Italy Core Banking Solutions Market Overview:

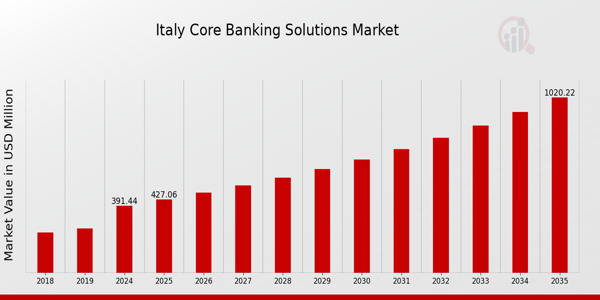

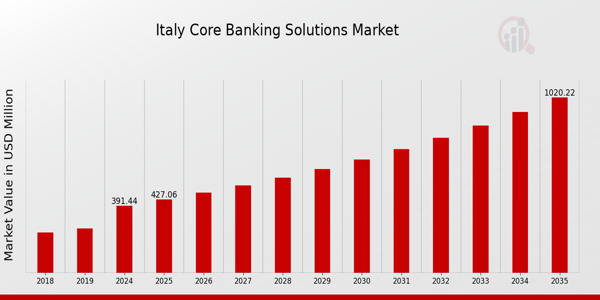

The Italy Core Banking Solutions Market Size was estimated at 341.88 (USD Million) in 2023. The Italy Core Banking Solutions Market Industry is expected to grow from 391.44(USD Million) in 2024 to 1,020.25 (USD Million) by 2035. The Italy Core Banking Solutions Market CAGR (growth rate) is expected to be around 9.099% during the forecast period (2025 - 2035).

Key Italy Core Banking Solutions Market Trends Highlighted

The Italy Core Banking Solutions Market is presently undergoing a digital revolution due to the growing need for financial services that are more customer-focused and flexible. Italian financial institutions are concentrating on replacing their antiquated systems with cutting-edge cloud-based solutions that provide more flexibility and improve operational efficiency. The Italian government's drive for digitalization across several industries supports this trend and emphasizes how important it is for banks to modify their fundamental systems to accommodate cutting-edge features like real-time transactions and mobile banking. Furthermore, traditional banks face competition as well as potential for cooperation from the emergence of fintech firms in Italy.

To take advantage of fintech’s' technological know-how and enhance their service offerings, numerous institutions are partnering with them. A focus on enhancing client experiences through individualized banking solutions and expedited service delivery is encouraged by this changing environment. Furthermore, as banks work to address strict rules set by authorities and guarantee data protection, regulatory compliance and risk management continue to be important motivators. There is need for more research in the Italian market in areas like integrating machine learning and artificial intelligence into basic banking systems. By analyzing consumer preferences and habits, these technologies enable banks to provide specialized goods and services. All things considered, the main trends influencing the landscape of core banking solutions in Italy are the continuous digital transformation, cooperation with fintech, regulatory compliance, and technology integration. Delivering better client experience and operational efficiency is the main goal, signaling a dramatic shift in the nation's financial service delivery model.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Italy Core Banking Solutions Market Drivers

Digital Transformation in the Banking Sector

The ongoing digital transformation in Italy is a significant driver for the Italy Core Banking Solutions Market Industry. According to the Bank of Italy, there has been a notable increase in the adoption of digital banking services, with nearly 70% of the Italian population utilizing online banking platforms in 2022. This shift towards digital solutions is pushing traditional banks to update their legacy systems and implement more sophisticated core banking solutions. Major banks such as UniCredit and Intesa Sanpaolo are investing heavily in technology and innovation, developing digital platforms that enhance customer experience while ensuring operational efficiency. Furthermore, the European Union has been promoting digitization in financial services, which further encourages Italian banks to invest in core banking technology to meet regulatory requirements and improve service delivery.

Regulatory Compliance and Risk Management

In Italy, increasingly stringent regulatory requirements, particularly those set by the European Central Bank and local financial authorities, are driving banks to adopt advanced core banking solutions. Compliance with regulations such as the General Data Protection Regulation (GDPR) and Anti-Money Laundering (AML) laws has become a priority for financial institutions. Data from the Banca d'Italia indicates that non-compliance can lead to substantial fines, with some banks facing penalties up to 4 percent of their annual turnover. This regulatory environment compels banks to seek robust core banking solutions that facilitate better risk management and compliance tracking. Established financial organizations in Italy are responding by aligning their core banking systems with the latest compliance requirements, thereby enhancing their overall operational stability.

