Market Analysis

In-depth Analysis of Location of Things Market Industry Landscape

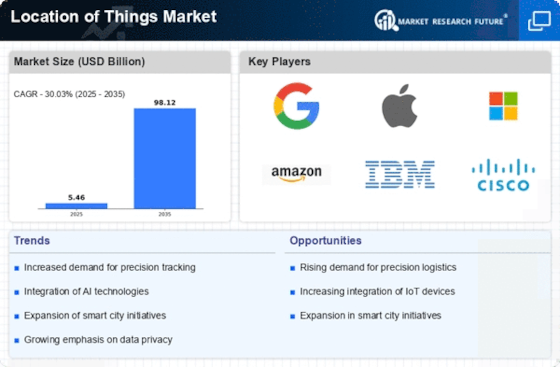

The location of things (LoT) market is experiencing disruptive shifts as technological advancements and the proliferation of connected devices continue reshaping the landscape. The underlying concept behind LoT entails integrating location-based information into an Internet of Things (IoT) ecosystem, thereby introducing new facets to other sectors. One key driver for these market dynamics is soaring demand for real-time location information across domains such as operations, transportation, and healthcare provision. Moreover, the uptake of technology related to the Location of Things is gaining pace in the retail industry, where personalized location-based services enhance customer experiences. Retailers use location data to send targeted promotions and notices directly to consumers' mobile devices when they are within a store's precinct. Another major factor influencing the dynamics of the LoT market is the rise of smart cities, which rely heavily on LoT technologies for efficient city services, traffic management, and public safety, among others, by state government agencies as well as town planners. Nevertheless, these come with challenges, too. Privacy concerns and data security risks associated with the collection and use of location data have become focal points for regulators and end-users alike. Striking a balance between the benefits derived from localized services while still protecting individual privacy will be key to ensuring sustainable growth of the LoT market. The competitive landscape in the Location of Things market is evolving rapidly, with established players and new entrants vying for a share. Furthermore, major technology companies and specialized LoT solution providers are developing innovative products and services to cater to diverse industry needs by adopting location-based technologies. There have also been increasing partnerships between technology companies and industry-specific players, leading to integration that enables seamless adoption of LoT solutions into existing systems. In addition, advancements in satellite navigation technologies, such as the integration of Galileo BeiDou among other global navigation satellite systems (GNSS), improve both the accuracy and precision of location-based data. This expansion of satellite infrastructure enhances the capabilities of Location of Things applications, especially in remote or difficult areas where traditional GPS systems may be constrained.

Leave a Comment