- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

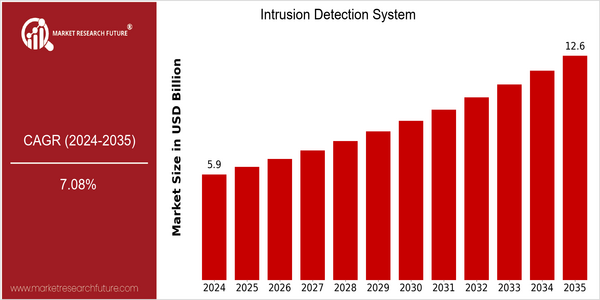

| Year | Value |

|---|---|

| 2024 | USD 5.93 Billion |

| 2035 | USD 12.58 Billion |

| CAGR (2025-2035) | 7.08 % |

Note – Market size depicts the revenue generated over the financial year

The Intrusion Detection System (IDS) market is poised for significant growth, with a current valuation of USD 5.93 billion in 2024, projected to reach USD 12.58 billion by 2035. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 7.08% from 2025 to 2035. The increasing frequency and sophistication of cyber threats, coupled with the rising demand for advanced security solutions across various sectors, are key drivers propelling this market forward. Organizations are increasingly recognizing the importance of proactive security measures, leading to heightened investments in IDS technologies. Technological advancements, such as the integration of artificial intelligence and machine learning into IDS solutions, are further enhancing the effectiveness of threat detection and response capabilities. Companies like Cisco, IBM, and Palo Alto Networks are at the forefront of this innovation, actively pursuing strategic initiatives such as partnerships, acquisitions, and product launches to strengthen their market position. For instance, Cisco's recent enhancements to its IDS offerings emphasize real-time threat intelligence, showcasing the industry's shift towards more adaptive and intelligent security frameworks. As the digital landscape continues to evolve, the IDS market is expected to expand significantly, driven by these technological trends and the increasing imperative for robust cybersecurity measures.

Regional Market Size

Regional Deep Dive

The Intrusion Detection System (IDS) market is experiencing significant growth across various regions, driven by increasing security concerns, technological advancements, and regulatory requirements. In North America, the market is characterized by a high adoption rate of advanced security technologies, particularly in sectors such as finance, healthcare, and government. Europe is witnessing a surge in demand for IDS solutions due to stringent data protection regulations like GDPR, while the Asia-Pacific region is rapidly expanding as businesses invest in cybersecurity to protect against rising cyber threats. The Middle East and Africa are also seeing growth, fueled by increasing investments in infrastructure and security technologies. Latin America, while still developing, is beginning to recognize the importance of IDS in safeguarding critical assets and information.

Europe

- The introduction of the General Data Protection Regulation (GDPR) has led to increased demand for IDS solutions as organizations seek to comply with stringent data protection requirements.

- Companies like Darktrace and Check Point Software Technologies are pioneering the use of AI-driven IDS solutions, which are becoming essential for organizations to detect and respond to sophisticated cyber threats.

Asia Pacific

- Countries like India and China are ramping up their cybersecurity measures, with government initiatives promoting the adoption of IDS technologies in both public and private sectors.

- The rise of smart cities in the region is driving demand for integrated security solutions, including IDS, as urban areas become more reliant on connected technologies.

Latin America

- The Brazilian government has launched initiatives to improve cybersecurity across various sectors, leading to increased investments in IDS technologies.

- Local companies are beginning to collaborate with global cybersecurity firms to enhance their IDS capabilities, reflecting a growing recognition of the importance of cybersecurity in the region.

North America

- The U.S. government has implemented various initiatives, such as the Cybersecurity Framework, which encourages organizations to adopt advanced intrusion detection systems to enhance national security.

- Key players like Cisco, IBM, and Palo Alto Networks are continuously innovating their IDS offerings, integrating AI and machine learning to improve threat detection and response capabilities.

Middle East And Africa

- The UAE's National Cybersecurity Strategy emphasizes the importance of advanced security measures, including IDS, to protect critical infrastructure and enhance national security.

- Organizations like the Saudi Arabian National Cybersecurity Authority are investing heavily in cybersecurity frameworks that include the deployment of IDS technologies to combat increasing cyber threats.

Did You Know?

“Approximately 60% of small to medium-sized businesses that experience a cyber attack go out of business within six months, highlighting the critical need for effective intrusion detection systems.” — Cybersecurity & Infrastructure Security Agency (CISA)

Segmental Market Size

The Intrusion Detection System (IDS) segment plays a critical role in enhancing cybersecurity measures across various industries, and it is currently experiencing robust growth. Key drivers of demand include the increasing frequency of cyberattacks, which compel organizations to bolster their security frameworks, and stringent regulatory policies that mandate compliance with data protection standards. Additionally, the rise of remote work has expanded the attack surface, further fueling the need for advanced intrusion detection solutions. Currently, the adoption of IDS technologies is in the scaled deployment phase, with notable leaders such as Cisco and Palo Alto Networks implementing comprehensive solutions across sectors like finance and healthcare. Primary applications include network security monitoring, threat detection, and incident response, with specific use cases seen in financial institutions employing IDS to safeguard sensitive customer data. Macro trends such as the ongoing digital transformation and heightened awareness of cybersecurity risks are accelerating growth in this segment, while technologies like machine learning and artificial intelligence are shaping its evolution by enhancing threat detection capabilities.

Future Outlook

The Intrusion Detection System (IDS) market is poised for significant growth from 2024 to 2035, with a projected market value increase from $5.93 billion to $12.58 billion, reflecting a robust compound annual growth rate (CAGR) of 7.08%. This growth trajectory is driven by the escalating need for enhanced security measures across various sectors, including government, healthcare, and financial services, as cyber threats become increasingly sophisticated. As organizations prioritize cybersecurity, the adoption of IDS solutions is expected to penetrate deeper into both large enterprises and small to medium-sized businesses, with usage rates potentially reaching over 60% by 2035, up from approximately 35% in 2024. Key technological advancements, such as the integration of artificial intelligence and machine learning into IDS solutions, are set to revolutionize the market. These technologies will enable more accurate threat detection and response capabilities, thereby enhancing the overall effectiveness of intrusion detection systems. Additionally, regulatory frameworks and compliance requirements, such as GDPR and HIPAA, will further drive the demand for IDS solutions as organizations seek to mitigate risks associated with data breaches. Emerging trends, including the rise of cloud-based IDS and the increasing importance of IoT security, will also shape the market landscape, presenting new opportunities for vendors and stakeholders in the coming years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 5.5 Billion |

| Market Size Value In 2023 | USD 5.8 Billion |

| Growth Rate | 6.11% (2023-2032) |

Intrusion Detection System Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.