LAN Cable Market Summary

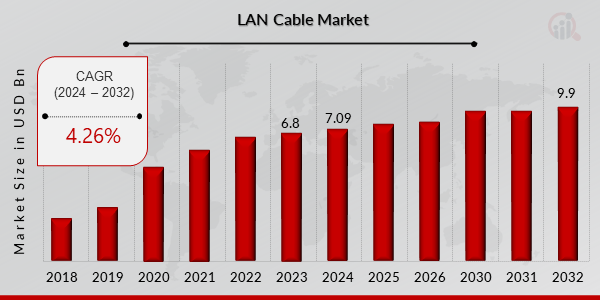

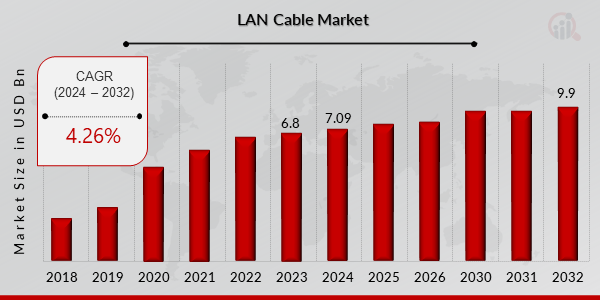

As per Market Research Future Analysis, the Global LAN Cable Market was valued at USD 6.8 Billion in 2023 and is projected to grow from USD 7.09 Billion in 2024 to USD 9.9 Billion by 2032, with a CAGR of 4.26% during the forecast period. The growth is driven by increased demand for data centers and high-speed data transfer. The market is dominated by copper cables due to their cost-effectiveness and flexibility, while fiber optic cables are expected to grow at a faster rate. The North American region leads the market, primarily due to advancements in fiber optic technology and the rise in data centers. The COVID-19 pandemic further boosted demand for LAN cables as remote work became prevalent.

Key Market Trends & Highlights

Key trends driving the LAN Cable market include technological advancements and increased demand for connectivity.

- Market Size in 2023: USD 6.8 Billion.

- Projected Market Size by 2032: USD 9.9 Billion.

- CAGR from 2024 to 2032: 4.26%.

- North America holds the largest market share due to digital advancements.

Market Size & Forecast

2023 Market Size: USD 6.8 Billion

2024 Market Size: USD 7.09 Billion

2032 Market Size: USD 9.9 Billion

CAGR (2024-2032): 4.26%

Largest Regional Market Share in 2024: North America.

Major Players

Key companies include Hitachi Ltd, BELDEN Inc., I-com, Nexans SA, Black Box Corporation, HYPERLITE, General Cable Technology Corporation, Prysmian Group, Infinite Electronics International Inc., and Fiberstore.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

LAN Cable Market Trends

- Growing demand for high-speed internet facilities is driving the market growth.

Market CAGR for LAN cable is being driven by the rising demand for high-speed internet facilities. The development in communication technology with the increase in the probing of connected devices is driving the LAN cable market growth. LAN cables are widely utilized to connect devices in a network, and it is a famous form of network connection utilized by specific organizations, like school campuses, offices, and hospitals. LAN cables have advanced from Cat1 to Cat6 cables and become a popular option for the data center, anticipated to create important opportunities for market growth.

A LAN cable is the hardware component of a network offering communication over a local network by connecting the router with peripheral devices and further connected to a local server. The laptops or computers can be connected with modems, routers, and switches by copper cables. Though it provides connectivity to a small area, various LANs can be connected to produce a bigger network. The market got a boost during Covid-19 as everyone was bound to do work from home, which increased the demand for LAN cables for better connection.

Ethernet LAN cables are largely utilized and trusted network technology as its simple to install and have various advantages over the alternative methods. Ethernet cables enhances the performance of connected devices by fast data transport. Wired internet-enabled devices like computers, modems, and routers can all connect to and transmit broadband signals.

The increased need for the construction of data hubs and their wide use in commercial and governmental organizations have been crucial driving factors for the expansion of the market. The infrastructure and development initiatives directly or indirectly boost the growth of the market. The Ethernet LAN cables have great durability and lesser security risks compared to additional interacting services like Wi-Fi and Bluetooth technologies; these factors will directly lead to the expansion of the market. Thus, driving the LAN Cable market revenue.

