Global Mechanical Spring Market Overview

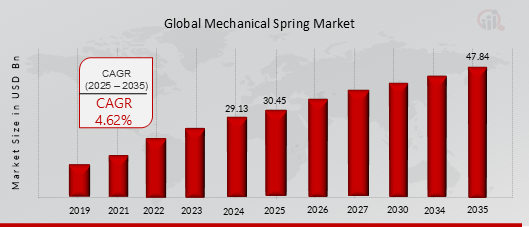

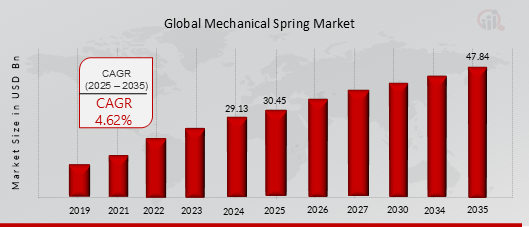

The Mechanical Spring Market was valued at USD 29.13 billion in 2024. The Mechanical Spring Market industry is projected to grow from USD 30.45 billion in 2025 to USD 47.84 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.62% during the forecast period (2025-2035).

The growing automotive industry impacts the demand for mechanical springs and increasing industrialization and urbanization promoting mechanical spring adoption and rapidly growing aerospace & defense sector fuels the mechanical spring demand are driving the growth of the Mechanical Spring Market.

As per the Analyst at MRFR, the global automotive industry is experiencing robust growth, driving increased demand for mechanical springs. As consumer preferences shift towards safer, more comfortable, and fuel-efficient vehicles, manufacturers are incorporating advanced spring technologies in suspension systems, engines, and seating mechanisms. As reported by the International Organization of Motor Vehicle Manufacturers (OICA) global automotive production experienced significant fluctuation between 2019 and 2023. It dropped from 91.86 million vehicles in 2019 to 77.44 million in 2020, reflecting a substantial decline due to global challenges.

However, production rebounded to 93.55 million vehicles by 2023, marking a modest 1.8% growth from 2019 and a notable 20.8% increase from the low point in 2020. Springs play a vital role in enhancing vehicle stability, ride comfort, and handling by absorbing shocks and vibrations. This growing emphasis on safety and performance has resulted in the widespread adoption of high-performance mechanical springs in both passenger and commercial vehicles.

FIGURE 1: MECHANICAL SPRING MARKET VALUE (2019-2035) USD BILLION

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Mechanical Spring Market Opportunity

INTEGRATION OF INDUSTRY 4.0 FOR ENHANCED PRODUCTION EFFICIENCY AND CUSTOMIZATION CREATES OPPORTUNITY

The adoption of smart manufacturing technologies, driven by the integration of Industry 4.0, presents significant growth opportunities for the mechanical spring industry. Industry 4.0 includes advanced digital technologies such as the Internet of Things (IoT), artificial intelligence (AI), automation, and data analytics, enabling manufacturers to optimize production processes and enhance operational efficiency. In the mechanical spring industry, these technologies facilitate real-time monitoring of production lines, predictive maintenance, and intelligent inventory management. By leveraging smart manufacturing solutions, spring manufacturers can minimize downtime, reduce waste, and improve productivity, ultimately leading to cost savings and increased profitability. This digital transformation is reshaping industry, enabling companies to remain competitive in a rapidly evolving market landscape.

One of the primary benefits of adopting smart manufacturing is the enhancement of production efficiency. IoT-enabled sensors and AI-powered systems allow for continuous monitoring and analysis of manufacturing processes, providing actionable insights to optimize machine performance and material usage. In the mechanical spring industry, this means better control over coiling, forming, and heat treatment processes, ensuring consistent product quality and minimizing defects. Automation further streamlines repetitive tasks, reducing human error and labor costs. As demand for high-precision and complex spring designs continues to grow, smart manufacturing empowers companies to achieve higher accuracy, faster production cycles, and improved yield rates, meeting customer requirements with shorter lead times.

