Emergence of Smart Cities

The concept of smart cities is gaining traction in Japan, significantly influencing the edge infrastructure market. As urban areas become increasingly interconnected, the demand for efficient data management and processing solutions rises. Edge infrastructure plays a pivotal role in enabling smart city initiatives by facilitating real-time data collection and analysis from various sources, such as traffic sensors and environmental monitoring systems. This integration of edge computing into urban planning is expected to enhance the quality of life for residents while optimizing resource allocation. The edge infrastructure market is projected to benefit from investments in smart city projects, with estimates suggesting that spending on smart city technologies could exceed $10 billion by 2027. This trend indicates a promising future for the edge infrastructure market, as cities strive to become more sustainable and technologically advanced.

Increased Focus on Cybersecurity

As the edge infrastructure market expands in Japan, the emphasis on cybersecurity becomes increasingly pronounced. With the proliferation of connected devices and the rise of IoT applications, the potential for cyber threats escalates, prompting organizations to prioritize security measures. The edge infrastructure market is witnessing a shift towards integrated security solutions that protect data at the source, thereby minimizing vulnerabilities. According to industry reports, investments in cybersecurity for edge computing are expected to reach $1 billion by 2026, reflecting the growing recognition of the need for robust security frameworks. This heightened focus on cybersecurity not only safeguards sensitive information but also instills confidence among users, thereby driving further adoption of edge solutions. Consequently, the edge infrastructure market is likely to evolve in tandem with advancements in cybersecurity technologies, ensuring a secure environment for data processing and storage.

Government Initiatives and Support

The Japanese government plays a crucial role in fostering the growth of the edge infrastructure market through various initiatives and support programs. Recognizing the strategic importance of digital transformation, the government has allocated substantial funding to promote research and development in edge computing technologies. Additionally, policies aimed at enhancing connectivity and infrastructure development are being implemented to facilitate the deployment of edge solutions. For instance, the government has set ambitious targets for expanding broadband access, which is essential for the effective functioning of edge infrastructure. This proactive approach is expected to stimulate investment in the edge infrastructure market, encouraging both domestic and international players to participate in the evolving landscape. As a result, the market is likely to witness accelerated growth, driven by government backing and a favorable regulatory environment.

Rising Demand for Real-Time Data Processing

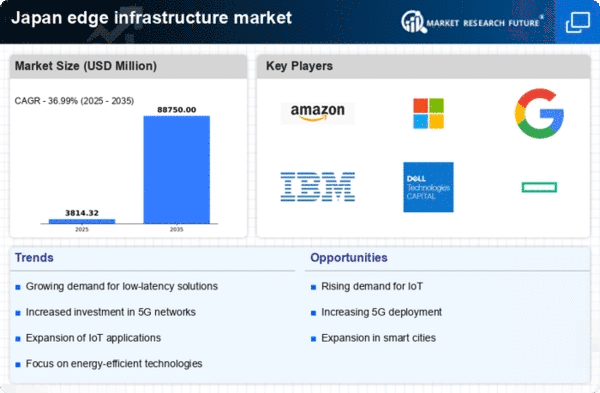

The edge infrastructure market in Japan is witnessing a significant increase in demand for real-time data processing capabilities. As industries increasingly rely on instantaneous data analytics, the need for localized computing resources becomes paramount. This trend is particularly evident in sectors such as manufacturing and logistics, where operational efficiency hinges on timely decision-making. According to recent estimates, the edge infrastructure market in Japan is projected to grow at a CAGR of approximately 25% over the next five years, driven by the necessity for low-latency applications. Companies are investing in edge computing solutions to enhance their data processing capabilities, thereby improving overall productivity and responsiveness. This rising demand for real-time data processing is likely to shape the future landscape of the edge infrastructure market, as organizations seek to leverage technology for competitive advantage.

Growth of Remote Work and Digital Collaboration

The shift towards remote work and digital collaboration in Japan has a profound impact on the edge infrastructure market. As organizations adapt to new work paradigms, the demand for reliable and efficient digital communication tools increases. Edge infrastructure solutions are being leveraged to enhance connectivity and ensure seamless collaboration among remote teams. This trend is particularly relevant in sectors such as education and professional services, where the need for effective communication is critical. The edge infrastructure market is likely to see a surge in demand for solutions that support remote work, with projections indicating a growth rate of approximately 20% over the next few years. This evolution in work dynamics underscores the importance of edge computing in facilitating a flexible and responsive work environment, ultimately shaping the future of the edge infrastructure market.