LAN Cable Market Segment Insights:

LAN Cable Type Insights

The LAN Cable Market segmentation, based on type, includes Copper and Fiber. The copper segment dominates the market, accounting for the largest market revenue as these are cost-effective and have greater flexibility than fiber-optic cable and thus dominate the market in terms of revenue and volume. The two types of copper cable are Network cable (CAT3, CAT5, CAT5e, and others) and Power over Ethernet (CAT6, CAT6A, CAT7, and CAT8). The fiber optic cable is anticipated to grow at a faster CAGR. The fiber optic cable is of two types, namely: single-mode and multi-mode fiber-optic cables.

LAN Cable Form Insights

The LAN Cable Market segmentation, based on form, includes Solid Ethernet Cable and Stranded Ethernet Cable. The solid ethernet cable dominates the market as it has superior performance and is resistant to electrical interference, and works well with the traditional punch-down the application. Solid copper conductors are much strong and durable, which makes them best for outdoor use. These are often present in the lengths required for in-wall or plenum space installations and also for outdoor uses. Furthermore, the Stranded Ethernet Cable is anticipated to grow at a faster CAGR.

Stranded cables are much flexible and can withstand greater bending when compared to rigid solid conductors that can fail when flexed too many times.

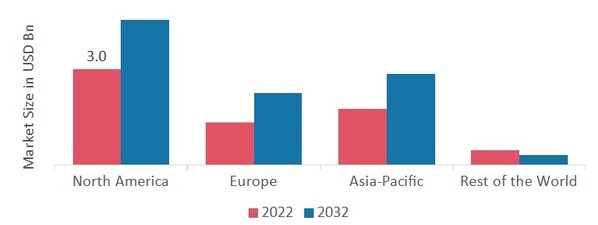

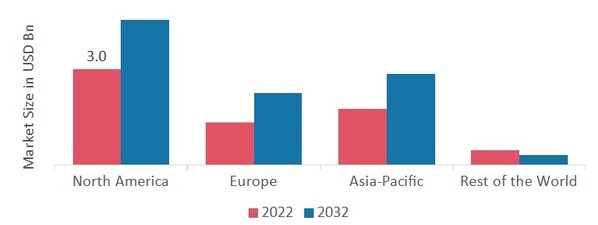

Figure 1: Global LAN Cable Market, by Form, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

LAN Cable Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American LAN Cable market dominates the market due to the rise in the fiber optic cable segment. The rise in digital advancement and adoption of new technology in commercial, industrial, and residential sections of the region has been increasing the demand for high-speed data transfer and a number of data centers. The US has the highest market share for the LAN Cable market in the region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: LAN Cable Market SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Asia Pacific LAN Cable market accounts for the second-largest market share because of the technically advanced infrastructure and new data centers set up in the region and rising demand from the developing countries in this region. Further, China’s LAN Cable market held the largest market share, and the Indian LAN Cable market was the rapid-growing market in the European region.

The European LAN Cable Market is expected to grow at the fastest CAGR from 2024 to 2032. This is due to the technological development in the Ethernet cable industry and increasing demand for power over Ethernet cables in the region. Moreover, the German LAN Cable market held the largest market share, and the UK LAN Cable market was the rapid-growing market in the Asia-Pacific region.

LAN Cable Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to spread their product lines, which will help the LAN Cable market grow even more. Market participants are also undertaking a various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the LAN Cable industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global LAN Cable industry to benefit clients and increase the market sector. In recent years, the LAN Cable industry has offered some of the most significant advantages to the cable industry. Major players in the LAN Cable market, including Hitachi Ltd, BELDEN Inc., I-com, Nexans SA, Black Box Corporation, HYPERTE, General Cable Technology Corporation, Prysmian Group, Infinite Electronics International Inc., Fiberstore, Huzhou Shumai Cable Co. Ltd., and others, are attempting to increase market demand by investing in research and development operations.

Nexans is the global leader in designing and manufacturing cable systems and services in five lead business areas, including energy generation & transmission, usage, telecom & data, and Industry & solutions. The company plays important in the electrification of the planet and pledges to contribute to carbon neutrality by 2030. It provides services that are sustainable, safer, renewable, and carbon-free in about 42 countries. In September 2021, Nexans SA announced an agreement to acquire Centelsa, a premium manufacturer of Latin America engaged in the manufacturing of cables for building and utility purposes.

The government has also approved the business for the development of items that can provide high speed and accuracy.

Black Box, headquartered in Texas, United States, is a multinational System Integration and products solution provider operating over 75 locations across 35 countries. The company's Global Solutions Integration offers digital workplaces, connected buildings, customer experience, enterprise networking services, and data centers. In November 2019, a distribution agreement was formed between Black Box and HYPERTE to provide their dealers and installers access to their customers in the UK and Ireland. On the commencement of this arrangement, the Black Box firms were able to provide technical backing and expedite delivery and resources.

