact. Its inherent durability and the ability to be reprocessed and reused contribute to production sustainability. Production of bio-based PA6 grades made of renewable resources additionally supports and resolves the problems the market is facing.Penetration of eco material and regulations for sustainability is continuously driving PA6 demand, with such applications as Automotive, Consumer goods, and Packaging having the highest sustainability pressure on their accounts.

Injection Molding Polyamide 6 Market Segment Insights

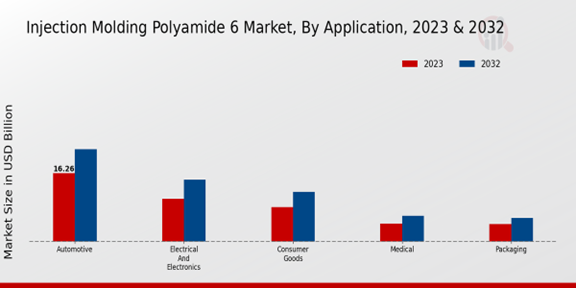

Injection Molding Polyamide 6 Market Application Insights

Application Segment Insights and Overview Injection Molding Polyamide 6 Market segmentation by application includes Automotive, Electrical and Electronics, Consumer Goods, Medical, and Packaging. The Automotive segment accounted for the largest share of the market in 2023, and it is anticipated to continue to record steady growth over the forecast period. The growth is expected to be driven by the increasing demand for lightweight and durable materials in the automotive sector. The Electrical and Electronics segment is also anticipated to record considerable growth as the demand for electronic devices and components rises.The Consumer Goods segment is anticipated to record moderate growth, which is attributed to the high demand for plastic products in various applications such as toys, appliances, and furniture. Medical segment growth is also forecasted to be stable, considering the rising demand for medical devices and equipment. The Packaging segment is anticipated to record low growth compared to other segments. In 2023, the Automotive segment accounted for approximately 40% of the Injection Molding Polyamide 6 Market revenue. The Electrical and Electronics segment accounted for about 25% of the market revenue, while the Consumer Goods segment accounted for 20% of the share. Medical and Packaging segments accounted for 15% of the market's revenue.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Injection Molding Polyamide 6 Market Resin Type Insights

The Injection Molding Polyamide 6 Market is segmented based on resin type into glass fiber reinforced polyamide 6, mineral-reinforced polyamide 6, and unreinforced polyamide 6. Among these segments, glass fiber-reinforced polyamide 6 held the largest market share in 2023. This is attributed to its high strength, stiffness, and dimensional stability, making it suitable for a wide range of applications in the automotive, electrical electronics, and consumer goods industries. Asia-Pacific is expected to be the largest market for injection molding polyamide 6, accounting for over 45% of the market share in 2023.This growth is attributed to the increasing demand from the automotive and electrical electronics industries in the region.

Injection Molding Polyamide 6 Market End-Use Industry Insights

The Injection Molding Polyamide 6 Market segmentation by End-Use Industry offers valuable insights into the performance of Polyamide 6 across various industries. In 2023, the Automotive segment held the largest revenue share of 35.2% due to the increasing demand for lightweight and durable components. The Medical industry is anticipated to grow at a substantial CAGR during the forecast period owing to the rising adoption of Polyamide 6 in medical devices and equipment. Furthermore, the Aerospace industry is expected to contribute significantly to the Injection Molding Polyamide 6 Market revenue, driven by the growing need for high-performance materials in aircraft components.Construction and Industrial Machinery are other key end-use industries that are expected to drive market growth in the coming years.

Injection Molding Polyamide 6 Market Molding Process Insights

Injection molding is the most widely used molding process for polyamide 6, accounting for over 60% of the Injection Molding Polyamide 6 Market revenue in 2023. This process involves injecting molten plastic into a mold cavity, where it cools and solidifies into the desired shape. Injection molding is preferred for its high precision, repeatability, and ability to produce complex shapes with intricate details. Blow molding is another common process, which uses compressed air to force molten plastic into a mold, creating hollow shapes such as bottles and containers.Extrusion molding involves forcing molten plastic through a die to create continuous profiles, such as pipes, sheets, and films. Compression molding, on the other hand, uses heat and pressure to compress plastic material into a mold, typically used for thicker and more durable products. The choice of molding process depends on factors such as part geometry, material properties, and production volume.

