- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

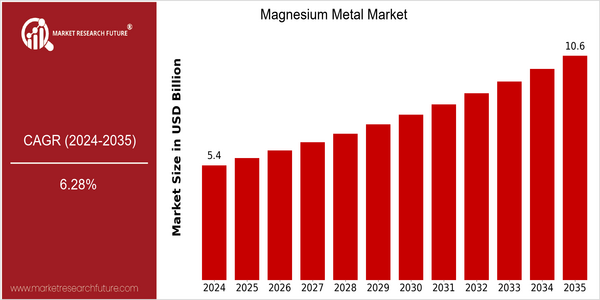

Magnesium Metal Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 5.4 Billion |

| 2035 | USD 10.55 Billion |

| CAGR (2025-2035) | 6.28 % |

Note – Market size depicts the revenue generated over the financial year

The world magnesium market is expected to grow significantly. It is expected to reach USD 10.55 billion by 2035. This growth rate will be a healthy CAGR of 6.28 % from 2025 to 2035. The primary reason for this growth is the increasing demand for lightweight materials in several industries, such as the automobile and the aircraft industry. Its unique properties, such as low density and high strength-to-weight ratio, make it a more attractive material than traditional metals. Also contributing to the growth of the magnesium market is the technological advancement in the extraction and processing of magnesium. This will lower the cost and increase the availability of magnesium. The leading companies, such as the US Magnesium LLC, China Magnesium Corp and Dead Sea Magnesium Ltd, are pursuing various strategies, such as strategic alliances and R & D investments, to strengthen their position in the market. These efforts will not only increase the production capacity but also lead to the development of new magnesium applications in the upcoming industries.

Regional Deep Dive

Magnesium Metal Market is a growing market that is gaining momentum across the globe. The growing demand for magnesium in the automobile, aerospace, and electrical industries is the major driving factor for the growth of the magnesium metal market. The North American magnesium market is characterized by a strong focus on lightweight materials to improve fuel efficiency and reduce emissions. The European magnesium market is growing due to the increase in the use of magnesium in the automobile industry, especially in the field of electric vehicles. The Asia-Pacific region is emerging as a manufacturing hub for magnesium. The magnesium market in the Middle East and Africa is gradually developing, mainly due to the availability of raw materials. Latin America is exploring the opportunities for sustainable magnesium production to meet the growing demand for magnesium in the world.

North America

- The United States Department of Energy has established a program to promote the use of magnesium in automobile components, which is expected to promote the use of magnesium in the automobile industry.

- This is where the new exploitation methods come in, reducing the cost of production and the impact on the environment, which is in line with the goals of sustainable development.

- Electric cars are driving demand for magnesium alloys. The weight savings they provide are crucial to improving the performance of the batteries.

Europe

- In the light of the European regulations aimed at reducing carbon emissions, magnesium is being increasingly used in the automobile industry in the form of lightweight parts.

- In Norway, the hydrocarbon company Norsk Hydro and the metallurgical group AMG are developing new methods for magnesium recovery. These methods are expected to make the supply chain more sustainable.

- In Germany and France, the production of electric vehicles is increasing, and the demand for magnesium components is increasing in order to optimize the weight of the vehicles.

Asia-Pacific

- China is the largest producer of magnesium metal in the world, and China Magnesium Group has been investing heavily in the development of magnesium production.

- In the aeronautical industry, the use of magnesium is in progress, a result of the efforts of companies such as Airbus and Boeing, which are working on the development of light alloys for the construction of aircraft.

- In India, for example, a number of government initiatives have been undertaken to develop magnesium production, in order to reduce the country’s dependence on imports and to develop its own manufacturing industry.

MEA

- Israel and South Africa are launching projects to develop magnesium production for the local and world market.

- The diversification of the economy of the region is based on a diversified production of the metals, mainly magnesium.

- The regulatory framework is evolving to support sustainable mining practices, which could improve the environment profile of magnesium production in the region.

Latin America

- Brazil is now a major player in the magnesium market, with a series of initiatives to develop sustainable mining practices to exploit its vast mineral wealth.

- The province of Mie, in southern China, is seeing the establishment of magnesium production plants by the collaboration of the government and international companies.

- The development of the magnesium market has been affected by the introduction of legislation aimed at encouraging sustainable mining practices. This has prompted investors to put their money into magnesium extraction processes that are more friendly to the environment.

Did You Know?

“Magnesium is the lightest of all structural metals, weighing about one-third less than aluminum, which makes it an excellent material for weight-reducing applications.” — International Magnesium Association

Segmental Market Size

Magnesium metal is at present in use in all branches of industry, and its increasing importance is largely due to its indispensable use in the aircraft, automobile and electrical industries. Magnesium is used in the manufacture of aeroplanes, and in the manufacture of all kinds of machinery, such as automobiles, trains, engines, dynamos, etc., for which reason it is called the metal of the air. Magnesium is used in the manufacture of various kinds of explosives, in the manufacture of glass, in the manufacture of matches, in the manufacture of fireworks, and in the manufacture of various kinds of chemicals. Magnesium is also in demand as a result of the new regulations requiring the substitution of magnesium for other materials.

At present the magnesium industry has entered a stage of full development, with such companies as the United States Magnesium Company and China Magnesium Corp. at the forefront of production and innovation. Magnesium is used in automobile die-casting and as an alloying agent in the manufacture of aluminum. The drive towards electric vehicles and the development of new technology for the recovery of magnesium are further driving growth. Moreover, the demand for eco-friendly materials is on the rise, driven by the new “green economy” policies. This is a sector where technological innovation is key, and the development of extraction and alloying methods will ensure that magnesium is an essential material in future production.

Future Outlook

The Magnesium Metal Market is expected to increase at a CAGR of 6.28% from 2024 to 2035, from a projected market size of $5.4 billion to $10.5 billion. This growth is due to the increasing demand for lightweight materials in various industries, particularly in the automobile and aeronautical industries, where magnesium's high strength-to-weight ratio is widely recognized. In order to reduce fuel consumption and CO2 emissions, magnesium alloys are expected to penetrate these industries further, reaching an average of more than 20% by 2035 compared to less than 10% in 2024.

The market is expected to grow mainly due to technological developments in the field of extraction and processing. Production innovations, such as the development of more efficient electrolysis methods, will not only reduce costs, but also improve the environment. In addition, government policies that support the use of light materials and the reduction of carbon footprints are expected to further drive market growth. Meanwhile, the trend of increasing magnesium content in the manufacture of electric vehicles and the increasing importance of circular economy will also play a key role in the development of the market. However, magnesium market players must be flexible to take advantage of these opportunities and overcome potential challenges, and ensure the resilience and sustainability of the magnesium metal market in 2035.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 4.7 Billion |

| Market Size Value In 2023 | USD 5.0384 Billion |

| Growth Rate | 7.20% (2023-2032) |

Magnesium Metal Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.