Growing Demand for Personalized Banking Services

The increasing consumer demand for personalized banking experiences is another critical driver for the Italy Core Banking Solutions Market Industry. According to recent surveys conducted by Fintech firms, approximately 65% of Italian banking customers expect personalized services catered to their preferences. In response, banks like Banca Nazionale del Lavoro are leveraging advanced analytics and customer data to provide tailored financial products and services. This trend highlights the necessity for flexible core banking solutions that can integrate customer relationship management systems and facilitate personalized offerings. The rise of Fintech companies also underscores this demand, pushing traditional banks to enhance their core banking platforms to remain competitive in a dynamic market landscape.

Italy Core Banking Solutions Market Segment Insights:

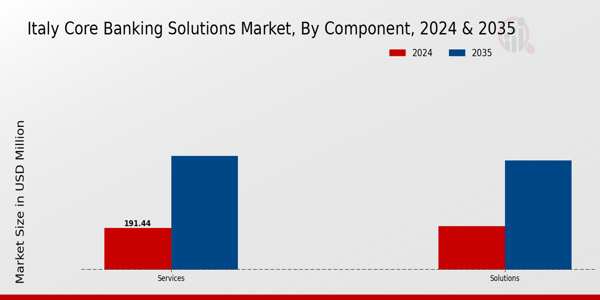

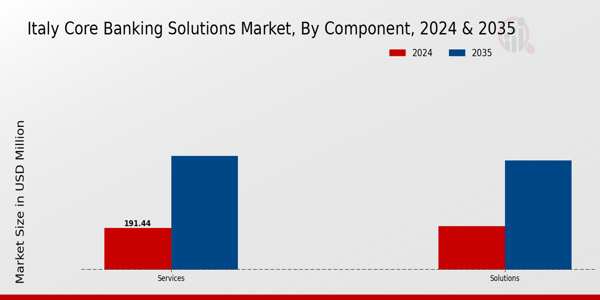

Core Banking Solutions Market Component Insights

The Component segment of the Italy Core Banking Solutions Market encapsulates essential elements that drive the overall functionality and efficiency of banking operations in the region. This segment is primarily divided into two critical areas: Solutions and Services, which play vital roles in shaping the banking landscape of Italy. Solutions encompass a range of software applications, including transaction processing systems, risk management tools, and customer relationship management platforms that are indispensable for seamless banking operations. Through the implementation of advanced solutions, financial institutions can enhance their operational agility and responsiveness, catering efficiently to evolving customer needs and regulatory requirements. Services, on the other hand, support the execution and management of these solutions, emphasizing the importance of consulting, maintenance, and support services.

Excellent services are crucial for ensuring the ongoing effectiveness of banking systems and can include technical support, system integrations, and performance optimization. The robust demand for both Solutions and Services in the Italy Core Banking Solutions Market has been driven by increasing digital transformation efforts within the banking sector, addressing the shift towards automation, mobile banking, and data analytics. This trend is further accentuated by regulatory compliance requirements, where financial institutions prioritize investing in innovative technologies to optimize their operations and improve customer satisfaction. Moreover, as the Italian banking industry faces rising competition from fintech firms, traditional banks must leverage modern solutions and responsive services to maintain market relevance.

The emphasis on improving customer engagement and satisfaction is another critical factor that has cemented the dominance of these components. Financial institutions are increasingly prioritizing customer-centric solutions that allow for personalized banking experiences, demonstrating the pivotal role this component segment plays. With continued investments and innovations in Solutions and Services, the Italy Core Banking Solutions Market is poised to address emerging challenges and harness growth opportunities in the years to come. Overall, these components are integral to enhancing operational frameworks of banks and financial institutions across Italy while contributing to the overall market growth trajectory.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Core Banking Solutions Market Deployment Insights

The Deployment segment of the Italy Core Banking Solutions Market is witnessing considerable traction, driven by the evolving demands of financial institutions for efficiency and agility. This segment primarily comprises On-Premise and Cloud-based solutions, each offering distinct advantages. On-Premise solutions provide institutions with greater control over their data and customization capabilities, favorable for banks with stringent regulatory requirements and data security concerns. In contrast, Cloud deployment is gaining popularity due to its flexibility, cost-effectiveness, and ability to enhance collaboration.

