- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

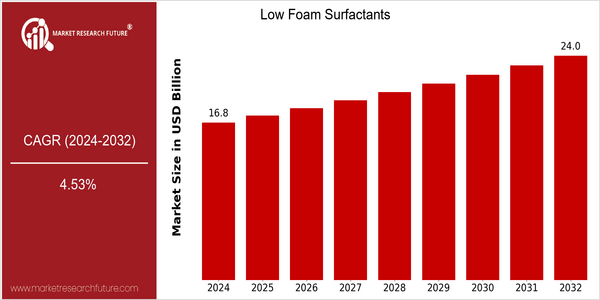

| Year | Value |

|---|---|

| 2024 | USD 16.82 Billion |

| 2032 | USD 23.98 Billion |

| CAGR (2024-2032) | 4.53 % |

Note – Market size depicts the revenue generated over the financial year

Low-foaming surfactants are a major source of surfactants in the cleaning industry. The global low-foaming surfactants market is expected to grow at a CAGR of 6% from 2019 to 2032, reaching a market size of $23.98 billion by 2032. This growth rate will be maintained throughout the forecast period. The demand for eco-friendly and sustainable products in various industries such as personal care, home care, and industrial cleaning is driving the market growth. Also, with the increase in the demand for green products, manufacturers are increasingly focusing on developing low-foaming surfactants that meet the criteria for sustainable development while maintaining high performance. The market is also driven by technological advances in formulation chemistry and the growing trend of green chemistry. In the meantime, companies such as BASF, The Dow Chemical Company, and Evonik Industries are leading the market by investing in R & D to develop high-performance low-foaming surfactants. Strategic alliances and collaborations are also expected to strengthen the product portfolio and increase the market share of these companies. Product launches focusing on biodegradable and non-toxic surfactants are expected to meet the needs of consumers and the requirements of the regulatory framework.

Regional Market Size

Regional Deep Dive

The low foam surfactants market is characterized by its diverse applications in personal care, household care, and industrial processes. In North America, the surfactants market is driven by the rising demand for eco-friendly and sustainable products as consumers prefer to formulate their products in such a way as to have the least possible impact on the environment. Also, new formulations are being developed to meet specific industrial requirements. Regulations that encourage the use of biodegradable surfactants also boost the market.

Europe

- The European Union's REACH regulation is pushing manufacturers to reformulate products with low foam surfactants that are less harmful to the environment, leading to increased investment in sustainable surfactant technologies.

- Companies such as Evonik and Clariant are actively developing low foam surfactants that comply with stringent EU regulations, which is expected to enhance their market position and drive growth in eco-friendly product lines.

Asia Pacific

- Rapid industrialization and urbanization in countries like China and India are driving the demand for low foam surfactants in various applications, particularly in textiles and personal care products.

- Local manufacturers are increasingly collaborating with global players to enhance their product offerings, with companies like Kao Corporation leading initiatives to innovate low foam surfactant formulations tailored to regional preferences.

Latin America

- The increasing consumer awareness regarding environmental sustainability is driving the demand for low foam surfactants in personal care and household cleaning products across Latin America.

- Local companies are beginning to adopt innovative formulations that utilize low foam surfactants, with firms like Oxiteno leading the charge in developing sustainable surfactant solutions tailored to the Latin American market.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced new guidelines encouraging the use of low foam surfactants in industrial applications, which is expected to drive innovation and adoption in the sector.

- Major companies like BASF and Dow are investing in R&D to develop advanced low foam surfactants that meet the growing demand for sustainable and high-performance products, reflecting a shift towards greener chemistry.

Middle East And Africa

- The growing oil and gas industry in the Middle East is creating a demand for low foam surfactants in enhanced oil recovery processes, with companies like SABIC investing in specialized surfactant solutions.

- Regulatory changes aimed at reducing environmental impact are prompting manufacturers in the region to shift towards low foam surfactants, aligning with global sustainability trends.

Did You Know?

“Did you know that low foam surfactants can significantly improve the efficiency of industrial cleaning processes by reducing the need for rinsing, thus saving water and energy?” — Industry reports and studies on surfactant efficiency

Segmental Market Size

Low Foam Surfactants are used in a number of industries, in particular in cleaning and care products where low foaming is a necessity. This product group is currently growing due to the growing demand for effective and environmentally friendly cleaning solutions. The increased awareness of sustainable development, as well as the desire to reduce water and energy consumption, are driving this growth. Furthermore, legislation that favours the use of biodegradable raw materials is enhancing the low foam surfactant's attractiveness. The market for low foam surfactants is currently at a mature stage, with BASF and Evonik being the main players. These surfactants are used mainly in household cleaners, industrial detergents and care products. Low foaming is preferred in these applications as it facilitates rinsing and increases the cleaning power. The trend towards sustainable development and the emergence of 'green chemistry' are driving this growth. In addition, technological advances, such as the development of biodegradable surfactants, are making the low foam surfactant more attractive to both manufacturers and consumers.

Future Outlook

From 2024 to 2032, the market for low-foaming surfactants is expected to grow from 16.8 billion to 23.9 billion at a CAGR of 4.5 percent. This growth is driven by the increasing demand for eco-friendly and effective cleaning solutions in various industries, such as personal care, household cleaning, and industrial cleaning. Moreover, with the growing awareness of the environment among consumers and manufacturers, the trend towards low-foaming surfactants that can clean effectively and have a lower impact on the environment is expected to accelerate. In the future, low-foaming surfactants are expected to penetrate the main industries by about 30 percent, mainly due to their excellent performance and compliance with the use of chemical substances. However, with the development of key technology, especially formulation chemistry, the performance of low-foaming surfactants will be further improved, and the market will be more attractive to manufacturers. Also, the development of bio-based surfactants and the development of multi-function products that combine cleaning and conditioning will continue to drive the market. Also, government policies promoting the reduction of the impact of chemical products on the environment will help low-foaming surfactants gain market share. The development of the industry is expected to be accompanied by the trend of the market, resulting in the market becoming more and more focused on the concepts of green and clean.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 15.2 Billion |

| Market Size Value In 2023 | USD 15.99 Billion |

| Growth Rate | 5.2% (2023-2032) |

Low Foam Surfactants Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.