- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

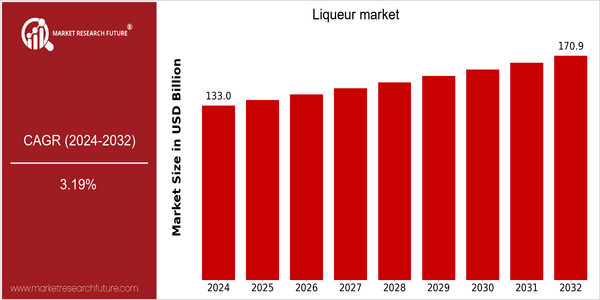

| Year | Value |

|---|---|

| 2024 | USD 133.0 Billion |

| 2032 | USD 170.9 Billion |

| CAGR (2024-2032) | 3.19 % |

Note – Market size depicts the revenue generated over the financial year

The liquor market will grow steadily from the current $133.1 billion in 2024 to reach $170.9 billion by 2032. The compound annual growth rate (CAGR) will be 3.19 percent during the forecast period. There are several reasons for this growth. First, the preference of consumers for premium and craft liqueurs, which are increasingly regarded as handicrafts and an improvement of the drinking experience. Then the trend towards mixology and the cocktail culture will further increase the demand for a wide variety of liqueurs. Then technological progress in the production process and the development of new marketing strategies will also play a significant role in the development of the liquor market. Companies will also invest in sustainable production methods and unique flavors to attract a wider customer base. Diageo, Pernod-Ricard and Bacardi are actively participating in strategic alliances and launching new products to expand their market share. Diageo's recent launch of new liqueurs and its collaboration with mixologists illustrate the industry's innovation and consumer-centricity, which will continue to drive market growth in the coming years.

Regional Market Size

Regional Deep Dive

The liqueur market is characterised by a rich diversity of flavours and a growing consumer interest in premium and craft products in various regions. In North America, the market is dominated by craft and locally produced liqueurs, while Europe remains a stronghold for established brands and new flavours. The Asia-Pacific region is undergoing a strong liqueur boom as younger consumers seek new drinking experiences, influenced by global trends. The Middle East and Africa are gradually embracing liqueurs, thanks to the growing hospitality sector and changing social customs. Latin America, with its unique cultural heritage, is also increasingly embracing local liqueurs, which are boosting the market’s vitality.

Europe

- The European liqueur market is experiencing a renaissance, with brands like Amaro Montenegro and Aperol innovating their product lines to cater to health-conscious consumers by reducing sugar content and introducing lower-alcohol options.

- Sustainability is becoming a key focus, with companies such as Diageo committing to environmentally friendly practices in production and packaging, which is expected to resonate well with the increasingly eco-conscious European consumer.

Asia Pacific

- The rise of social media and influencer marketing is driving the popularity of liqueurs among younger consumers in Asia-Pacific, with brands like Soju and Baijiu adapting their marketing strategies to appeal to this demographic.

- Regulatory changes in countries like Japan are allowing for greater experimentation with flavors and production methods, leading to a surge in innovative liqueur offerings that blend traditional and modern tastes.

Latin America

- The resurgence of traditional liqueurs, such as Pisco in Peru and Cachaça in Brazil, is gaining traction as consumers seek authentic local experiences, with brands like 51 and Pisco Portón leading the charge.

- Government initiatives aimed at promoting local spirits are encouraging the growth of the liqueur market, with programs that support small producers and highlight the cultural significance of these beverages.

North America

- The movement of the artisanal cocktails has influenced the liqueur market greatly. In this regard, the liqueurs of St. George and Bittermens are at the forefront, characterized by their unique flavours and small batch production.

- Regulatory changes in several states have made it easier for small distilleries to enter the market, fostering innovation and competition. This has led to an increase in local liqueur brands, enhancing consumer choice and market diversity.

Middle East And Africa

- The gradual shift in social attitudes towards alcohol consumption in the Middle East is opening up new opportunities for liqueur brands, with companies like M.H. Alshaya Co. introducing international liqueur brands to local markets.

- Cultural events and festivals are increasingly featuring liqueurs, which is helping to normalize their consumption and expand their market presence in regions where they were previously less accepted.

Did You Know?

“Did you know that the global liqueur market is expected to see a significant increase in the popularity of herbal and botanical liqueurs, driven by consumer interest in natural ingredients and wellness?” — Market Research Future

Segmental Market Size

The liqueur category plays a key role in the overall spirits market, which is currently growing steadily. The main growth drivers are the trend towards premium and craft drinks, and the development of the industry. The growing popularity of cocktails, which often contain liqueurs, is also fuelling the demand for liqueurs. Also contributing to the category’s appeal are the responsible drinking campaigns promoted by the government and the growing mixology culture. The liqueur market is currently in a mature growth stage. The main players are launching new products and launching them onto the market. The main applications are in cocktails, food and as a beverage, for example Amaretto in desserts or Baileys in coffee. The trend towards sustainable and healthy consumption is also driving the category’s development. This has led to a growing focus on organic ingredients and lower alcohol levels. The latest distilling and flavour extraction methods are also influencing the category’s development, enabling producers to produce more unique and varied liqueurs.

Future Outlook

During the period 2024 to 2032 the liqueur market will increase in value from $133 billion to $170 billion, at a CAGR of 3.19%. It is expected that the trend towards liqueurs with a premium price and artisanal style will continue to grow. The increasing demand for liqueurs with exotic and sustainable ingredients will also contribute to the market penetration. The consumption of liqueurs will rise significantly by 2032, with an estimated 25 per cent of consumers regularly drinking liqueurs, up from the 18 per cent in 2024. The liqueur market will also be influenced by the technological developments and the regulatory framework. The e-commerce and digital marketing strategies will make it possible to reach a wider audience and to increase the availability of liqueurs. Also, the regulatory changes that encourage the production and distribution of alcoholic beverages, especially in the emerging markets, will open up new growth opportunities. In the future, the liqueurs with a low alcohol content and those with health-giving ingredients will be in demand. In general, the liqueur market will develop significantly, influenced by innovations, changing preferences and favourable market conditions.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 128.9 Billion |

| Growth Rate | 3.19% (2024-2032) |

Liqueur Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.