- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

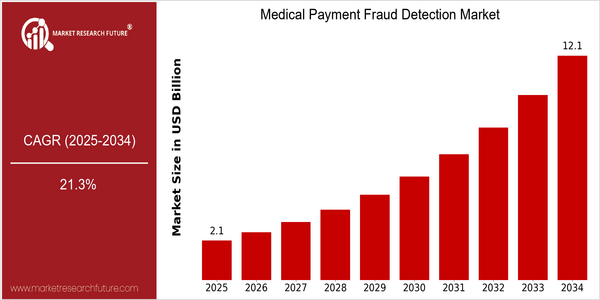

| Year | Value |

|---|---|

| 2025 | USD 2.13 Billion |

| 2034 | USD 12.13 Billion |

| CAGR (2025-2034) | 21.3 % |

Note – Market size depicts the revenue generated over the financial year

The Medical Payment Fraud Detection Market is poised for significant growth, with a current market size of USD 2.13 billion in 2025 projected to expand to USD 12.13 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 21.3%. This remarkable growth trajectory underscores the increasing urgency for healthcare organizations to adopt advanced fraud detection solutions in response to the rising incidence of fraudulent activities within the medical payment ecosystem. As healthcare costs continue to escalate, the financial implications of fraud have become a critical concern, prompting stakeholders to invest in innovative technologies that enhance detection capabilities and streamline claims processing. Several factors are driving this market expansion, including the integration of artificial intelligence (AI) and machine learning (ML) technologies, which enable more sophisticated analysis of claims data and real-time fraud detection. Additionally, regulatory pressures and the need for compliance with stringent healthcare regulations are compelling organizations to implement robust fraud prevention measures. Key players in the market, such as Optum, IBM Watson Health, and SAS Institute, are actively pursuing strategic initiatives, including partnerships and product innovations, to enhance their offerings. For instance, recent collaborations aimed at leveraging big data analytics and predictive modeling are expected to further bolster the effectiveness of fraud detection systems, thereby contributing to the overall market growth.

Regional Market Size

Regional Deep Dive

The Medical Payment Fraud Detection Market is experiencing significant growth across various regions, driven by increasing healthcare expenditures, the rise in fraudulent activities, and the need for advanced technologies to combat fraud. In North America, stringent regulations and a high prevalence of healthcare fraud are propelling the demand for sophisticated detection solutions. Europe is witnessing a surge in regulatory frameworks aimed at enhancing transparency and accountability in healthcare payments. Meanwhile, the Asia-Pacific region is rapidly adopting digital health solutions, creating opportunities for innovative fraud detection technologies. The Middle East and Africa are also focusing on improving healthcare systems, which includes implementing fraud detection measures. Latin America is gradually recognizing the importance of fraud detection in healthcare, influenced by rising healthcare costs and the need for efficient resource allocation.

Europe

- The European Union has introduced the General Data Protection Regulation (GDPR), which impacts how healthcare data is managed and shared, necessitating the development of compliant fraud detection systems.

- Organizations like the National Health Service (NHS) in the UK are implementing advanced fraud detection technologies to address the estimated £1.2 billion lost annually to healthcare fraud.

Asia Pacific

- Countries like India and China are increasingly adopting telemedicine and digital health solutions, which are creating new avenues for fraud, prompting the need for robust detection systems.

- The Australian government has launched initiatives to enhance the integrity of its healthcare system, including the use of data analytics to identify and prevent fraudulent claims.

Latin America

- Countries like Brazil are beginning to implement more stringent regulations around healthcare payments, which is expected to increase the demand for fraud detection solutions.

- The rise of private health insurance in Latin America is leading to a greater focus on fraud prevention, as insurers seek to protect their interests and reduce losses.

North America

- The U.S. Department of Health and Human Services has intensified its efforts to combat healthcare fraud through initiatives like the Health Care Fraud Prevention Partnership, which collaborates with various stakeholders to share data and best practices.

- Key players such as Optum and IBM Watson Health are investing in AI-driven solutions to enhance fraud detection capabilities, reflecting a trend towards leveraging advanced analytics and machine learning.

Middle East And Africa

- The UAE has established a national health insurance scheme that includes measures for fraud detection, reflecting a growing recognition of the need for integrity in healthcare financing.

- In South Africa, the Council for Medical Schemes is implementing stricter regulations and oversight to combat fraud, which is expected to drive demand for detection technologies.

Did You Know?

“In the U.S., healthcare fraud is estimated to cost the government and private insurers over $100 billion annually, highlighting the critical need for effective fraud detection systems.” — National Health Care Anti-Fraud Association (NHCAA)

Segmental Market Size

The Medical Payment Fraud Detection Market is a critical segment within the healthcare industry, currently experiencing robust growth due to increasing incidences of fraud and the need for enhanced security measures. Key drivers include stringent regulatory policies aimed at reducing healthcare fraud, such as the Affordable Care Act in the U.S., and the rising demand for advanced technological solutions that leverage artificial intelligence and machine learning to detect anomalies in billing practices. Currently, the market is in a scaled deployment stage, with notable players like Optum and IBM Watson Health leading the charge in implementing sophisticated fraud detection systems. Primary applications include claims processing, patient identity verification, and billing audits, particularly in regions like North America and Europe where regulatory frameworks are more established. Trends such as the COVID-19 pandemic have accelerated the adoption of digital health solutions, further catalyzing the need for robust fraud detection mechanisms. Technologies like predictive analytics and blockchain are shaping the segment's evolution, providing innovative methods to enhance transparency and security in medical transactions.

Future Outlook

The Medical Payment Fraud Detection Market is poised for significant growth from 2025 to 2034, with a projected market value increase from $2.13 billion to $12.13 billion, reflecting a robust compound annual growth rate (CAGR) of 21.3%. This growth trajectory is driven by the increasing prevalence of healthcare fraud, which is estimated to cost the U.S. healthcare system over $300 billion annually, prompting healthcare providers and insurers to invest heavily in advanced fraud detection technologies. As the market matures, we anticipate a surge in the adoption of artificial intelligence (AI) and machine learning (ML) solutions, which are expected to enhance the accuracy and efficiency of fraud detection processes, thereby reducing false positives and improving overall operational efficiency. Key technological advancements, such as real-time data analytics and blockchain technology, will further shape the landscape of the Medical Payment Fraud Detection Market. These innovations not only facilitate better tracking and verification of medical claims but also enhance transparency and trust among stakeholders. Additionally, regulatory frameworks are becoming increasingly stringent, with governments worldwide implementing policies aimed at curbing healthcare fraud. This regulatory push is expected to drive the adoption of sophisticated fraud detection systems across various healthcare segments, including hospitals, insurance companies, and government health programs. As a result, by 2034, we anticipate that the penetration of advanced fraud detection solutions will reach approximately 70% of healthcare organizations, underscoring the critical need for robust fraud prevention measures in an evolving healthcare environment.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 21.30% (2023-2032) |

Medical Payment Fraud Detection Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.