- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

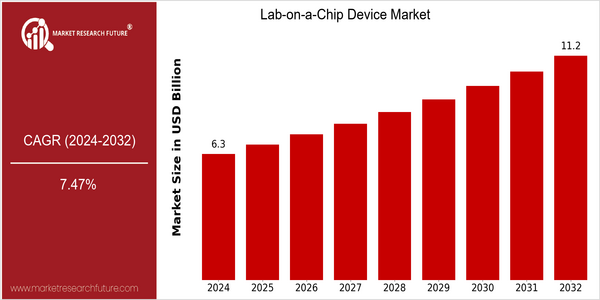

| Year | Value |

|---|---|

| 2024 | USD 6.29 Billion |

| 2032 | USD 11.2 Billion |

| CAGR (2024-2032) | 7.47 % |

Note – Market size depicts the revenue generated over the financial year

The Lab-on-a-Chip (LoC) device market is poised for significant growth, with the current market size estimated at USD 6.29 billion in 2024 and projected to reach USD 11.2 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 7.47% over the forecast period. This growth trajectory underscores the increasing adoption of miniaturized diagnostic tools in various applications, including healthcare, environmental monitoring, and food safety. The rising demand for point-of-care testing and personalized medicine is further propelling the market, as these devices offer rapid, accurate results with minimal sample volumes, enhancing patient outcomes and operational efficiencies in clinical settings. Several technological advancements are driving this market expansion, particularly innovations in microfluidics, biosensors, and nanotechnology. These advancements enable the development of more sophisticated and versatile Lab-on-a-Chip devices that can perform multiple analyses simultaneously, catering to the evolving needs of researchers and clinicians. Key players in the industry, such as Abbott Laboratories, Agilent Technologies, and Bio-Rad Laboratories, are actively investing in R&D and forming strategic partnerships to enhance their product offerings and expand their market presence. For instance, recent collaborations aimed at integrating AI with Lab-on-a-Chip technologies are expected to further revolutionize diagnostic capabilities, thereby contributing to the market's growth.

Regional Market Size

Regional Deep Dive

The Lab-on-a-Chip Device Market is experiencing significant growth across various regions, driven by advancements in microfluidics, increasing demand for point-of-care testing, and the rising prevalence of chronic diseases. Each region exhibits unique characteristics influenced by technological innovation, regulatory frameworks, and healthcare infrastructure. North America leads in technological advancements and investment, while Europe focuses on regulatory compliance and innovation. The Asia-Pacific region is rapidly expanding due to increasing healthcare expenditure and a growing population, while the Middle East and Africa face challenges related to healthcare access but show potential for growth through government initiatives. Latin America is gradually adopting these technologies, influenced by economic factors and healthcare needs.

Europe

- The European Union's In Vitro Diagnostic Regulation (IVDR) has introduced stricter compliance requirements, pushing manufacturers to innovate and improve the accuracy and reliability of Lab-on-a-Chip devices.

- Companies such as Roche and Siemens Healthineers are collaborating with academic institutions to develop next-generation Lab-on-a-Chip solutions, focusing on personalized medicine and rapid diagnostics.

Asia Pacific

- China's government has launched initiatives to boost the domestic production of Lab-on-a-Chip devices, aiming to reduce dependency on foreign technology and enhance local healthcare capabilities.

- Startups in India, like Mylab Discovery Solutions, are emerging with innovative Lab-on-a-Chip solutions for COVID-19 testing, showcasing the region's potential for rapid technological adoption.

Latin America

- Brazil is witnessing a surge in public-private partnerships aimed at developing Lab-on-a-Chip technologies to improve diagnostic capabilities in remote areas.

- Regulatory bodies in countries like Mexico are beginning to adapt their frameworks to accommodate the rapid development of Lab-on-a-Chip devices, which is expected to enhance market growth.

North America

- The U.S. Food and Drug Administration (FDA) has recently streamlined the approval process for Lab-on-a-Chip devices, encouraging innovation and faster market entry for new products.

- Key players like Abbott Laboratories and Thermo Fisher Scientific are investing heavily in R&D to enhance the capabilities of Lab-on-a-Chip technologies, particularly in the areas of infectious disease diagnostics.

Middle East And Africa

- The UAE has initiated a national strategy to enhance healthcare technology, including Lab-on-a-Chip devices, as part of its Vision 2021 plan, aiming to improve healthcare access and quality.

- Collaborations between local universities and international companies are fostering innovation in Lab-on-a-Chip technologies, addressing specific regional health challenges such as infectious diseases.

Did You Know?

“Lab-on-a-Chip devices can perform multiple laboratory functions on a single chip, potentially reducing the time for diagnostic results from hours to just minutes.” — National Institutes of Health (NIH)

Segmental Market Size

The Lab-on-a-Chip (LoC) device segment plays a crucial role in the overall market by enabling miniaturized, integrated systems for biochemical analysis, and it is currently experiencing significant growth. Key drivers of demand include the increasing need for rapid diagnostics in healthcare, particularly in point-of-care testing, and advancements in microfluidics technology that enhance the functionality and efficiency of these devices. Regulatory policies promoting faster approval processes for diagnostic tools also contribute to this segment's expansion. Currently, the adoption of Lab-on-a-Chip devices is in the scaled deployment stage, with companies like Abbott Laboratories and Roche leading the way in integrating these technologies into clinical settings. Primary applications include disease diagnostics, environmental monitoring, and food safety testing, with notable examples being the use of LoC devices for detecting pathogens in food products. Trends such as the ongoing emphasis on personalized medicine and the impact of global health crises, like the COVID-19 pandemic, are accelerating growth in this segment. Furthermore, innovations in nanotechnology and biosensors are shaping the evolution of Lab-on-a-Chip devices, enhancing their capabilities and broadening their application scope.

Future Outlook

The Lab-on-a-Chip (LoC) device market is poised for significant growth from 2024 to 2032, with a projected market value increase from $6.29 billion to $11.2 billion, reflecting a robust compound annual growth rate (CAGR) of 7.47%. This growth trajectory is driven by the increasing demand for point-of-care diagnostics, advancements in microfluidics technology, and the rising prevalence of chronic diseases that necessitate rapid and accurate testing solutions. As healthcare systems globally shift towards more decentralized and efficient diagnostic methods, the penetration of LoC devices is expected to rise substantially, with usage rates potentially reaching 30% in clinical settings by 2032, up from approximately 15% in 2024. Key technological drivers include innovations in nanotechnology and biosensors, which enhance the sensitivity and specificity of tests conducted on LoC devices. Furthermore, supportive government policies aimed at promoting personalized medicine and reducing healthcare costs are likely to bolster market growth. Emerging trends such as the integration of artificial intelligence for data analysis and the development of multi-analyte testing capabilities will further shape the landscape of the LoC market. As stakeholders, including healthcare providers and technology developers, continue to collaborate, the Lab-on-a-Chip device market is set to transform diagnostic practices, making healthcare more accessible and efficient.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 5.5 Billion |

| Market Size Value In 2023 | USD 6.0 Billion |

| Growth Rate | 4.90% (2023-2032) |

Lab-on-a-Chip Device Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.