The Life Reinsurance Market is currently characterized by a dynamic competitive landscape, driven by factors such as increasing longevity, rising healthcare costs, and the growing need for risk management solutions. Major players like Swiss Re (CH), Munich Re (DE), and Hannover Re (DE) are at the forefront, each adopting distinct strategies to enhance their market positioning. Swiss Re (CH) emphasizes innovation through digital transformation initiatives, aiming to leverage data analytics for improved underwriting processes. Meanwhile, Munich Re (DE) focuses on strategic partnerships, collaborating with insurtech firms to integrate advanced technologies into their offerings. Hannover Re (DE) appears to be concentrating on regional expansion, particularly in emerging markets, to capitalize on untapped opportunities. Collectively, these strategies contribute to a competitive environment that is increasingly shaped by technological advancements and evolving customer expectations.

In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets, which enhances their responsiveness to local needs. The Life Reinsurance Market is moderately fragmented, with a mix of large, established players and smaller, niche firms. This structure allows for a diverse range of products and services, while the collective influence of key players drives innovation and competitive differentiation.

In August 2025, Swiss Re (CH) announced a partnership with a leading AI firm to develop predictive analytics tools aimed at enhancing risk assessment capabilities. This strategic move is significant as it positions Swiss Re (CH) to better anticipate market trends and customer needs, thereby improving their competitive edge in a rapidly evolving landscape. The integration of AI into their operations could potentially streamline processes and reduce costs, further solidifying their market position.

In September 2025, Munich Re (DE) launched a new product line specifically designed for the aging population, reflecting their commitment to addressing demographic shifts. This initiative not only showcases their innovative approach but also highlights their strategic focus on sustainability and social responsibility. By catering to the needs of an aging demographic, Munich Re (DE) is likely to enhance its market share and strengthen customer loyalty.

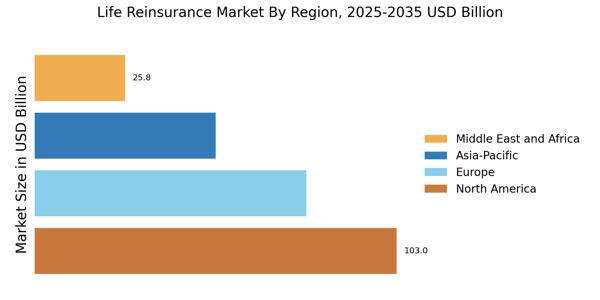

In July 2025, Hannover Re (DE) expanded its operations into Southeast Asia, establishing a new office in Singapore. This expansion is indicative of their strategy to tap into high-growth markets, which may offer substantial opportunities for growth. By localizing their presence, Hannover Re (DE) can better understand regional risks and tailor their products accordingly, thereby enhancing their competitive positioning in the global market.

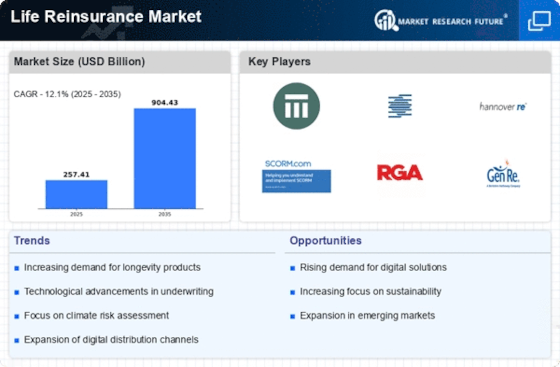

As of October 2025, the Life Reinsurance Market is witnessing trends such as digitalization, sustainability, and the integration of artificial intelligence. These trends are reshaping the competitive landscape, with strategic alliances becoming increasingly important for driving innovation and enhancing service delivery. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that companies that prioritize innovation and customer-centric solutions will likely emerge as leaders in the market.

Leave a Comment