This trend is particularly significant as banks in Italy increasingly embrace digital transformation to improve their service delivery and customer engagement. The rising emphasis on operational efficiency and the need for scalable solutions are pivotal growth drivers in this market. Furthermore, challenges like data privacy and integration with existing systems create a complex landscape for deployment options. However, the ongoing shift towards Cloud technology presents opportunities for innovation, as banks seek to leverage advanced analytics and artificial intelligence to optimize their operations. Overall, the diverse needs of the banking sector in Italy are shaping the Deployment segment, highlighting its crucial role in the broader Core Banking Solutions Market.

Core Banking Solutions Market Organization Size Insights

The Italy Core Banking Solutions Market effectively addresses various organization sizes, reflecting the diverse banking needs across its landscape. Small and medium-sized enterprises (SMEs) typically seek flexibility and adaptability in core banking systems to manage operations efficiently while scaling their services. This segment often requires cost-effective solutions that maintain compliance with regulatory standards while enhancing customer engagement. On the other hand, large enterprises focus on integrated platforms capable of managing vast amounts of transactions and data, emphasizing robust security features and advanced technological capabilities.

As the financial services sector in Italy continues to evolve, there is a growing demand for innovative features, such as real-time processing and analytics, which significantly enhance operational efficiency. The trend towards digital transformation in Italy’s banking industry further accentuates the importance of targeted solutions for both SMEs and large enterprises, with an increasing adoption of cloud-based systems that foster collaboration and streamline processes. The balance between cost-efficiency for SMEs and comprehensive functionalities for large enterprises positions the Italy Core Banking Solutions Market in a pivotal role for future growth and innovation within the region’s banking infrastructure.

Core Banking Solutions Market End Users Insights

The End Users segment of the Italy Core Banking Solutions Market is predominantly characterized by institutions such as banks and financial institutions, which play a critical role in the country's economic framework. Given the historically strong foundation of banking in Italy, these entities are increasingly adopting advanced core banking solutions to enhance operational efficiency, customer experience, and regulatory compliance. Banks leverage these solutions to manage vast volumes of transactions seamlessly while ensuring secure data handling. Financial institutions, on the other hand, are utilizing sophisticated technologies to tailor services to diverse customer needs, thereby driving innovation. The growing demand for digital banking services and the necessity for real-time data processing are major factors propelling the adoption of core banking solutions in Italy. Moreover, increasing regulatory requirements continue to push these entities to modernize their core systems, making this segment highly significant as it adapts to the ever-evolving financial landscape. Overall, the evolution of the banking ecosystem presents numerous opportunities for core banking service providers to cater to these end users effectively, fostering a competitive environment marked by continuous improvement and customer-centric innovations.

Italy Core Banking Solutions Market Key Players and Competitive Insights:

The Italy Core Banking Solutions Market is characterized by a dynamic competitive landscape shaped by various factors including technological innovation, regulatory environment, and evolving consumer preferences. Key players are striving to enhance their offerings and gain a competitive edge through customization, adaptability, and integration of advanced technologies such as artificial intelligence and blockchain. As financial institutions continue to evolve towards digital transformation, the demand for robust core banking solutions that ensure operational efficiency, regulatory compliance, and superior customer experience grows. Competitors in this market aim to provide scalable and secure solutions that not only address the current needs of banking institutions but also anticipate future trends. Additionally, partnerships and collaborations among tech firms and banks play a crucial role in driving market growth, enabling firms to leverage each other’s strengths and expand their market reach.

In the context of the Italy Core Banking Solutions Market, Oracle presents itself as a formidable player, known for its comprehensive suite of banking solutions designed to streamline operations and enhance customer experience. Oracle’s strengths lie in its advanced technology framework that offers scalability and flexibility, making its solutions adaptable to the unique needs of Italian banks. The company has built a significant market presence through its robust offerings in digital banking, risk management, and compliance solutions, which are vital in the Italian regulatory landscape. Furthermore, Oracle’s commitment to innovation, backed by continuous investment in research and development, ensures that it remains at the forefront of providing cutting-edge technology to address the challenges faced by Italian financial institutions.