In order to expand its business in public and commercial sectors globally, this agreement offered a strong value proposition.

Key Companies in the LAN Cable market include

LAN Cable Market Developments

-

Q2 2024: Prysmian Group launches new Cat 6A LAN cable for data centers Prysmian Group announced the launch of its new Cat 6A LAN cable designed for high-speed data transmission in modern data centers, expanding its product portfolio to meet growing demand for advanced networking solutions.

-

Q1 2024: Nexans opens new LAN cable manufacturing facility in Morocco Nexans inaugurated a new manufacturing facility in Morocco dedicated to producing LAN cables, aiming to strengthen its supply chain and serve the expanding African and European markets.

-

Q2 2024: Belden introduces new industrial-grade Ethernet LAN cables for harsh environments Belden launched a new line of industrial-grade Ethernet LAN cables engineered for use in harsh and demanding environments, targeting sectors such as manufacturing and energy.

-

Q3 2024: Leviton announces partnership with Cisco to deliver next-generation LAN cabling solutions Leviton and Cisco entered into a partnership to co-develop and market next-generation LAN cabling solutions optimized for enterprise and data center applications.

-

Q2 2024: Panduit launches new Category 8 LAN cable for ultra-high-speed data transmission Panduit introduced a new Category 8 LAN cable designed for ultra-high-speed data transmission, targeting data centers and enterprise networks requiring top-tier performance.

-

Q1 2024: CommScope expands manufacturing capacity for LAN cables in the United States CommScope announced the expansion of its LAN cable manufacturing capacity at its U.S. facilities to meet increasing demand from the North American market.

-

Q2 2024: Superior Essex launches sustainable LAN cable line with recycled materials Superior Essex introduced a new line of sustainable LAN cables made with recycled materials, targeting environmentally conscious customers in commercial and industrial sectors.

-

Q3 2024: Furukawa Electric unveils new high-flexibility LAN cable for robotics applications Furukawa Electric launched a high-flexibility LAN cable specifically designed for robotics and automation applications, addressing the needs of advanced manufacturing environments.

-

Q2 2024: Siemon introduces shielded LAN cable system for secure government networks Siemon released a new shielded LAN cable system aimed at providing enhanced security and performance for government and defense network installations.

-

Q1 2024: Hengtong Group secures major LAN cable supply contract for Asian data center project Hengtong Group announced it has secured a significant contract to supply LAN cables for a large-scale data center project in Asia, strengthening its presence in the regional market.

-

Q2 2024: LS Cable & System wins contract to supply LAN cables for European smart city initiative LS Cable & System was awarded a contract to provide LAN cables for a major smart city infrastructure project in Europe, supporting advanced connectivity and IoT deployment.

-

Q3 2024: Sumitomo Electric launches new flame-retardant LAN cable for public infrastructure Sumitomo Electric introduced a new flame-retardant LAN cable designed for use in public infrastructure projects, enhancing safety and compliance with regulatory standards.

LAN Cable Market Segmentation:

LAN Cable Type Outlook

LAN Cable Form Outlook

LAN Cable Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 6.8 Billion |

| Market Size 2024 |

USD 7.09 Billion |

| Market Size 2032 |

USD 9.9 Billion |

| Compound Annual Growth Rate (CAGR) |

4.80% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Form, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Hitachi Ltd, BELDEN Inc., I-com, Nexans SA, Black Box Corporation, HYPERTE, General Cable Technology Corporation, Prysmian Group, Infinite Electronics International Inc., Fiberstore, Huzhou Shumai Cable Co. Ltd. |

| Key Market Opportunities |

Rising construction and infrastructure projects. |

| Key Market Dynamics |

Increase demand for high-speed data transfer and rising number of data centers. |

LAN Cable Market Highlights:

Frequently Asked Questions (FAQ):

The LAN Cable Market size was valued at USD 6.8 Billion in 2023.

The global market is foreseen to grow at a CAGR of 4.26% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are Hitachi Ltd, BELDEN Inc., I-com, Nexans SA, Black Box Corporation, HYPERTE, General Cable Technology Corporation, Prysmian Group, Infinite Electronics International Inc., Fiberstore, Huzhou Shumai Cable Co. Ltd.

The copper category dominated the market in 2022.

The Solid ethernet cable had the largest share in the global market.