Rising Air Travel Demand

The aviation fuel market in Japan is experiencing a notable surge in demand due to the increasing number of air travelers. In recent years, the number of domestic and international flights has escalated, driven by a growing middle class and enhanced connectivity. According to data from the Ministry of Land, Infrastructure, Transport and Tourism, air passenger traffic in Japan is projected to grow by approximately 4.5% annually through 2025. This rise in air travel directly correlates with the demand for aviation fuel, as airlines require substantial quantities to operate their fleets. Consequently, the aviation fuel market is poised to benefit from this upward trend, as fuel suppliers and distributors adapt to meet the needs of an expanding aviation sector.

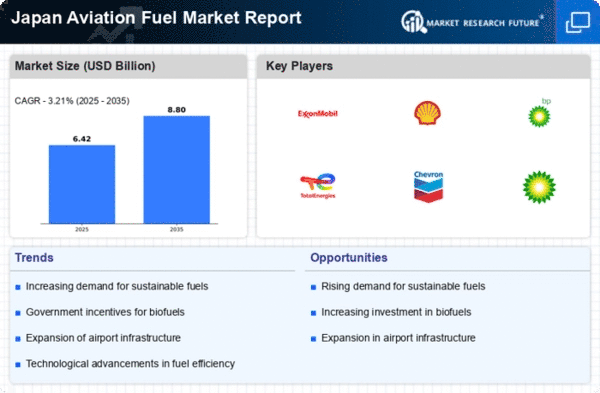

Competitive Landscape and Market Dynamics

The competitive landscape of the aviation fuel market in Japan is characterized by a mix of domestic and international players vying for market share. Major oil companies and independent suppliers are actively engaged in strategic partnerships and collaborations to enhance their service offerings. This competitive environment encourages innovation and efficiency, which can lead to more favorable pricing for airlines. Additionally, the presence of multiple suppliers in the aviation fuel market may result in improved service levels and reliability for airlines. As competition intensifies, it is likely that suppliers will seek to differentiate themselves through quality, pricing, and sustainability initiatives, shaping the future dynamics of the market.

Economic Growth and Infrastructure Investment

Japan's economic growth and ongoing investments in infrastructure are pivotal drivers of the aviation fuel market. The government has committed substantial resources to enhance airport facilities and expand air traffic management systems. This investment is expected to facilitate increased air traffic, thereby boosting the demand for aviation fuel. According to the Japan National Tourism Organization, the tourism sector is anticipated to grow, further stimulating the aviation industry. As a result, the aviation fuel market is likely to experience heightened activity, with fuel suppliers needing to scale operations to meet the rising demand stemming from both domestic and international travel.

Technological Advancements in Fuel Efficiency

Technological innovations in aircraft design and fuel efficiency are significantly influencing the aviation fuel market in Japan. Airlines are increasingly investing in modern, fuel-efficient aircraft that consume less fuel per passenger mile. For instance, the introduction of next-generation aircraft, such as the Boeing 787 and Airbus A350, has led to a reduction in fuel consumption by up to 20% compared to older models. This shift not only lowers operational costs for airlines but also impacts the overall demand for aviation fuel. As airlines continue to prioritize fuel efficiency, the aviation fuel market must adapt to these changes, ensuring that fuel supply aligns with the evolving needs of the aviation sector.

Regulatory Framework and Environmental Standards

The aviation fuel market in Japan is significantly shaped by stringent regulatory frameworks and environmental standards. The Japanese government has implemented various policies aimed at reducing carbon emissions from the aviation sector. For example, the Ministry of the Environment has set ambitious targets to decrease greenhouse gas emissions by 26% by 2030. These regulations compel airlines to adopt cleaner fuels and technologies, thereby influencing the types of aviation fuel available in the market. As a result, the aviation fuel market is likely to see a shift towards more sustainable fuel options, which may include biofuels and synthetic fuels, as compliance with environmental standards becomes increasingly critical.