Growing Awareness and Education

There is a notable increase in awareness and education regarding hematological disorders among the Japanese population. Public health campaigns and educational initiatives are informing individuals about the importance of early detection and regular screening for blood-related conditions. This heightened awareness is likely to drive more patients to seek diagnostic testing, thereby expanding the hematology diagnostics market. Furthermore, healthcare professionals are receiving enhanced training on the latest diagnostic techniques, which is expected to improve the quality of care provided. As a result, the demand for hematology diagnostics is anticipated to grow as more individuals recognize the value of timely diagnosis and treatment.

Increased Healthcare Expenditure

Japan's healthcare expenditure is on the rise, which is positively impacting the hematology diagnostics market. The government has been increasing its budget allocation for healthcare services, with a focus on improving diagnostic capabilities. In 2025, healthcare spending is projected to reach approximately $500 billion, with a significant portion directed towards diagnostic services. This increase in funding allows for the procurement of advanced diagnostic equipment and the implementation of comprehensive screening programs. Consequently, healthcare facilities are better equipped to diagnose and manage hematological disorders, leading to improved patient outcomes and a growing market for hematology diagnostics.

Rising Prevalence of Hematological Disorders

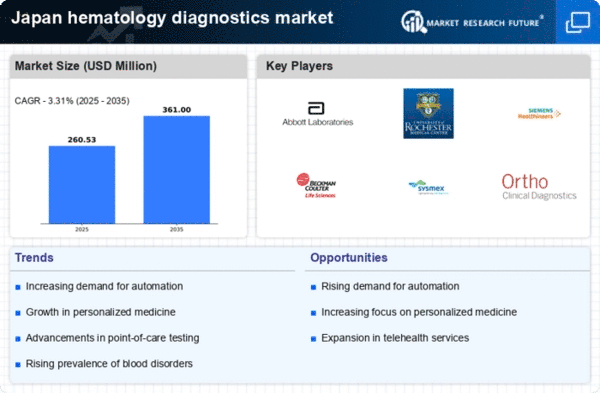

The rising incidence of hematological disorders in Japan drives the hematology diagnostics market. Conditions such as anemia, leukemia, and lymphoma are becoming more prevalent, necessitating advanced diagnostic solutions. According to recent health statistics, approximately 1.5 million individuals in Japan are diagnosed with some form of blood disorder annually. This growing patient population is likely to drive demand for innovative diagnostic tools and technologies. Furthermore, the aging population, which is projected to reach 36% of the total demographic by 2040, contributes to the rise in hematological conditions. As a result, healthcare providers are increasingly investing in hematology diagnostics to enhance patient outcomes and streamline treatment protocols.

Regulatory Support for Diagnostic Innovations

The regulatory environment in Japan is becoming increasingly supportive of innovations in the hematology diagnostics market. The Pharmaceuticals and Medical Devices Agency (PMDA) is streamlining the approval process for new diagnostic technologies, which encourages manufacturers to invest in research and development. This regulatory support is crucial for the introduction of novel diagnostic tools that can improve patient care. As a result, the market is likely to see a surge in the availability of advanced hematology diagnostics solutions. The proactive stance of regulatory bodies not only fosters innovation but also ensures that patients have access to the latest and most effective diagnostic options.

Technological Innovations in Diagnostic Tools

Technological advancements in diagnostic tools are significantly influencing the hematology diagnostics market. Innovations such as automated blood analyzers and advanced imaging techniques are enhancing the accuracy and efficiency of hematological assessments. The market for hematology analyzers in Japan was expected to grow at a CAGR of 6.5% from 2025 to 2030, reflecting the increasing adoption of these technologies. Additionally, the integration of artificial intelligence and machine learning in diagnostic processes is streamlining workflows and improving diagnostic precision. These innovations not only facilitate faster results but also reduce the likelihood of human error, thereby enhancing the overall quality of patient care in hematology.