Customization is becoming increasingly important in the mechanical spring industry as customers demand tailored solutions to meet specific application requirements. Smart manufacturing enables mass customization through flexible production systems and advanced design capabilities. With the integration of computer-aided design (CAD) and computer-aided manufacturing (CAM) software, manufacturers can easily customize spring dimensions, materials, and performance characteristics based on customer specifications. Additionally, additive manufacturing (3D printing) allows for rapid prototyping and low-volume production runs of custom-designed springs with intricate geometries. This flexibility not only enhances customer satisfaction but also expands market reach by catering to niche applications in aerospace, automotive, medical devices, and industrial machinery.

Predictive maintenance is another crucial advantage of smart manufacturing adoption. By leveraging IoT sensors and AI-driven analytics, manufacturers can monitor the health and performance of production equipment in real-time, predicting potential failures before they occur. This proactive approach minimizes unplanned downtime, extends the lifespan of machinery, and optimizes maintenance schedules. In the mechanical spring industry, where precision and reliability are critical, predictive maintenance ensures consistent product quality and uninterrupted production flow. This capability is particularly valuable for high-volume manufacturing environments, reducing operational costs and enhancing overall efficiency. As competition intensifies, companies that invest in predictive maintenance solutions can achieve higher productivity and a competitive edge.

The integration of Industry 4.0 technologies also supports data-driven decision-making, enabling manufacturers to make informed strategic choices based on real-time data analysis. By collecting and analyzing data from various stages of the production process, manufacturers can identify bottlenecks, optimize resource allocation, and improve supply chain efficiency. In the mechanical spring industry, data analytics provides insights into material usage, energy consumption, and production trends, facilitating continuous improvement and cost optimization. Moreover, cloud-based platforms enable seamless collaboration between design teams, production units, and supply chain partners, ensuring agile and responsive manufacturing operations. As digitalization continues to transform the industry, companies that embrace data-driven strategies will be better equipped to adapt to market demands, innovate rapidly, and maintain a leadership position in the Mechanical Spring Market.

Mechanical Spring Market Segment Insights

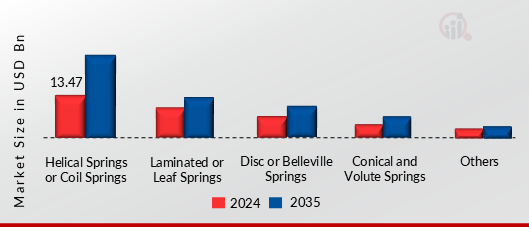

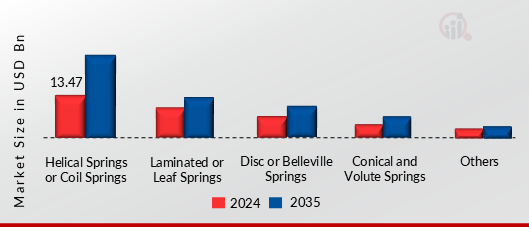

Mechanical Spring by Type Insights

Based on Type, this segment includes Helical Springs or Coil Springs, Conical and Volute Springs, Laminated or Leaf Springs, Disc or Belleville Springs, Others. The Helical Springs or Coil Springs segment dominated the global market in 2024, while the Disc or Belleville Springs segment is projected to be the fastest–growing segment during the forecast period. Helical springs, also known as coil springs, are the most widely used type of mechanical springs due to their versatility and cost-effectiveness.

These springs are designed to absorb shock, store energy, and provide resistance to compressive or tensile forces, making them essential in automotive suspension systems, industrial machinery, and consumer products. In the automotive industry, they are extensively used in suspension systems for vehicles to enhance ride comfort and stability. The growing demand for electric vehicles (EVs) is driving the need for lightweight, high-performance coil springs that contribute to improved energy efficiency. Additionally, helical springs are increasingly used in medical devices and precision instruments due to their compact design and consistent force application.

