- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

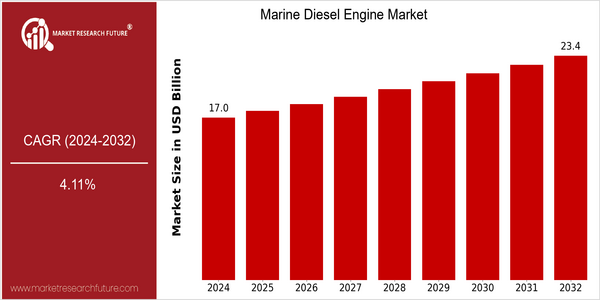

| Year | Value |

|---|---|

| 2024 | USD 16.98 Billion |

| 2032 | USD 23.43 Billion |

| CAGR (2024-2032) | 4.11 % |

Note – Market size depicts the revenue generated over the financial year

The global marine diesel engine market is poised for steady growth, with a current market size of USD 16.98 billion in 2024, projected to reach USD 23.43 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.11% over the forecast period. The increasing demand for efficient and environmentally friendly marine propulsion systems is a significant driver of this market expansion. As shipping companies and operators seek to comply with stringent emissions regulations and improve fuel efficiency, the adoption of advanced marine diesel engines is becoming more prevalent. Technological advancements, such as the integration of digital solutions and hybrid propulsion systems, are further propelling the market forward. Key players in the industry, including MAN Energy Solutions, Wärtsilä, and Rolls-Royce, are actively investing in research and development to innovate and enhance engine performance. Strategic initiatives, such as partnerships aimed at developing next-generation marine engines and investments in sustainable technologies, are also shaping the competitive landscape. As the industry evolves, the focus on reducing carbon footprints and enhancing operational efficiency will continue to drive growth in the marine diesel engine market.

Regional Market Size

Regional Deep Dive

The Marine Diesel Engine Market is characterized by a diverse range of applications across various regions, driven by the increasing demand for efficient and environmentally friendly marine transportation. In North America, the market is influenced by a robust shipping industry and stringent environmental regulations, while Europe is focusing on innovation and sustainability. The Asia-Pacific region is witnessing rapid growth due to expanding maritime trade and shipbuilding activities. The Middle East and Africa are emerging markets with significant investments in port infrastructure, and Latin America is gradually enhancing its marine capabilities, driven by economic growth and resource exploration.

Europe

- The European Union's Green Deal aims to reduce greenhouse gas emissions, leading to increased investment in hybrid and alternative fuel marine engines by companies such as Wärtsilä and Rolls-Royce.

- The introduction of the IMO 2020 regulation has compelled shipowners to upgrade their fleets, creating opportunities for manufacturers to supply compliant marine diesel engines.

Asia Pacific

- China's Belt and Road Initiative is significantly enhancing maritime trade routes, resulting in a surge in shipbuilding activities and a corresponding demand for marine diesel engines.

- Japan is focusing on developing advanced marine technologies, with companies like Mitsubishi Heavy Industries investing in next-generation diesel engines that meet international emission standards.

Latin America

- Brazil's growing offshore oil and gas exploration activities are driving demand for marine diesel engines, with local companies seeking partnerships with global manufacturers.

- Regulatory changes in Argentina aimed at promoting sustainable shipping practices are encouraging investments in cleaner marine diesel technologies.

North America

- The U.S. Coast Guard has implemented stricter emissions regulations, prompting manufacturers like Caterpillar and MAN Energy Solutions to innovate cleaner marine diesel engines.

- The rise of the offshore wind energy sector has led to increased demand for specialized marine vessels, boosting the marine diesel engine market in the region.

Middle East And Africa

- The UAE is investing heavily in port infrastructure and logistics, which is expected to drive demand for marine diesel engines as new vessels are commissioned.

- Saudi Arabia's Vision 2030 initiative includes plans to expand its maritime sector, leading to increased opportunities for marine engine manufacturers in the region.

Did You Know?

“Marine diesel engines are responsible for powering over 90% of the world's shipping fleet, highlighting their critical role in global trade.” — International Maritime Organization (IMO)

Segmental Market Size

The Marine Diesel Engine segment plays a crucial role in the maritime industry, primarily powering commercial vessels and offshore applications. This segment is currently experiencing stable growth, driven by increasing global trade and the need for efficient marine transportation. Key factors propelling demand include stringent emissions regulations, such as the International Maritime Organization's (IMO) 2020 sulfur cap, which compels shipowners to adopt cleaner technologies. Additionally, advancements in engine efficiency and fuel economy are critical in meeting operational cost pressures. Currently, the adoption of advanced marine diesel engines is in the scaled deployment phase, with companies like MAN Energy Solutions and Wärtsilä leading the charge in innovation. Primary applications include container ships, bulk carriers, and fishing vessels, where reliability and performance are paramount. Trends such as the push for decarbonization and the integration of digital technologies, like predictive maintenance and IoT, are catalyzing growth in this segment. Furthermore, the shift towards hybrid and alternative fuel systems is reshaping the landscape, as stakeholders seek sustainable solutions to meet evolving regulatory and environmental demands.

Future Outlook

The Marine Diesel Engine Market is poised for significant growth from 2024 to 2032, with the market value projected to increase from $16.98 billion to $23.43 billion, reflecting a compound annual growth rate (CAGR) of 4.11%. This growth trajectory is underpinned by a rising demand for efficient and reliable marine transportation, driven by global trade expansion and the increasing need for sustainable shipping solutions. As the maritime industry continues to recover from the impacts of the COVID-19 pandemic, the adoption of advanced marine diesel engines that comply with stringent emissions regulations is expected to accelerate, enhancing operational efficiency and reducing environmental footprints. Key technological advancements, such as the integration of digital technologies and automation in marine diesel engines, are anticipated to reshape the market landscape. Innovations in engine design, fuel efficiency, and hybrid propulsion systems will play a crucial role in meeting the evolving regulatory standards and consumer preferences for greener alternatives. Furthermore, the implementation of policies aimed at reducing greenhouse gas emissions in the shipping sector, such as the International Maritime Organization's (IMO) 2020 sulfur cap, will drive investments in cleaner and more efficient marine diesel technologies. As a result, the market is expected to witness a steady increase in penetration rates, with an estimated 60% of new vessels being equipped with advanced marine diesel engines by 2032, positioning the industry for a sustainable future.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 16.22 Billion |

| Growth Rate | 4.11% (2024-2032) |

Marine Diesel Engine Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.