- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

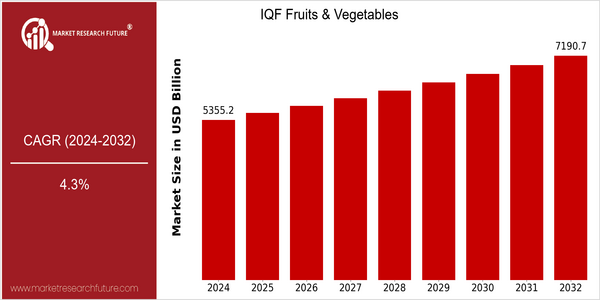

| Year | Value |

|---|---|

| 2024 | USD 5355.2 Billion |

| 2032 | USD 7190.7 Billion |

| CAGR (2024-2032) | 4.3 % |

Note – Market size depicts the revenue generated over the financial year

The global IQF (Individually Quick Frozen) Fruits & Vegetables market is poised for significant growth, with a current market size of USD 5355.2 Billion in 2024, projected to reach USD 7190.7 Billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.3% over the forecast period. The increasing demand for convenient and nutritious food options, coupled with the rising trend of healthy eating, is driving the expansion of this market. Consumers are increasingly seeking frozen fruits and vegetables as they offer longer shelf life and retain nutritional value, making them an attractive alternative to fresh produce, especially in regions with limited access to fresh goods year-round. Technological advancements in freezing techniques and supply chain logistics are also contributing to market growth. Innovations such as improved freezing methods that enhance product quality and texture are gaining traction. Key players in the industry, including companies like Greenyard, Dole Food Company, and Ardo, are actively investing in research and development to enhance their product offerings. Strategic initiatives such as partnerships with local farmers and investments in sustainable practices are further positioning these companies to capitalize on the growing demand for IQF fruits and vegetables, ensuring they remain competitive in this evolving market landscape.

Regional Market Size

Regional Deep Dive

The IQF Fruits & Vegetables Market is experiencing significant growth across various regions, driven by increasing consumer demand for convenience foods, health consciousness, and the rising trend of plant-based diets. In North America, the market is characterized by a well-established supply chain and a high level of innovation in processing technologies. Europe showcases a strong preference for organic and sustainably sourced products, while the Asia-Pacific region is rapidly expanding due to urbanization and changing dietary patterns. The Middle East and Africa are witnessing growth fueled by a young population and increasing investments in food processing, while Latin America is leveraging its agricultural diversity to enhance its IQF offerings.

Europe

- In Europe, the trend towards sustainability is leading to innovations in packaging, with companies like Bonduelle investing in biodegradable materials for their IQF products to reduce environmental impact.

- The European Union's Farm to Fork Strategy is promoting local sourcing and reducing food waste, which is encouraging more local producers to enter the IQF market, thus enhancing regional supply chains.

Asia Pacific

- The Asia-Pacific region is witnessing rapid urbanization, with companies like McCain Foods investing in local processing facilities to meet the growing demand for convenient frozen food options.

- Government initiatives in countries like India are promoting the cold chain infrastructure, which is crucial for the IQF market, enabling better distribution and reducing post-harvest losses.

Latin America

- Latin America is leveraging its rich agricultural resources, with countries like Brazil and Chile exporting IQF fruits to international markets, supported by government programs aimed at boosting agricultural exports.

- The rise of e-commerce in the region is facilitating access to IQF products, with local startups emerging to provide online platforms for consumers to purchase frozen fruits and vegetables directly.

North America

- The North American market is seeing a surge in demand for organic IQF products, with companies like Dole Food Company and Green Giant expanding their organic lines to cater to health-conscious consumers.

- Recent regulatory changes, such as the USDA's focus on food safety and quality standards, are pushing manufacturers to adopt more stringent processing practices, thereby enhancing product quality and consumer trust.

Middle East And Africa

- In the Middle East, the increasing expatriate population is driving demand for diverse IQF products, with companies like Al Ain Farms expanding their product lines to cater to multicultural tastes.

- The African continent is seeing investments from international players like Nestlé, which are focusing on enhancing local processing capabilities to tap into the growing consumer base for frozen fruits and vegetables.

Did You Know?

“Did you know that IQF technology allows fruits and vegetables to retain up to 90% of their nutrients compared to fresh produce that may lose nutrients during transportation and storage?” — Food and Agriculture Organization (FAO)

Segmental Market Size

The IQF (Individually Quick Frozen) Fruits & Vegetables segment plays a crucial role in the overall frozen food market, currently experiencing stable growth due to increasing consumer demand for convenience and healthy eating options. Key drivers include the rising awareness of the nutritional benefits of frozen produce, which retains vitamins and minerals, and the growing trend of plant-based diets. Additionally, advancements in freezing technology enhance product quality and shelf life, further boosting demand. Currently, the adoption of IQF technology is in a mature stage, with companies like Greenyard and Dole Food Company leading the way in production and distribution. Primary applications include retail frozen food sections, food service industries, and meal kit providers, where IQF products are favored for their ease of use and minimal preparation time. Macro trends such as the COVID-19 pandemic have accelerated the shift towards frozen foods as consumers seek longer-lasting options. Sustainability initiatives also drive growth, as companies focus on reducing food waste and improving supply chain efficiency through innovative freezing methods.

Future Outlook

The IQF (Individually Quick Frozen) Fruits & Vegetables market is poised for significant growth from 2024 to 2032, with a projected market value increase from $5,355.2 million to $7,190.7 million, reflecting a compound annual growth rate (CAGR) of 4.3%. This growth trajectory is underpinned by rising consumer demand for convenient, nutritious food options, as well as an increasing awareness of the benefits of frozen produce, which retains essential nutrients and flavors. As health-conscious eating trends continue to gain momentum, the penetration of IQF products in both retail and foodservice sectors is expected to rise, with usage rates potentially reaching upwards of 30% in key markets by 2032, compared to current levels of approximately 20%. Key technological advancements in freezing and packaging processes are anticipated to further enhance product quality and shelf life, making IQF fruits and vegetables more appealing to consumers. Additionally, sustainability initiatives and policies aimed at reducing food waste are likely to drive the adoption of frozen produce, as it offers a longer shelf life compared to fresh alternatives. Emerging trends such as plant-based diets and the growing popularity of meal kits are also expected to contribute to the market's expansion, as these segments increasingly incorporate IQF ingredients to meet consumer preferences for convenience and health. Overall, the IQF Fruits & Vegetables market is set to thrive, driven by evolving consumer behaviors and innovative industry practices.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 5,355.2 million |

| Growth Rate | 4.30% (2022-2030) |

IQF fruits vegetables Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.