Banca Mediolanum operates in the Italy Core Banking Solutions Market with a focus on delivering personalized banking solutions that cater to the evolving needs of its clientele. The company is recognized for its efficient digital banking services, customer-centric approach, and comprehensive investment products. With a market presence that has expanded significantly, Banca Mediolanum stands out for integrating financial services with innovative technologies, enhancing customer engagement through tailored offerings. The company has been involved in strategic mergers and acquisitions, strengthening its position in the market while expanding its service portfolio to include wealth management and insurance products. Its strengths lie in its ability to leverage data analytics to understand customer segments better, develop innovative solutions, and maintain a competitive edge in a rapidly evolving market characterized by changing consumer expectations.

Key Companies in the Italy Core Banking Solutions Market Include:

- Oracle

- Banca Mediolanum

- Banca Nazionale del Lavoro

- Finastra

- FIS

- Railsbank

- UniCredit

- Aquila Capital

- Temenos

- Cassa Depositi e Prestiti

- Sia

- SAP

- Diebold Nixdorf

- Intesa Sanpaolo

Italy Core Banking Solutions Market Industry Developments

In recent months, the Italy Core Banking Solutions Market has witnessed various developments impacting both technology and financial institutions. Notably, Oracle announced enhancements to its cloud-based banking solutions in October 2023, focusing on digital transformation for banks. Meanwhile, Banca Mediolanum has implemented a new core banking system in response to changing customer needs, showcasing the industry's shift toward customer-centric solutions. In addition, FIS revealed a strategic partnership with a leading Italian bank to modernize payment infrastructures. Merger and acquisition activities have also been present, with Temenos acquiring a significant share of a smaller tech firm in September 2023 to bolster its Italian market presence. Additionally, in November 2022, UniCredit expanded its services through a partnership with Railsbank, enhancing its role in the open banking landscape. The market continues to grow, with various companies experiencing a positive upward trend in valuation due to increased digitization and the demand for advanced banking solutions. This growth reflects the banking sector's adaptability amid evolving consumer expectations and regulatory landscapes in Italy over the past few years.

Italy Core Banking Solutions Market Segmentation Insights

Core Banking Solutions Market Component Outlook

Core Banking Solutions Market Deployment Outlook

Core Banking Solutions Market Organization Size Outlook

Core Banking Solutions Market End Users Outlook

- Banks

- Financial Institutions

Report Scope:

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

341.88(USD Million) |

| MARKET SIZE 2024 |

391.44(USD Million) |

| MARKET SIZE 2035 |

1020.25(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

9.099% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Oracle, Banca Mediolanum, Banca Nazionale del Lavoro, Finastra, FIS, Railsbank, UniCredit, Aquila Capital, Temenos, Cassa Depositi e Prestiti, Sia, SAP, Diebold Nixdorf, Intesa Sanpaolo |

| SEGMENTS COVERED |

Component, Deployment, Organization Size, End Users |

| KEY MARKET OPPORTUNITIES |

Digital transformation initiatives, Regulatory compliance advancements, Integration of AI technologies, Enhanced customer experience solutions, Expansion of neobanks and fintechs |

| KEY MARKET DYNAMICS |

Regulatory compliance demands, Digital transformation initiatives, Multi-channel banking solutions, Enhanced customer experiences, Data security concerns |

| COUNTRIES COVERED |

Italy |

Frequently Asked Questions (FAQ) :

The Italy Core Banking Solutions Market is expected to be valued at 391.44 million USD in 2024.

By 2035, the market is projected to reach a valuation of 1020.25 million USD.

The market is expected to grow at a CAGR of 9.099 percent during the forecast period from 2025 to 2035.

In 2024, solutions are expected to be valued at 200.0 million USD and services at 191.44 million USD.

In 2035, the solutions segment is expected to reach 500.0 million USD while the services segment is projected to reach 520.25 million USD.

Key players in the market include Oracle, Finastra, FIS, UniCredit, and SAP among others.

The main opportunities in the market stem from technological advancements and rising demand for digital banking solutions.

The market faces challenges such as regulatory compliance and the need for continuous innovation.

Emerging trends include increasing adoption of cloud solutions and enhanced digital customer experiences.

The competitive landscape has evolved with increasing investments in innovative technologies and partnerships among major players.