Injection Molding Polyamide 6 Market Distribution Channel Insights

The Injection Molding Polyamide 6 Market segmentation by Distribution Channel includes Direct Sales, Distributors, Online Marketplaces, and Retail Stores. Among these channels, Direct Sales is expected to dominate the market in 2023, accounting for around 45% of the Injection Molding Polyamide 6 Market revenue. This is due to the increasing preference for direct purchasing from manufacturers by end-users, as it offers benefits such as lower prices, better product customization, and faster delivery times. Distributors are also a significant channel, accounting for around 30% of the market.They play a crucial role in reaching a wider customer base and providing value-added services such as inventory management, technical support, and after-sales services. Online Marketplaces are gaining traction, particularly in the B2B segment, and are expected to grow at a significant rate in the coming years. Retail Stores account for a smaller share of the market, primarily catering to individual consumers and small businesses. However, they are expected to continue to play a role in the market, particularly for niche products and specialized applications.

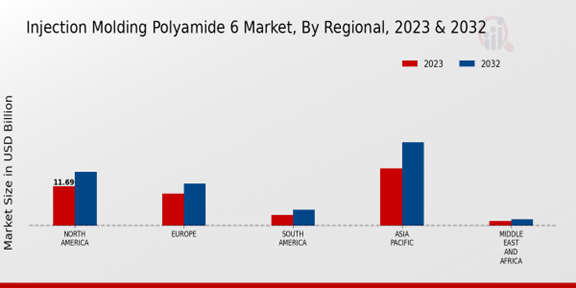

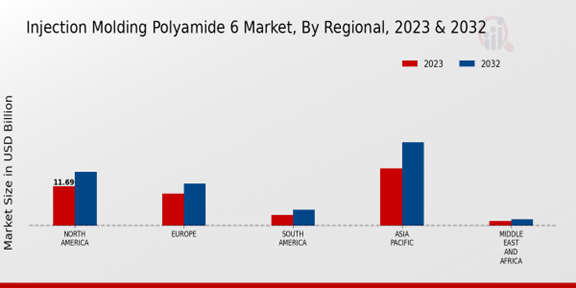

Injection Molding Polyamide 6 Market Regional Insights

The regional segmentation of the Injection Molding Polyamide 6 Market offers insights into the market's geographic distribution and performance. North America held the largest market share in 2023, driven by the presence of major automotive and electronics industries. Europe followed closely, with strong demand from the automotive and construction sectors. APAC is projected to witness significant growth over the forecast period, owing to the expanding automotive and consumer goods industries in the region. South America and MEA are expected to contribute a smaller but growing share of the market, driven by increasing urbanization and industrialization.The Injection Molding Polyamide 6 Market revenue in North America is expected to reach $12.5 billion by 2024, while the APAC market is projected to reach $18.2 billion by the same year. This data highlights the significant opportunities and variations in market dynamics across different regions.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Injection Molding Polyamide 6 Market Key Players And Competitive Insights

The major players in the Injection Molding Polyamide 6 Market are focusing on expanding their market presence, which is one of the key drivers for the development of the industry. To this end, they make acquisitions and enter into partnerships and collaborations aimed at increasing their sales and revenues. Additionally, the leading vendors invest in research and development activities to develop new products and technologies that would satisfy the changing demands of the customers.

However, the most crucial development in the context of the Injection Molding Polyamide 6 Market is the higher level of focus on production capacity expansion due to the consistent growth of the market, which is inclined to further support and enhance the described trend. Among other drivers of the industry development is the increasing demand for light and strong materials in various end-use applications, such as the automotive, consumer goods, and electrical and electronics industries. Overall, the Injection Molding Polyamide 6 Market Competitive Landscape can be considered competitive and is expected to remain so in the future.DSM is a vendor that offers a wide range of polyamide 6 products, having a specific focus on the Injection Molding Polyamide 6 Market. The company is one of the biggest suppliers and competes at the forefront of the industry. DSM operates worldwide and manufactures its products in Europe, Asia, and North America, with a higher focus on the expansion of production capacity. The leading products of the vendor are Akulon, Novamid, and Stanyl. Akulon is the polyamide 6 resin, while the other two are grades produced by the company. Similar to DSM, BASF also competes at the forefront of the Injection Molding Polyamide 6 Market. The leading products of the company are Ultramid and Ultradur, while it currently serves its customers from factories in Europe, Asia, and North America, with the highest focus on production capacity expansion.