FIGURE 2: MECHANICAL SPRING MARKET SHARE BY TYPE 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Mechanical Spring by Material Insights

Based on Material, this segment includes Steel, Stainless Steel, Copper, Titanium, Others. The Steel segment dominated the global market in 2024, while the Titanium segment is projected to be the fastest–growing segment during the forecast period. Steel springs are the most widely used type of mechanical springs due to their high strength, durability, and cost-effectiveness.

Carbon steel and alloy steel are the two primary types of steel used in manufacturing springs, offering excellent tensile strength and resistance to deformation under high stress. These springs are commonly used in automotive suspension systems, industrial machinery, and heavy equipment due to their ability to withstand heavy loads and harsh environments. For example, in the automotive industry, steel coil springs are utilized in shock absorbers and suspension systems to provide stability and comfort during vehicle operation.

Mechanical Spring by Application Insights

Based on Application, this segment includes Automotive, Aerospace, Electrical & Electronics, Medical, Others. The Automotive segment dominated the global market in 2024, while the Medical segment is projected to be the fastest–growing segment during the forecast period. The automotive industry is one of the largest consumers of mechanical springs, where they are used extensively in suspension systems, engine components, brakes, and transmission systems.

Coil springs, leaf springs, and valve springs are integral to vehicle performance, providing stability, comfort, and safety. In modern vehicles, especially electric and hybrid models, lightweight and high-strength springs are crucial for enhancing energy efficiency and driving dynamics. The growing demand for electric vehicles (EVs) and autonomous vehicles is driving the need for advanced spring materials like titanium and composite springs, which offer superior strength-to-weight ratios.

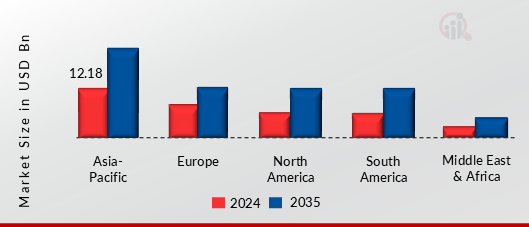

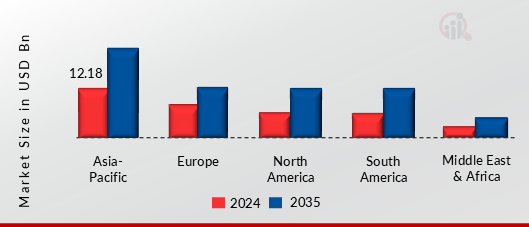

Mechanical Spring Regional Insights

Based on the Region, the Global Mechanical Spring is segmented into North America, Europe, Asia-Pacific, South America and Middle East & Africa. The Asia Pacific dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. Major demand factors driving the Asia Pacific market are the growing automotive industry impacts the demand for mechanical springs and increasing industrialization and urbanization promoting mechanical spring adoption and rapidly growing aerospace & defense sector fuels the mechanical spring demand.

Countries such as China, India, and those in Southeast Asia are witnessing increased demand for cost-effective springs across various sectors, including automotive, electronics, and construction. China has become a global leader in electric vehicle (EV) production, with companies like BYD and NIO spearheading this surge, thereby necessitating high-volume spring manufacturing. Simultaneously, Japan and South Korea are at the forefront of high-tech applications, producing specialized springs essential for semiconductor manufacturing and precision instruments.

FIGURE 3: MECHANICAL SPRING MARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, Germany, France, UK, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, South Africa and others.

Global Mechanical Spring Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the Mechanical Spring Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major competitors in the market are Barnes Group Inc, MW Industries (MWI), Lee Spring Co., Century Spring Corp. (CSC), IDC Spring, Stanley Spring & Stamping Corporation, Katy Spring & Manufacturing, Inc., Vulcan Spring, WCS Industries, ACE Controls Inc. are among others. The Mechanical Spring Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the Mechanical Spring Market include

- Barnes Group Inc

- MW Industries (MWI)

- Lee Spring Co.

