- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

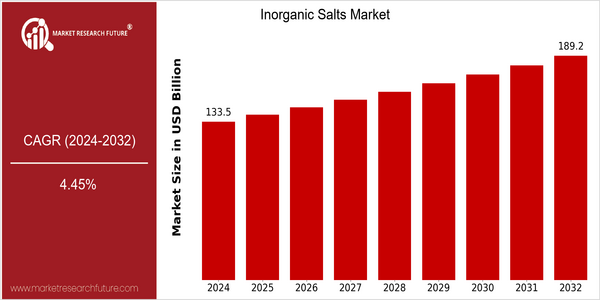

| Year | Value |

|---|---|

| 2024 | USD 133.54 Billion |

| 2032 | USD 189.17 Billion |

| CAGR (2024-2032) | 4.45 % |

Note – Market size depicts the revenue generated over the financial year

Inorganic salts are used in a great variety of industries. They are used as a mordanting, in medicine, in agriculture, in chemistry, in the chemical industry, in the chemical laboratory, in the tannery, in the chemical laboratory, in the dye-works, in the tannery, in the smelting and allied trades, in the tin-plate and in the tinning of iron. They are also used in the manufacture of glass, in the manufacture of cement, in the manufacture of vitriol, in the manufacture of sulphuric acid, in the manufacture of nitric acid, in the manufacture of soap, in the manufacture of sulphur, in the manufacture of nitric acid in the form of caustic potash, in the manufacture of soap and in the manufacture of glass. The use of inorganic salts has increased very much in the last ten years. It is due to the growing demand for inorganic salts in various industries, such as agriculture, pharmaceuticals, and food-processing. In the next few years the demand for inorganic salts is expected to grow even more rapidly, as industries seek to improve the quality of their products and increase their efficiency. The development of new production methods will also increase the growth of the market. In recent years, companies have made a large investment in research and development in order to produce more efficient and sustainable production methods. The major players, such as BASF, Solvay, and Tata Chemicals, are making efforts to strengthen their market positions. These efforts not only improve their product offerings, but also correspond to the growing emphasis on the environment and sustainability in the chemical industry.

Regional Market Size

Regional Deep Dive

Various applications of inorganic salts are found in agriculture, pharmaceuticals, and food. Each region is subject to different conditions of demand, legislation, and economy. Inorganic salts are a result of increasing industrialization and the increasing demand for special chemicals. The most important market is Asia-Pacific, where the rapid growth of the industrial sector is expected. North America and Europe are focused on innovation and the use of sustainable materials in the production process.

Europe

- In Europe, the European Chemicals Agency (ECHA) has introduced new regulations under REACH that require comprehensive safety assessments for inorganic salts, influencing how companies like BASF and Solvay approach product development and compliance.

- The growing emphasis on circular economy principles is leading to innovations in recycling and reusing inorganic salts, with initiatives from organizations such as the European Union promoting sustainable practices across the chemical industry.

Asia Pacific

- The Asia-Pacific region is witnessing significant investments in the chemical sector, with companies like Tata Chemicals expanding their production capacities to meet the rising demand for inorganic salts in agriculture and industrial applications.

- China's government has implemented policies to support the development of the chemical industry, including subsidies for manufacturers of inorganic salts, which is expected to boost local production and export capabilities.

Latin America

- Latin America is seeing a rise in agricultural applications of inorganic salts, particularly in countries like Brazil, where the government is promoting the use of fertilizers that include inorganic salts to enhance crop yields.

- The region is also experiencing increased foreign investment in the chemical sector, with companies like Yara International establishing operations to cater to the growing demand for inorganic fertilizers.

North America

- The North American market is experiencing a shift towards sustainable practices, with companies like Albemarle Corporation investing in eco-friendly production methods for inorganic salts, which is expected to enhance their market competitiveness.

- Regulatory changes, particularly the implementation of stricter environmental regulations by the Environmental Protection Agency (EPA), are pushing manufacturers to adopt cleaner technologies, thereby impacting production costs and market dynamics.

Middle East And Africa

- In the Middle East, the growth of the petrochemical industry is driving demand for inorganic salts, with companies like SABIC focusing on diversifying their product offerings to include specialty inorganic chemicals.

- Regulatory frameworks in several African countries are evolving, with governments implementing stricter environmental standards that are encouraging local manufacturers to adopt more sustainable practices in the production of inorganic salts.

Did You Know?

“Did you know that sodium chloride, a common inorganic salt, is not only used for seasoning food but also plays a crucial role in the production of chlorine and caustic soda, which are essential for various industrial processes?” — International Salt Association

Segmental Market Size

The inorganic salts market is currently growing at a steady rate, driven by the growing demand from various industries such as agriculture, pharmaceuticals, and food & beverages. Among the main factors driving the growth of this industry are the increasing demand for fertilizers in agriculture to increase the yield, and the growing pharmaceutical industry, which requires inorganic salts for the formulation of drugs. In addition, the growing demand for high-quality inorganic salts is also a result of the increasingly stringent regulations on food safety and the environment. At present, the inorganic salts industry is in a mature stage of development, with BASF and Solvay as the leading companies in terms of production and innovation. These inorganic salts are used mainly as fertilizers, food preservatives, and water treatment chemicals. Among the latest trends that are likely to boost the market’s growth are the growing trend of reducing the use of agricultural chemicals, as well as the growing emphasis on food safety. The emergence of new extraction methods and eco-friendly production methods will also help the inorganic salts market grow and meet the regulatory requirements and consumer expectations.

Future Outlook

The inorganic salts market is expected to grow at a CAGR of 4.36% from 2024 to 2032. This growth is due to the growing demand for inorganic salts in various end-use industries such as agriculture, pharmaceuticals, and water treatment. As the population grows and urbanization increases, the need for fertilizers and water treatment solutions is expected to rise. Inorganic salts such as nitrogen, phosphorus, and potassium salts are essential for the growth of crops and the health of the soil. Inorganic salts are also used in the pharmaceutical industry to preserve the stability of the human body. Moreover, technological advancements and government initiatives are expected to shape the market in the near future. The development of more efficient synthesis methods and the implementation of sustainable practices will increase the availability and reduce the environmental impact of inorganic salts. Moreover, the implementation of regulations aimed at promoting sustainable agriculture and the preservation of the environment will boost the demand for eco-friendly inorganic salts. The rising adoption of precision agriculture and the growing focus on water quality management will also boost the demand for inorganic salts, as these will be used to address the growing food security and environmental challenges.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 120.9 Billion |

| Market Size Value In 2023 | USD 127.06 Billion |

| Growth Rate | 5.10% (2023-2032) |

Inorganic Salt Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.