Key Companies in the Injection Molding Polyamide 6 Market Include

- LyondellBasell Industries Holdings B.V.

- ExxonMobil Chemical Company

Injection Molding Polyamide 6 Market Industry Developments

Increasing demand for lightweight and durable materials in various industries, such as automotive, electrical electronics, and consumer goods, is driving market growth. Polyamide 6's excellent mechanical properties, high strength-to-weight ratio, and resistance to chemicals and wear, make it suitable for a wide range of applications. Key market players are focusing on developing innovative grades of polyamide 6 with improved properties to meet the evolving needs of end-use industries. Strategic acquisitions and collaborations are also shaping the competitive landscape as companies seek to expand their product offerings and geographical reach.

Injection Molding Polyamide 6 Market Segmentation Insights

Injection Molding Polyamide 6 Market Application Outlook

- Electrical and Electronics

Injection Molding Polyamide 6 Market Resin Type Outlook

- Glass Fiber Reinforced Polyamide 6

- Mineral Reinforced Polyamide 6

Injection Molding Polyamide 6 Market End-Use Industry Outlook

Injection Molding Polyamide 6 Market Molding Process Outlook

Injection Molding Polyamide 6 Market Distribution Channel Outlook

Injection Molding Polyamide 6 Market Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2024 |

46.26 (USD Billion) |

| Market Size 2025 |

48.01 (USD Billion) |

| Market Size 2034 |

67.11 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

3.80% (2025 - 2034) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2034 |

| Historical Data |

2020 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

DSM Engineering Plastics, BASF SE, LANXESS AG, INEOS Group, Celanese Corporation, DuPont de Nemours, Inc., Toray Industries, Inc., Solvay SA, Mitsui Chemicals, Inc., Covestro AG, LyondellBasell Industries Holdings B.V., Sabic, ExxonMobil Chemical Company, Evonik Industries AG, Asahi Kasei Corporation |

| Segments Covered |

Application, Resin Type, End-Use Industry, Molding Process, Distribution Channel, Regional |

| Key Market Opportunities |

Automotive lightweight, Electronics miniaturization, Healthcare precision, Packaging sustainability, Consumer durables durability |

| Key Market Dynamics |

Rising demand in automotive, Increasing technological advancements, Growing adoption in electrical and electronics. |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ) :

The Injection Molding Polyamide 6 Market is expected to reach an overall valuation of 48.01 USD Billion in 2025.

The Injection Molding Polyamide 6 Market is expected to reach an overall valuation of 67.11 USD Billion in 2034.

The Injection Molding Polyamide 6 Market is expected to grow at a CAGR of 3.80% from 2025 to 2034.

Key applications of Injection Molding Polyamide 6 include automotive parts, electrical and electronics, consumer goods, and industrial machinery.

Key competitors in the Injection Molding Polyamide 6 Market include BASF SE, LANXESS, Solvay, SABIC, and DuPont.

The Asia-Pacific region is expected to hold the largest market share in the Injection Molding Polyamide 6 Market, followed by North America and Europe.

Key growth drivers of the Injection Molding Polyamide 6 Market include increasing demand from the automotive industry, rising consumption of electrical and electronic devices, and growing awareness of lightweight materials.

Key challenges faced by the Injection Molding Polyamide 6 Market include fluctuating raw material prices, intense competition, and stringent environmental regulations.

Opportunities for the Injection Molding Polyamide 6 Market include growing demand from emerging economies, technological advancements, and increasing adoption of sustainable materials.

Key trends in the Injection Molding Polyamide 6 Market include the development of bio-based materials, lightweight materials, and the integration of smart technologies.