- Century Spring Corp. (CSC)

- IDC Spring

- Stanley Spring & Stamping Corporation

- Katy Spring & Manufacturing, Inc.

- Vulcan Spring

- WCS Industries

- ACE Controls Inc.

Mechanical Spring Market Industry Developments

January 2025: Barnes Group Inc, a global provider of highly engineered products, differentiated industrial technologies and innovative solutions, and Apollo announced that funds managed by affiliates of Apollo have completed the previously announced acquisition of Barnes in an all-cash transaction with a total enterprise value of approximately $3.6 billion.

January 2021: Lee Spring announced the acquisition of Michigan based M & S Spring. M & S Spring, located in Fraser, Michigan, specializes in rapid prototype custom springs that require quick turnaround with quantities ranging from a single piece to higher volume pilot runs.

May 2021: Stanley Spring and Stamping, Chicago, IL, a supplier of custom metal parts and springs, has acquired Precision Forming and Stamping, also in Chicago, a supplier of four-slide, multi-slide and other small stampings and flat springs to the automotive, electrical, HVAC and medical industries.

November 2021: MW Industries, a provider of precision components, announced the acquisition of Fox Valley Spring Company, LLC, a principal supplier of springs, wire forms, and flat springs.

Mechanical Spring Market Segmentation

Mechanical Spring by Type Outlook

- Helical Springs or Coil Springs

- Conical and Volute Springs

- Laminated or Leaf Springs

- Disc or Belleville Springs

- Others

Mechanical Spring by Material Outlook

- Steel

- Stainless Steel

- Copper

- Titanium

- Others

Mechanical Spring by Application Outlook

- Automotive

- Aerospace

- Electrical & Electronics

- Medical

- Others

Mechanical Spring Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2024

|

USD 29.13 Billion

|

|

Market Size 2025

|

USD 30.45 Billion

|

|

Market Size 2035

|

USD 47.84 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

4.42 % (2025-2035)

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2035

|

|

Historical Data

|

2019-2023

|

|

Forecast Units

|

Value (USD Billion)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Segments Covered

|

By Type, By Material, By Application

|

|

Geographies Covered

|

North America, Europe, Asia Pacific, South America, Middle East & Africa

|

|

Countries Covered

|

The US, Canada, Mexico, Germany, France, UK, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, South Africa

|

|

Key Companies Profiled

|

Barnes Group Inc, MW Industries (MWI), Lee Spring Co., Century Spring Corp. (CSC), IDC Spring, Stanley Spring & Stamping Corporation, Katy Spring & Manufacturing, Inc., Vulcan Spring, WCS Industries, ACE Controls Inc.

|

|

Key Market Opportunities

|

· Integration of industry 4.0 for enhanced production efficiency and customization creates opportunity

· Growing demand for electric vehicles (EV) creates future prospect for the mechanical spring industry

· Growing emphasis towards eco-friendly and recyclable spring materials in green manufacturing shapes opportunity

|

|

Key Market Dynamics

|

· Growing automotive industry impacts the demand for mechanical springs

· Increasing industrialization and urbanization promoting mechanical spring adoption

· Rapidly growing aerospace & defense sector fuels the mechanical spring demand

|

Frequently Asked Questions (FAQ) :

USD 29.13 Billion is the Mechanical Spring Market in 2024

The Helical Springs or Coil Springs segment by Type holds the largest market share and grows at a CAGR of 4.66 % during the forecast period.

Asia Pacific holds the largest market share in the Mechanical Spring Market.

Barnes Group Inc, MW Industries (MWI), Lee Spring Co., Century Spring Corp. (CSC), IDC Spring, Stanley Spring & Stamping Corporation, Katy Spring & Manufacturing, Inc., Vulcan Spring, WCS Industries, ACE Controls Inc. are prominent players in the Mechanical Spring Market.

The Steel segment dominated the market in 2024.