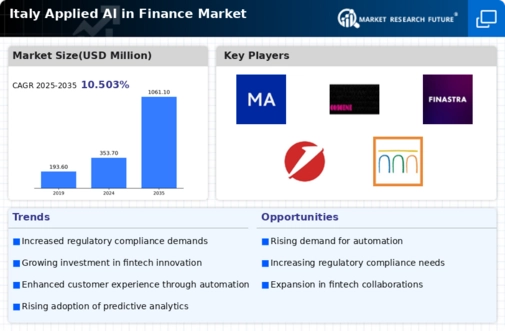

The Italy Applied AI in Finance Market is witnessing significant advancements driven by the increasing adoption of technology among financial institutions. The demand for improved decision-making processes, enhanced customer experiences, and operational efficiency is prompting companies in this space to leverage artificial intelligence. Competitive insights reveal that various players are enhancing their capabilities in machine learning, data analytics, and automation technologies. As the financial services sector evolves, organizations are integrating AI to streamline operations, reduce costs, and better serve their clients, thus creating a dynamic competitive landscape where innovation plays a crucial role.

Generali has established a robust presence in the Italy Applied AI in Finance Market by capitalizing on its deep understanding of insurance and financial services. The company focuses on leveraging AI technologies to optimize risk assessment and enhance customer engagement, positioning itself as a leader in personalized financial solutions. With a strong emphasis on customer experience, Generali uses AI to refine its service offerings, ensuring that clients receive tailored products that meet their specific needs.

Moreover, Generali has invested in partnerships and collaborations aimed at integrating advanced technology within its operations, thus further solidifying its competitive advantage in the Italian financial landscape.

Exela Technologies is an influential player within the Italy Applied AI in Finance Market, recognized for its comprehensive suite of digital transformation services that include automation and data analytics, which are vital for enhancing financial operations. The company offers key products and services that include intelligent document processing, financial transaction automation, and cloud-based solutions that drive efficiency in the financial sector. Exela's market presence is marked by strategic mergers and acquisitions that have expanded its technological capabilities and strengthened its service portfolio.

By focusing on the delivery of data-driven insights and automating business processes, Exela Technologies is well-placed to support financial institutions in Italy as they navigate the complexities of an increasingly tech-driven market, allowing them to enhance their operational efficiency and service delivery.