Increasing Pet Ownership

The rise in pet ownership in Japan appears to be a significant driver for the pet food market. As more households adopt pets, the demand for quality pet food increases. Recent statistics indicate that approximately 40% of households in Japan own at least one pet, with dogs and cats being the most popular choices. This growing trend in pet ownership is likely to continue, as urbanization and changing lifestyles lead to more individuals seeking companionship through pets. Consequently, the pet food market is experiencing a surge in demand for diverse and nutritious food options tailored to various pet needs. This shift not only enhances the market's growth potential but also encourages manufacturers to innovate and expand their product lines to cater to the evolving preferences of pet owners.

Health and Wellness Trends

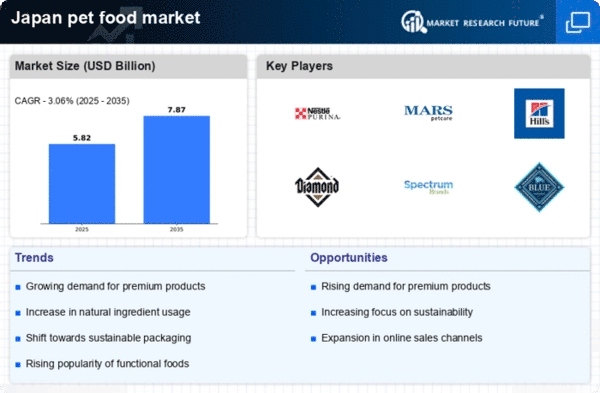

The increasing focus on health and wellness among pet owners is driving the pet food market in Japan. Pet owners are becoming more conscious of the nutritional value of the food they provide to their pets, leading to a demand for organic, natural, and high-quality ingredients. Reports suggest that the premium segment of the pet food market has seen a growth rate of around 15% annually, as consumers are willing to invest more in their pets' health. This trend is further supported by the rising awareness of pet obesity and related health issues, prompting owners to seek specialized diets that promote overall well-being. As a result, manufacturers are responding by developing innovative products that align with these health-conscious consumer preferences, thereby enhancing their market presence.

Expansion of Retail Channels

The expansion of retail channels is significantly influencing the pet food market in Japan. Traditional brick-and-mortar stores are increasingly complemented by online platforms, providing consumers with greater access to a variety of pet food options. Recent data suggests that e-commerce sales in the pet food sector have grown by approximately 20% in the past year, reflecting a shift in consumer shopping habits. This trend is likely to continue as more pet owners prefer the convenience of online shopping, especially for specialized or premium products. Retailers are responding by enhancing their online presence and offering exclusive deals, thereby driving competition and innovation within the pet food market. This expansion not only benefits consumers but also encourages manufacturers to diversify their distribution strategies.

Sustainability and Eco-Friendly Products

The growing emphasis on sustainability and eco-friendly practices is emerging as a key driver for the pet food market in Japan. Consumers are increasingly concerned about the environmental impact of their purchasing decisions, leading to a demand for sustainable packaging and ethically sourced ingredients. Recent surveys indicate that around 30% of pet owners are willing to pay a premium for products that align with their values regarding sustainability. This shift is prompting manufacturers to adopt greener practices, such as using recyclable materials and reducing carbon footprints in their production processes. Consequently, the pet food market is likely to see a rise in the availability of eco-friendly products, which not only cater to consumer preferences but also contribute to a more sustainable future.

Technological Advancements in Production

Technological advancements in production processes are playing a crucial role in shaping the pet food market in Japan. Innovations such as automated manufacturing and improved supply chain management are enabling companies to produce high-quality pet food more efficiently. This not only reduces production costs but also enhances product consistency and safety. Furthermore, the integration of data analytics and artificial intelligence in product development allows manufacturers to better understand consumer preferences and tailor their offerings accordingly. As a result, the pet food market is likely to witness an increase in the availability of customized products that meet specific dietary needs, thereby attracting a broader customer base and driving overall market growth.